Week Ahead: Altcoin plays for traders as Bitcoin crosses $42,000

Bitcoin price hit $40,000 over the weekend as investors anticipate a spot BTC ETF approval in January. Bitcoin trades around $42,000 and shows no signs of stopping. This publication will focus on two things:

- What to expect this week.

- The outlook for Bitcoin and if the fourth cycle is any different.

Altcoin sectors to focus this week

Monday, December 4:

- BNB Greenfield Upgrade

- BITTREX End of Service

- OSMO Co-Founder Teased Significant Announcement

Tuesday, December 5:

- PSTAKE 600k ATOM Governance Ends

- APE LOTM Season 2 Ends

- AR Hardfork

- LSK V4 Mainnet

- COINBASE POLY Delisting

- GTA 6 First Trailer Revealed (Gaming tokens might rally - MANA, ENJ, APE, AXS etc)

Wednesday, December 6:

- Aptos and READYgg Game Release

- SCRT Proposal To Reduce Inflation From 15% To 9%

- CGPT Launch of Cross-Chain Swap Aggregator (AI coin trend - AGIX, RNDR, FET)

- ZEN V.4.11 Upgrade (privacy coins focussed: XMR, SCRT)

- FET Demo Showcasing at AI Summit NY From Dec 6-7

- DOGE birthday (December 6, 2013)

Thursday, December 7:

- MATIC Polygon Connect

- LINK Staking V0.2 Early Access

- COINBASE Perp listing of MATIC & BCH

- KAVA Kava 15 Mainnet

- US NFP Preview

Friday, December 8:

- BLOCKFI Debt Proof Submission

- SUSHI End of V3 Rewards Program

- US Unemployment Numbers & NFP (13:30 GMT) Reaction

- ENJ NFT & Token Migration

Sunday, December 10:

- zkSync Phase 2 Out of 4, 40% Token Burn

Gaming Sector

With the launch of the GTA 6 trailer on December 6, many gaming token altcoins have already jumped the gun and triggered a rally over the weekend. This week, ApeCoin’s APE, Enjin Coin’s ENJ, and Axie Infinity’s AXS tokens are three cryptos to watch.

Two wildcard gaming tokens that could make a lot of noise are Illuvium’s ILV token – which recently launched on Epic Games – and Aptos’ APT token, with the collaboration between Readygg and Aptos Labs.

Read more: Three gaming crypto tokens to have in your watchlist as GTA 6 trailer looms: AXS, MANA and ENJ

Honorary mentions

Dogecoin (DOGE) was launched on December 6, 2013, which makes it the tenth birthday of the dog-themed crypto. Additionally, the upcoming launch of the DOGE-1 moon mission will also increase the chances of investors speculating on the price of Dogecoin.

Read more: Dogecoin breaks key $0.088 barrier ahead of tenth birthday, 87% DOGE holders at profit

Binance Coin (BNB) has been on traders’ watchlist after Changpeng Zhao (CZ), the founder of Binance, stepped down as its CEO. Despite this massive event, the altcoin did not crash. With the upcoming Pampas upgrade to the Greenfield Mainnet chances of a volatile trading atmosphere for BNB are high.

Read more: Binance trading volume hits April high despite CZ’s exit

Newly listed coins like Celestia (TIA), Ordi (ORDI), Meme (MEME), Pyth Network (PYTH) and Sei Network (SEI) are likely to have a high trading volume and hence high volatility due to the freshness of these coins among traders.

Bitcoin ETF propels BTC to $40,000

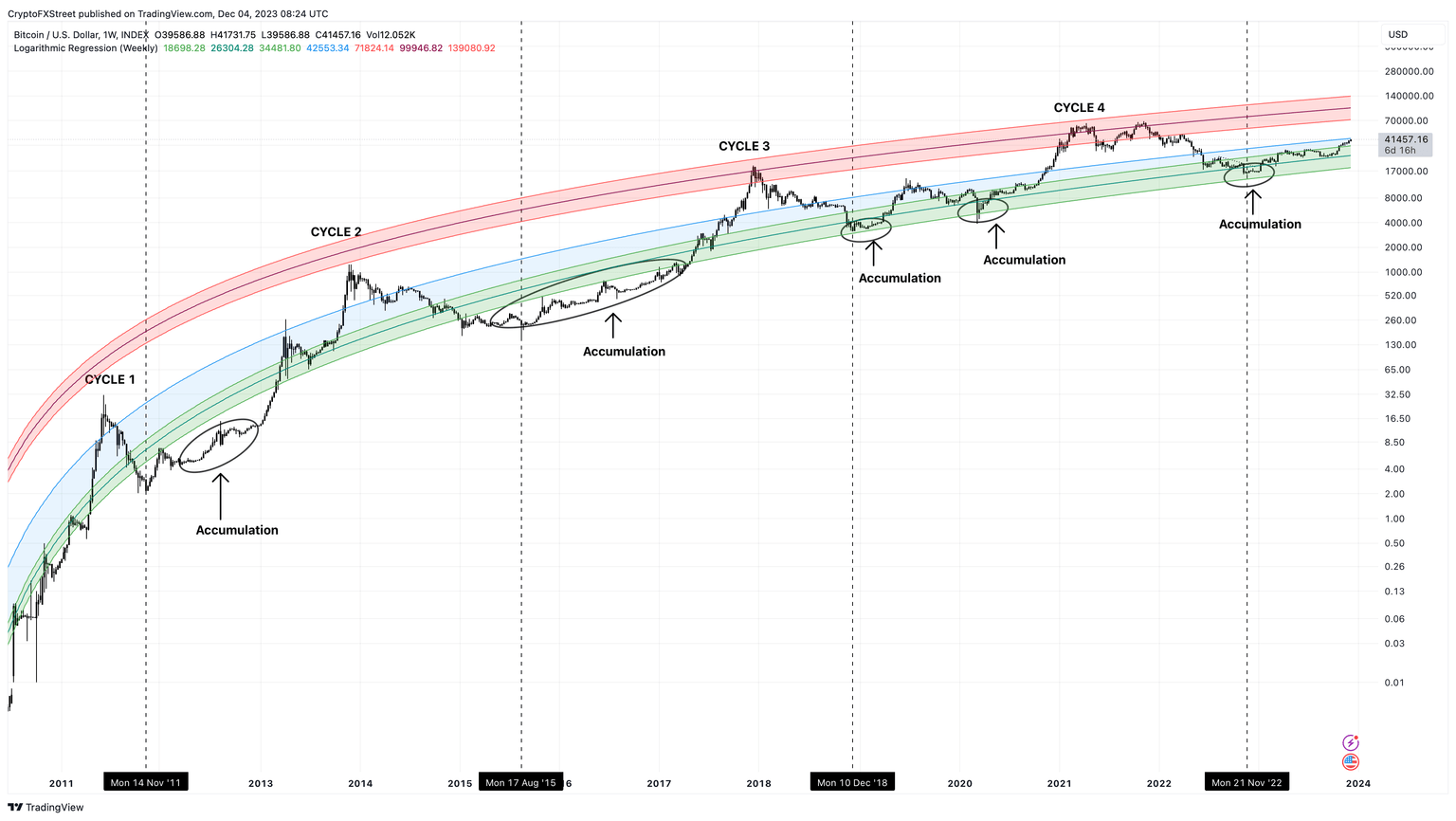

The logarithmic regression curve chart for Bitcoin price shows three key bands – the green, blue, white and red bands. As seen in the chart, the green bands and lower are where cycle bottoms are formed, and long-term investors accumulate. Blue bands show the transition of a bottom/accumulation to an attempt at a bull run. Often, there are rejections that send BTC back to the lower bands. A transition from blue to white and red bands confirms the start of a bull run and potential top formations.

In 2017, there were two 40% corrections when transitioning from green to blue and blue to white. In 2019, when BTC attempted a bull rally, it faced two 20% corrections. In the fifth cycle, there were two near-20% corrections at the green and blue band intersections.

Currently, BTC trades at $42,000 and is knocking on the intersection between blue and white. If the current rally is similar to the 2019 price action, then a blow-off will be the sell signal. But if the market outlook is different this time due to the approval of the Bitcoin ETF, then a continuation of the run-up is to be expected.

In such a case, the next logarithmic band is present at $71,824.97, which would be an all-time high for Bitcoin price.

BTC/USDT 1-week chart

On the other hand, if there is a rejection at around the $42,000 level, a 20% correction could send BTC down to $33,600, which is a great place to form a higher low for a further ascent. The $35,000 to $32,200 range is a good place to accumulate BTC.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.