Web3 gaming becoming the focus of 2023 could lead to a rise in these tokens - AXS, APE, FLOKI

- Web3 gaming noted significant traction in 2022, with investors pouring in $4.5 billion, which is continuing in 2023 as well.

- The space is still facing challenges in terms of scalability and adoption, as only 3% of gamers held NFTs last year.

- Rising interest in the space could result in a breakout for the gaming tokens, with Axie Infinity expected to lead them.

Over the last year, the Web3 gaming sector noted a stellar increase at the hands of investors and venture capitalists. The rise of Non-Fungible Tokens (NFTs) and the Metaverse further fuelled this interest which is expected to continue into 2023 as well, provided investors can tackle some of the biggest roadblocks.

Web3 gaming - Where it is and what is next?

The Web3 gaming sector observed massive interest at the hands of venture capitalists who invested nearly $4.5 billion into such projects. The funding received by gaming projects last year superseded the investments from 2021 by over 48%. Most of this was directed toward Web3 gaming which accounted for 62% of the Web3 investments.

The interest in Web3 gaming projects has notably not decreased this year either as focus on the industry continues to sustain. Most recently, investment firm DWF Labs invested $16 million in Web3 company RACA. The company intends to use the funding to expand further and become a Web3 gaming ecosystem.

Similarly, the Web3 gaming engine Paima Studios integrated with Cardano allows users to play on-chain games with other networks. This feature enables cross-chain gaming for the DeFi blockchain, making it possible for users of other networks to play a Cardano-based game without the need to bridge ADA or other tokens.

However, while the Web3 gaming sector has support from financers, it needs to build a base with its users as well. A user poll from 2022 noted that only 3% of the gamers owned NFTs, and nearly 52% of the users surveyed were unaware of Web3 gaming terms. The poll also noted that only 15% of the surveyors were actually interested in Web3 gaming.

But this is expected to change over the next quarter as a rise in gaming tokens’ price could draw investors’ attention to the gaming projects as well. As it is over the last week, gaming tokens’ trading noted a 22% surge, with volumes rising to $1.5 billion.

The tokens that could go big in Q2 2023

Of the many gaming tokens in the crypto market - Axie Infinity (AXS), ApeCoin (APE) and Floki Inu (FLOKI) are expected to yield holders significant returns.

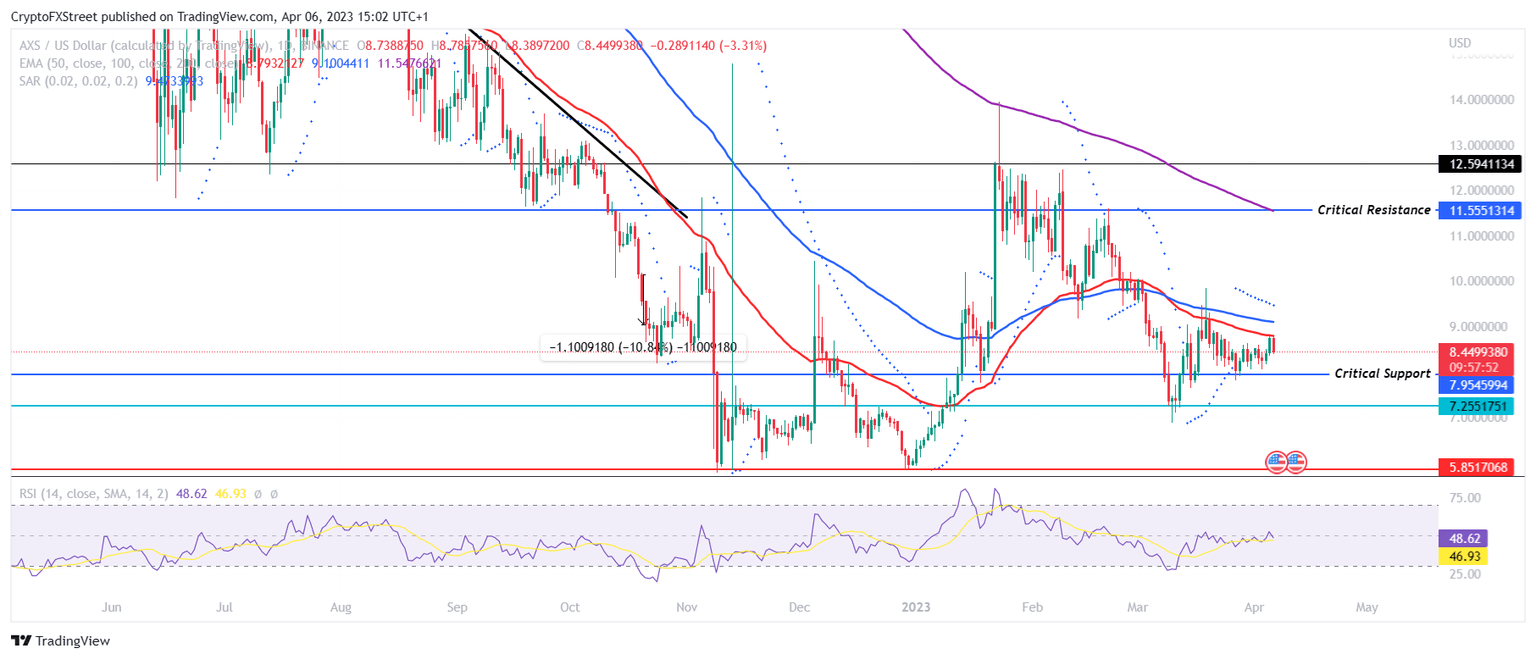

AXS

Axie Infinity is one of the biggest gaming projects, and its native token, AXS, is expected to note a rise of over 48% as the project’s tractions increase in 2023. The altcoin would need to see some bullish support in order to breach the critical resistance (CR), which sits at the confluence of the 200-day Exponential Moving Average (EMA) at $11.55. Breaching this barrier will direct AXS toward a 2023 high of $12.59.

AXS/USD 1-day chart

However, should the cryptocurrency fail to find buying pressure and sink below the critical support (CS) at $7.95, the gaming token could decline to March lows of $7.20. Not only will the bullish thesis be invalidated, but the cryptocurrency would be vulnerable to a fall to December 2022 lows of $5.85

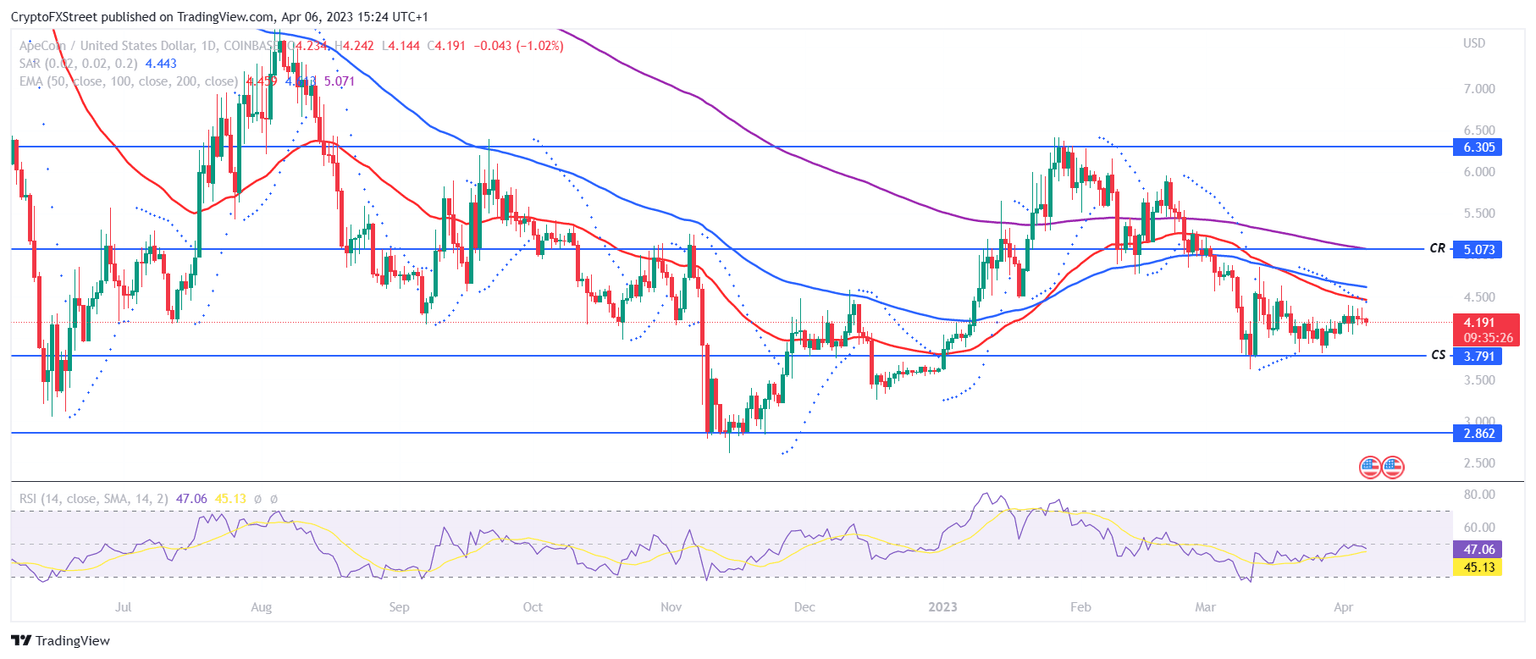

APE

ApeCoin continues to be an interest of investors thanks to Bored Ape Yacht Club being the biggest NFT collection. Over the last 30 days, the NFTs have generated $1.29 billion in trading volume, which could translate into a bullish momentum for the token.

APE could note a rise of over 50% during the alt season if bulls support the cryptocurrency. Breaching the CS at $5.00, coinciding with the 200-day EMA, is a crucial barrier for them to overcome. This would allow the token to chart new year-to-date highs of $6.30.

APE/USD 1-day chart

Nevertheless, selling pressure could trigger a decline and the loss of the CS at $3.70 could leave ApeCoin susceptible to a crash to November 2022 lows of $2.80.

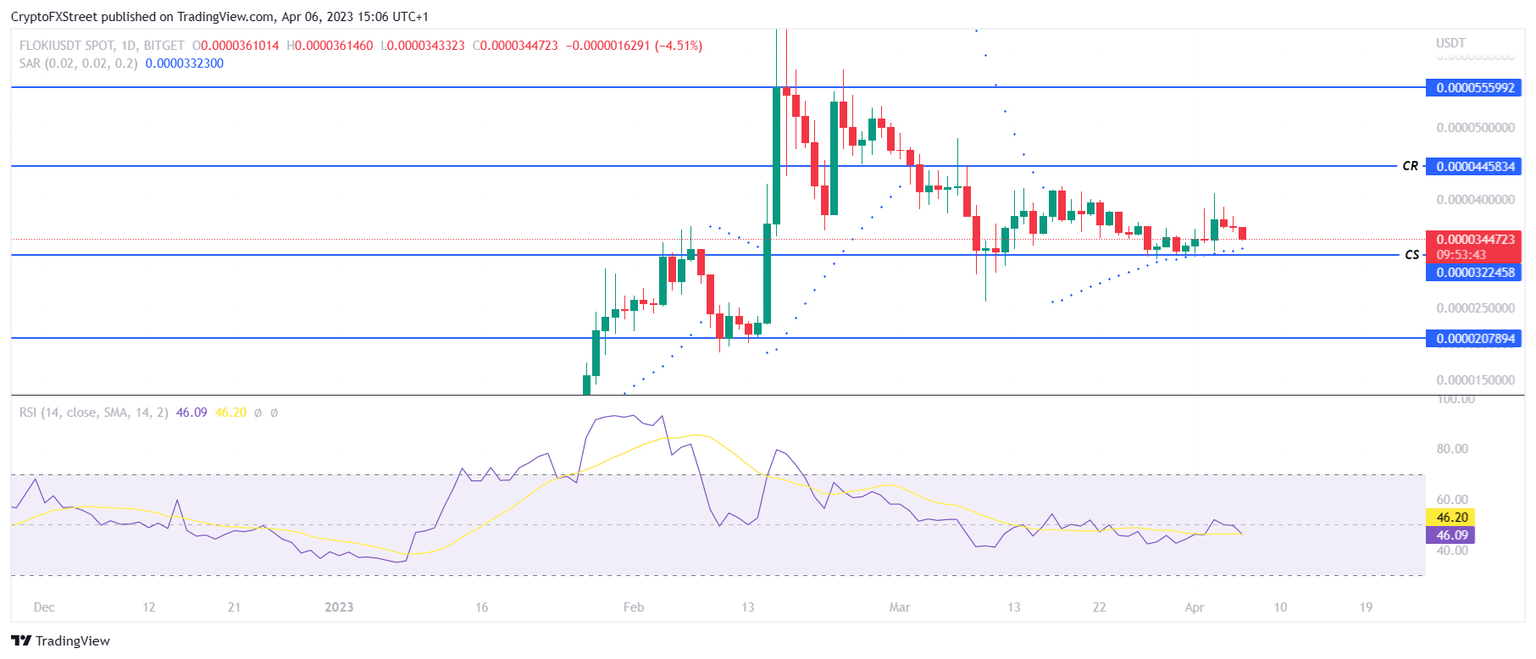

FLOKI

Belonging to the family of Dogecoin, Floki Inu made a name for itself by drawing users to its NFT Metaverse game Valhalla. The recent Elon Musk Twitter stunt is expected to trigger a rise in meme coins, and FLOKI could benefit from the same.

In order to mark a new 2023 high, the altcoin would need to breach the CR at $0.00004458, which is in line with the 50% Fibonacci Retracement of $0.00005559 to $0.00003224. Flipping it into support would enable a rise to $0.00005559, marking a 60% increase.

FLOKI/USD 1-day chart

But the failure to do so could result in a drawdown, and Floki Inu price could end up falling through the CS at $0.00003224. This would not only invalidate the bullish thesis but also lead FLOKI to drop to February lows of $0.00002078.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.