Weakness creeping in for Bitcoin

Bitcoin is struggling to find any direction and it will not be a stretch statement to say that the price has been very much consolidating for the last number of days. This is quite interesting because if we look at the news flow, there is ample optimism. Every day, almost, we hear more major institutions, including some big banks issuing statements that they will be offering Bitcoin to their wealthy clients. But if we look at the Bitcoin price, it seems like it is struggling to keep hold of its gains.

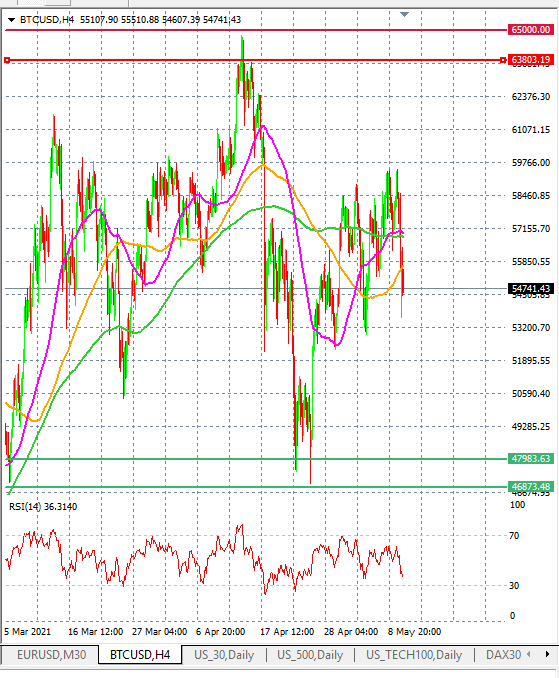

From a technical price points, things are looking weaker. The reason for this is that the Bitcoin price has clearly lost the battle with the 50-day SMA on the daily time frame, and the price has moved below this important average. In addition to this, the price is also struggling to stay above the 100-day SMA as well. Traders will also need to pay attention to the 4-hour time frame where things are looking uglier. I am saying this is chiefly because the price has crossed below the 50, 100, and 200-day SMA, which means we are likely to see more sell-off if the price doesn't move above any of these averages any time soon.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.