WazirX hacker moves $11M stolen Ether to Tornado Cash

-

The North Korean entity responsible for the hack on India's WazirX crypto exchange moved over $11 million in stolen ether (ETH) to Tornado Cash early Monday, aiming to mask the transaction trail.

-

The breach in July resulted in the loss of over $100 million in SHIB, $52 million in ETH, and other assets, representing a significant portion of WazirX's reserves, with ongoing efforts to manage the fallout through restructuring.

The North Korean entity behind India’s biggest crypto hack moved $11 million in stolen ether (ETH) early Monday in the latest batch of transfers to mixing service Tornado Cash.

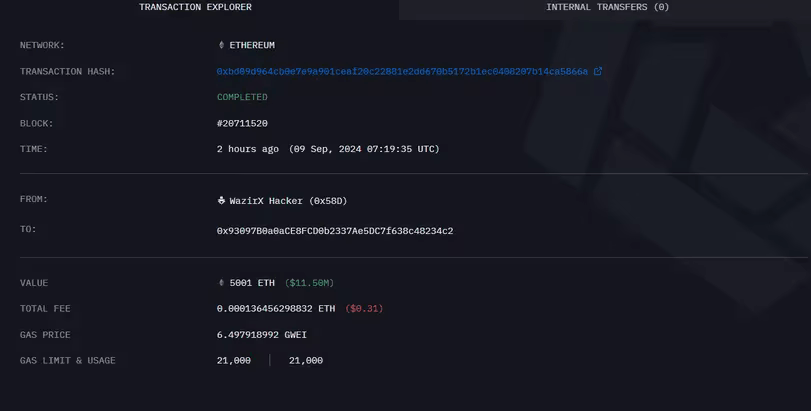

Wallet data tracked by Arkham shows over 5,000 ETH, worth just over $11 million at current prices, from July’s attack on crypto exchange WazirX was moved to a new address at 07:19 UTC.

Then, $1.2 million in tokens from that address were sent to Tornado Cash over five different transfers.

Tornado Cash allows crypto users to exchange tokens while masking wallet addresses on various blockchains. The service, by itself, is not nefarious but is commonly used by crypto criminals to clean an online trail that could lead to the identity of those moving stolen funds.

The moves follow a $4 million transfer from last week, as first reported by CoinDesk. The hacker’s main address holds over $107 million worth of various tokens - with a majority in ether at $100 million.

(Arkham)

In July, WazirX was hit by a security breach in one of its multisig wallets, causing over $100 million in shiba inu (SHIB) and $52 million in ether, among other assets, to be drained from the exchange.

The stolen funds accounted for over 45% of the total reserves cited by the exchange in a June 2024 report – and the exchange has since filed for a restructuring process to clear liabilities.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.