Ethereum co-founder Vitalik Buterin has drastically increased his activity on X, posting more in the last month than the 18 months prior after criticism he had abandoned the platform.

Across all of August, Buterin posted or replied about Ether ETH $2,343, the Ethereum blockchain, and other topics at least 158 times, as trader and conomist Alex Krüger pointed out in a Sept. 12 X post.

In comparison, from January to July, he posted 44 posts and posted just 13 times in all of 2023.

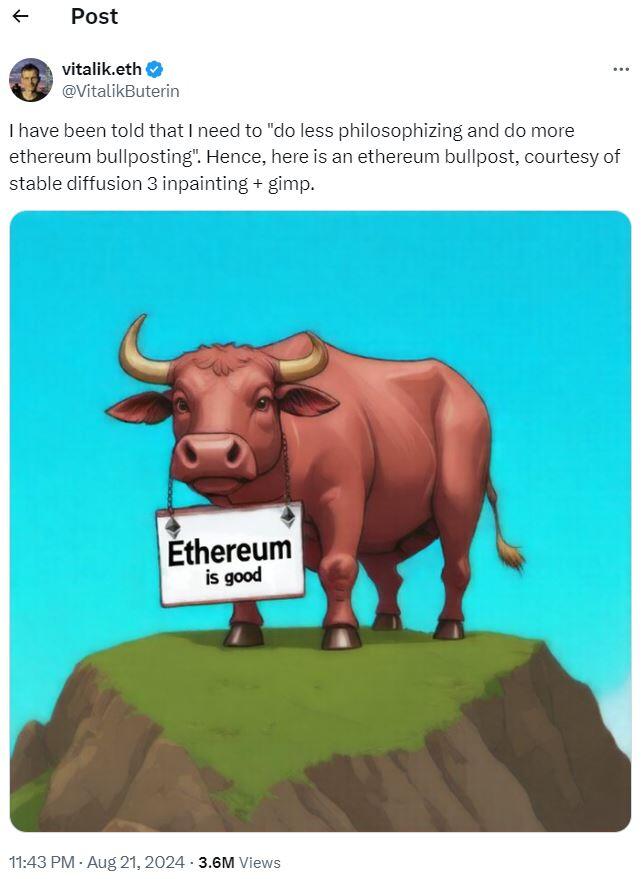

Buterin wrote in an Aug. 20 X post that he was told to "do less philosophizing and do more Ethereum bullposting.”

Source: Vitalik Buterin

Buterin was criticized and accused of abandoning X for the smaller Farcaster platform, with largely follower accounts, including by “Autism Capital,” who called for Buterin to return to X and push Ethereum.

In a reply to Elon Musk, Autism Capital speculated that Buterin left X for Farcaster because it allowed him to engage with a smaller group of like-minded peers with less scrutiny.

Source: Autism Capital

Buterin’s increased X activity has continued into September, with more than 30 posts or replies up to Sept. 13, with posts suggesting that the community should begin ramping up the pressure on L2s without adequate decentralization protocols.

In July, Solana surpassed Ethereum in weekly total fees for the first time, clocking approximately $25 million in revenue versus Ethereum’s $21 million.

At the same time, Buterin transferred about $10 million worth of his Ether holdings to wallets associated with crypto exchanges in August and Arkham Intelligence data showed Buterin’s address had outflows of around 422,000 ETH (worth $993 million) since 2015.

The transfers led to speculation that Buterin has been selling his Ether holdings to realize profits, which he denied, saying he has never sold his Ether holdings for profit, only to support various projects that he thinks are valuable.

The price of Ether is currently sitting at $2,350 and has been unable to close above $2,500 since Sept. 2.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.