One of the rules of thumb in the crypto space, when deciding which exchange you are going to set up shop on, is that the more volume and the more liquidity, the better. Using objective and truthful market information when entering the cryptocurrency sector is crucial as it drastically reduces the risk of making a mistake.

This is why data aggregating sites are so important in crypto. Not long ago exchange titan Binance purchased CoinMarketCap for an undisclosed sum of money, rumored to be in the tens of millions of dollars. Even before the sale though, these sites have long been acknowledged as wielding great influence in the industry.

The crypto space, as it exists now, is still a murky place. There are some regulations based on geographical location, but they are hardly comprehensive. In the absence of comprehensive regulation, the industry and the people who work in it are at the mercy of the information available to them. Therefore, tools like CMC, and other sites like it, make a world of difference.

As such, before being acquired by Binance, one of the most significant features of CMC was its volume breakdown. When you went to the home page and clicked on the exchanges tab you had three options by which you could sort the listed exchanges: reported volume, adjusted volume and liquidity. These three values are very much related, but they each represent distinct things.

What good was a volume split?

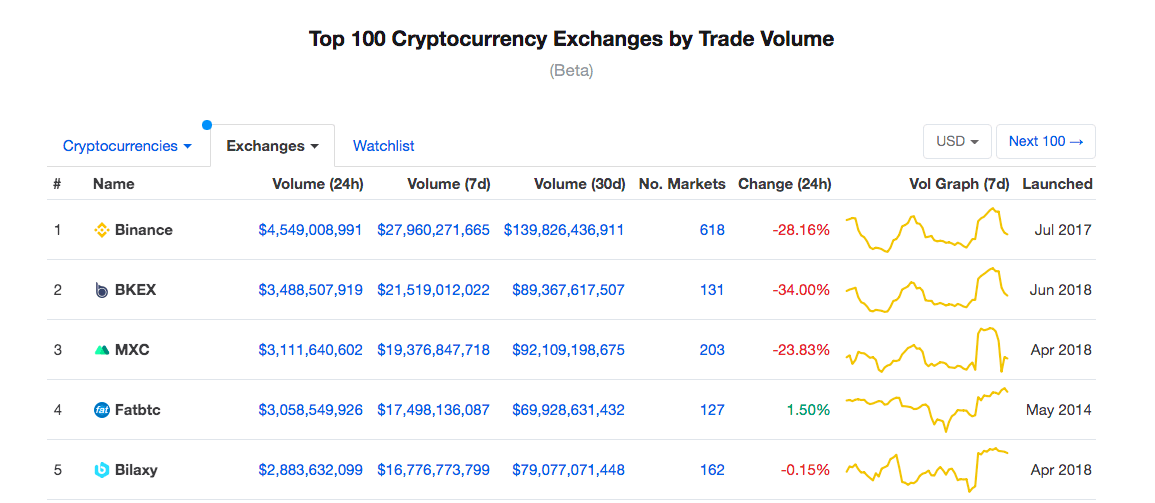

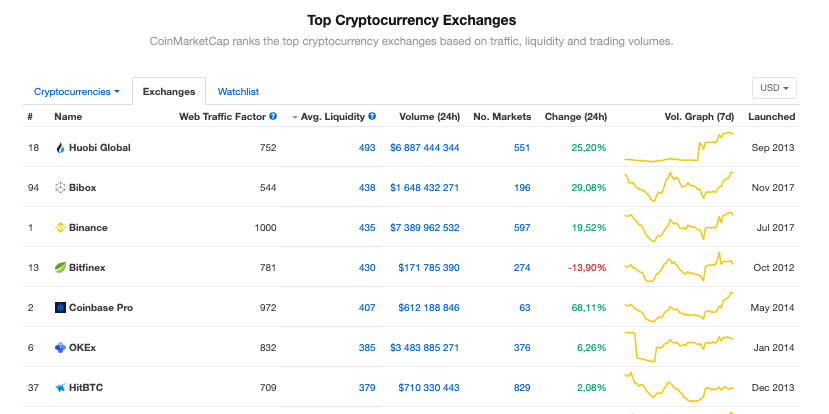

To start with reported volume, it applies to the total volume coming directly from exchanges. When gathering data from exchanges and then reproducing it on their site, CMC uses the APIs of the exchanges it probes. Exchanges tend to use different and unique APIs and, as a result, the raw data that CMC and other sites get is heterogenous in what it represents. For example, different exchanges use different metrics when measuring their volumes and the difference in metrics can inflate or deflate their values when compared with another exchange that is using a different measurement scheme. To summarise, reported volume is pretty much a readout of the raw volume data from an exchange as it is transmitted via its own API. To help visualize here is what the reported volume rankings looked like as far as this mid-April:

As you can see Binance was on top by the equivalent of over a million dollars. Here we should remember that this is the raw data and presented as such.

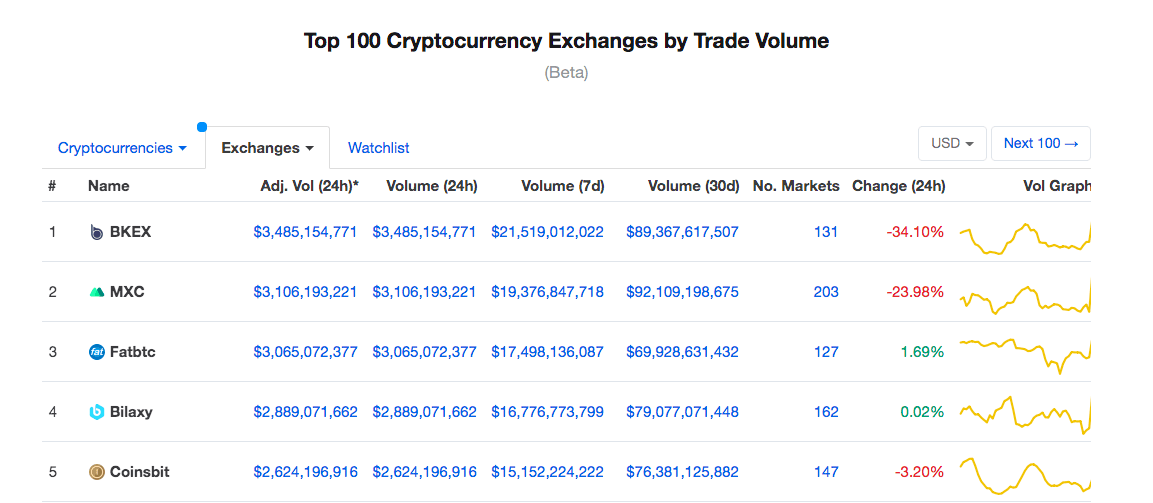

The solution to the disparity was for CMC to give two volume readouts: reported and adjusted. Adjusted volume describes the volume provided by spot markets excluding that with no fees and transaction mining.

CMC, and any other data aggregator worthy of its name, has analysts that take the trouble of parsing through all of this reported raw data and imposing a universal scheme of volume measurement upon it that is much more honest. When you look at the adjusted volume, you see a different picture:

Binance isn’t even in the top five. The other four have pretty static values, but the discrepancy for Binance is remarkable. From $4.5 billion to less than $1.5 billion, or from first place to 20th. It follows that reported volume is usually bigger than adjusted volume and is not that accurate as well.

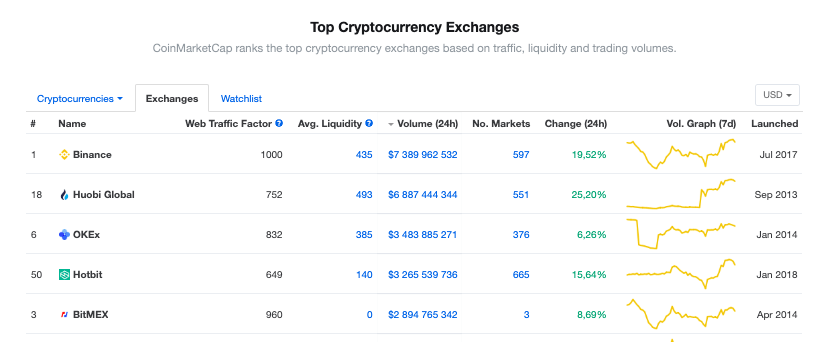

Now when it comes to measuring trading volume, CMC ranks exchanges regarding only their daily volume without any separation between reported and adjusted, which again catapulted Binance to the top of the list.

Knowing what we know about the sale of CMC we might suspect some home cooking here, but now, this is not to suggest that Binance is maliciously inflating its numbers. There are not many people out there that would claim that Binance is a scam, we are just taking it as an example because it used to be illustrative of the difference between the two values. And, while you probably don’t have to worry about an exchange as big as Binance, you should be careful when taking exchanges at their word without having an extra adjusted volume cushion. The volume numbers that exchanges put out can reflect merely the particular circumstances of trading on their exchange, which they have played a huge part in establishing.

Liquidity as key

There is, of course, a third value that we don’t forget about, and this may be the most helpful of the three to traders. Why is liquidity pivotal? Liquidity is a measure of market activity. When a market has high liquidity it means that transactions of almost any size can be processed without disrupting the flow of the market. When a market is flowing properly, that means that both buyers and sellers can rely on fairly agreed-upon prices. In other words, when a market has a high level of liquidity you won’t be at risk of selling or buying something at a price that does not equal its value.

This is especially important in the crypto sphere where prices rise and fall markedly over the course of a single day. Traders, whether they are just starting out or they have some experience already, typically flock to exchanges that can provide them with the best liquidity. And, beyond that, the industry is dependent on exchanges that can provide solid liquidity in order to maintain its health. Liquid exchanges allow assets to grow and people to enter the market, without them the industry cannot thrive.

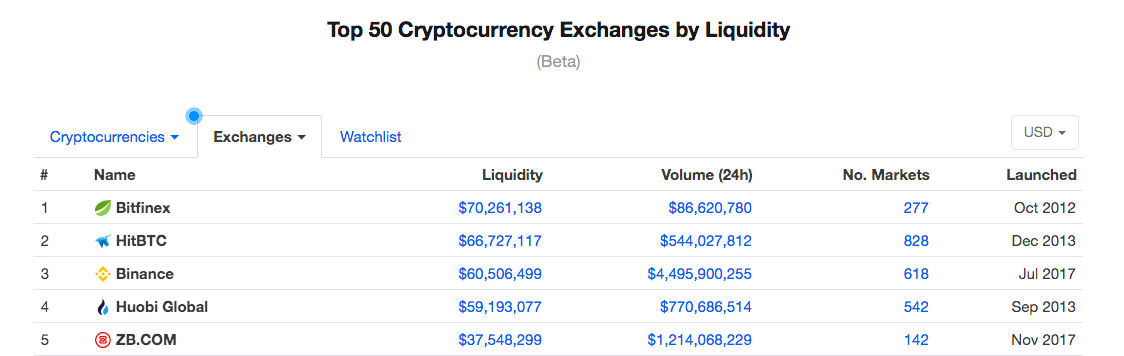

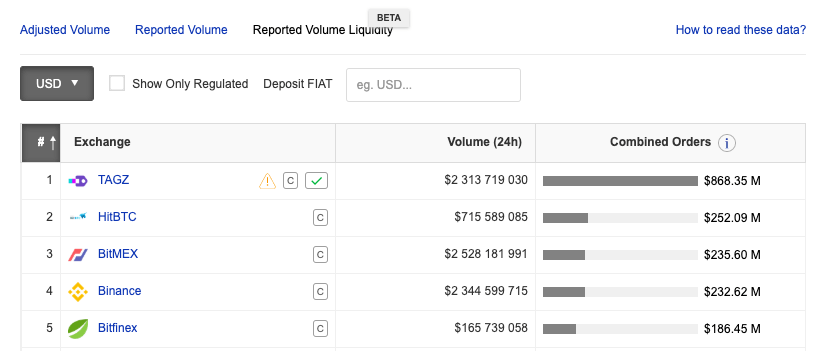

The liquidity rating will give you an idea of the market health of an exchange. If an exchange has a high liquidity rate with a lot of open markets that will tell you that it is pretty trader friendly. Here’s what the liquidity rankings looked like before the fundamental changes in metrics took effect on CMC:

Again, we see Binance. But while Binance towers over Bitfinex and HitBTC in terms of volume, it has a slightly lower liquidity rate.

The way things stand now, the methodology of liquidity exchange rating has changed as well, grading all crypto markets with a score from 0 to 1000 in order to allegedly simplify the process of comparing the difference in liquidity across various markets and make the rating more relevant. However, the point is that it doesn't clarify why the current ranking is so strikingly different from that prior to the implementation of these changes.

Binance is the only exchange to remain in the top 3 while Bitfinex and HitBTC have lost their leading positions. Previously the liquidity indicator was based on the depth of the order book, with larger orders meaning a more liquid market. Such an approach was focused on both retail and institutional players and didn’t prioritize the former to the detriment of the latter. At present only orders in the range of $100 to $10,000 carry weight, meaning that CMC almost completely ignores the interests of the whole class of big crypto market participants to suit average traders. This is why exchanges that serve more institutional investors have slid down outside of the liquidity top 3.

By comparison, we can check the same rate on the alternative Coinpaprika cryptocurrency research platform where our three values are still available to examine.

Despite the different ranking methodologies, we see a pretty similar picture for Binance and Bitfinex, while HitBTC is back up ahead of them, reminiscent of when the evaluation of major exchanges characteristics on CMC was far more objective.

Breaking down CoinMarketCap

With that being said, the current top three volume and liquidity rate suggested by CMC are not the only ones you should rely on now. The same is true for the new CMC web traffic indicator, aimed at ranking exchanges in accordance with their amount of web traffic. The higher, the better, and Binance seems to be outplaying everybody in this regard, giving itself a ranking of 1000 out of 1000. This metric is being criticized most of all because it can’t be counted on to deliver relevant information while many market participants trade with API keys. What is even more confusing is the fact that Web Traffic Factor places exchanges that are outsiders in terms of liquidity and trading volume like Indodax or Mercado Bitcoin at the forefront, which makes such a ranking practically unreasonable. All together it results in the crypto community searching for other data aggregating shelters like Coinpaprika or CoinGecko.

For the traders reading this, to sum up the aforementioned data from two different but recognized sources, Bitfinex, HitBTC and Binance are probably, at the moment, the three most trader friendly exchanges in the industry, with HitBTC perhaps getting the slight edge by virtue of its advantage in terms of number of markets.

So, if you are looking for a good place to trade, you can’t really go wrong with those three. But remember, in your journeys here in the crypto space — especially now in these still early days — take everything with a grain of salt, and do your homework; your portfolio will thank you in the end.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.