Wealth management firms offering BTC to clients, could help boost prices

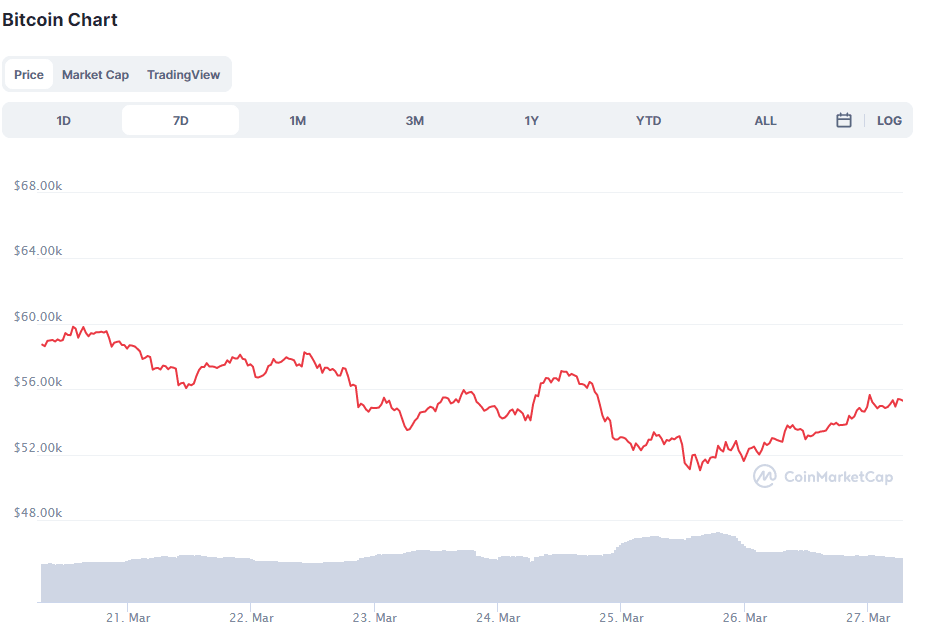

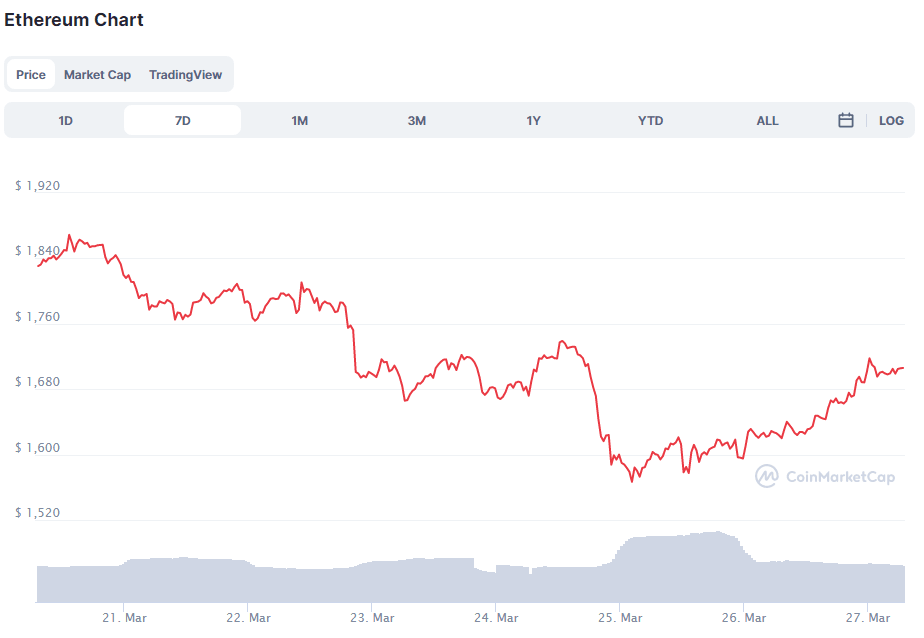

Both Bitcoin and Ethereum prices have been gradually dropping for an entire last week, with both coins seeing a particularly sharp drop late on Wednesday, March 24th. The drop came in expectation of the expiry of $6 billion worth of options contracts, as many started selling their coins in expectation of a large correction. However, now that this has passed, the future looks a lot brighter for the two leading coins’ prices.

Options knock prices down, options can get them back up

Bitcoin and Ethereum prices surged beyond any expectations in early 2021, but the expiry date of over 100,000 BTC options worth over $6 billion caused them to drop for most of the past week, with BTC hitting bottom at $51,100 and Ether at $1,556. However, things are looking up, as a number of options traders have started betting that the prices will go up.data shows that there is nearly $15 billion in open interest across different exchanges that offer BTC contracts, as traders believe that BTC price will soar to $80,000 by May 2021.

Another extremely positive development has shown that institutional investors were not scared off by the recent price dip. In fact, despite BTC recently dropping by 14%, US-based institutions are continuing to buy, seemingly confident that the situation will turn around.

On top of that, JMP Securities revealed that it expects $1.5 trillion to flow into Bitcoin after retail wealth management firms started following the example set by Morgan Stanley, and decided to offer Bitcoin to their clients.

Another encouragement for this to happen likely came from Elon Musk’s recent announcement that Tesla will now start accepting Bitcoin as a means of payment.

However, for all the positive news, there is also a hint of negative development, as the legendary investor, Ray Dalio, recently warned that the US government might end up banning Bitcoin, comparing the current situation with the one in the 1930s, when the gold ban came into action.

Another piece of relatively bad news concerns Ethereum, as it was revealed that Ethereum’s scaling solution, Optimism, might end up postponing the launch of the project’s mainnet until at least July. The mainnet was previously expected to come out last week, but now, it seems that this won’t happen for some time longer.

Bitcoin and Ethereum start recovery after options expired Friday

As Friday, March 26th approached, and with it the expiration of the mentioned Bitcoin options, the world’s first cryptocurrency started to drop. BTC has been going up and down for an entire week, with the overall trend being bearish, as can be seen on the last week’s chart.

Fortunately, the situation started to turn immediately after the options expired. The new, positive outlook provided by the next set of options encouraged investors to return to BTC, and the coin’s price started rising again, reaching $55k only 24 hours after hitting a 2-week low.

Ethereum mirrored Bitcoin’s performance despite the fact that its mainnet launch was delayed by several months, once again showing how strong BTC dominance is. Over the course of last week, the coin dropped from $1,868 to $1,566, only to rise back to $1,717 by Saturday morning, and keep going up after a brief correction.

Author

Greg Waisman

Mercuryo

Greg Waisman is one of the co-founders at Mercuryo, has deep expertise in the field of technology, fintech and blockchain. Greg has a history of working with tech-related projects.