Vitalik Buterin excludes L2 chains that do not use Ethereum for data availability at web3 carnival

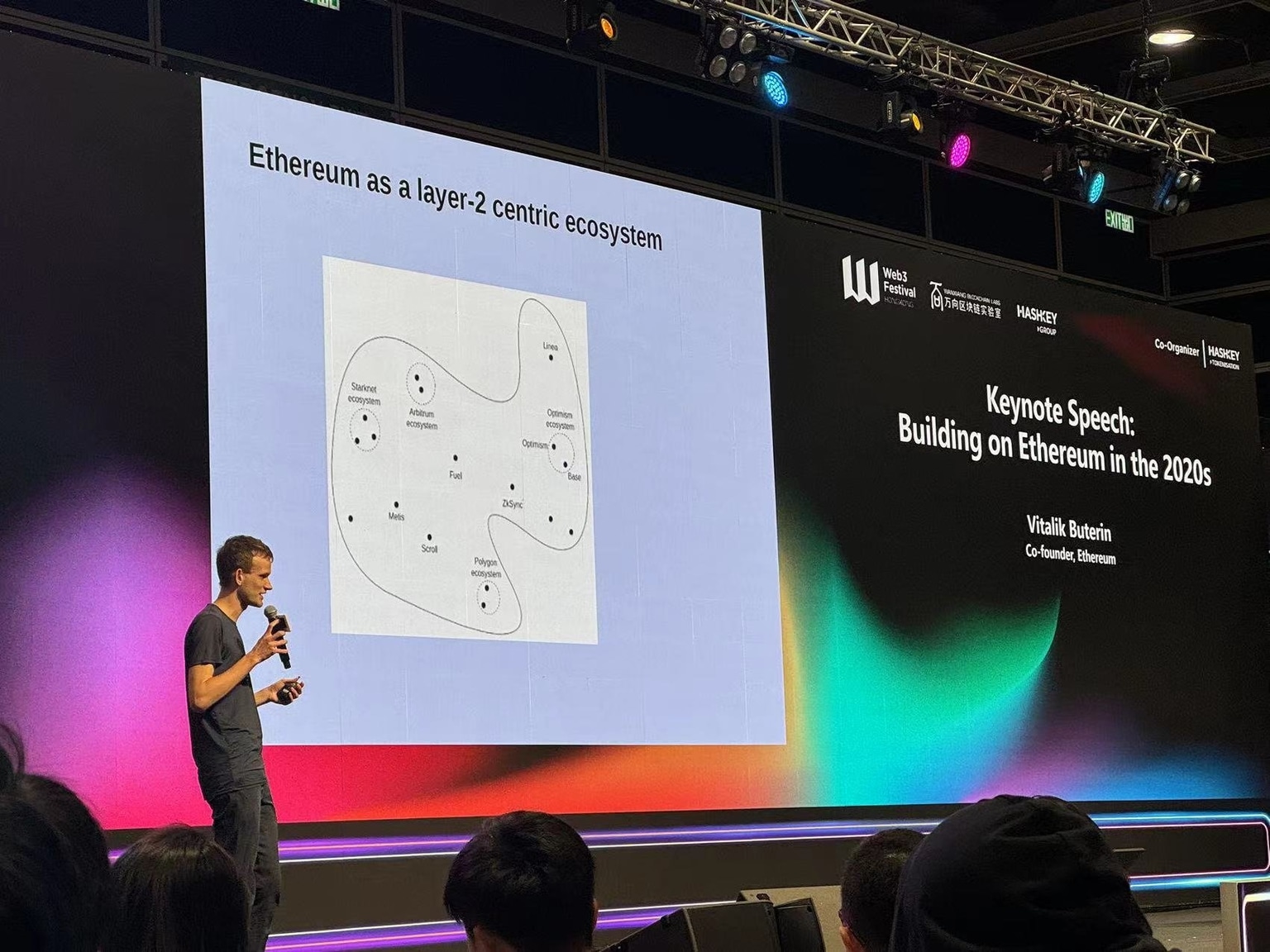

- Vitalik Buterin presented an Ethereum Ecosystem diagram at the 2024 Hong Kong web3 carnival on Tuesday.

- Buterin spoke of Arbitrum, Optimism, Base, Starknet, zkSync, Metis, Linea, Scroll, Polygon and Fuel, among other Layer 2 chains.

- The Ethereum co-founder left chains that do not use ETH for data availability out of his keynote.

Ethereum co-founder Vitalik Buterin addressed crypto traders and web3 market participants at the Hong Kong web3 carnival on Tuesday. Buterin’s Ethereum Ecosystem diagram included Layer 2 projects that use Ether for data availability while leaving out projects that use other chains like Celestia.

Buterin’s keynote on web3 drops Blast, Manta Pacific and Celestia out of his talk.

Buterin addresses web3 users, talks about the Ethereum ecosystem

In his presentation at the 2024 Hong Kong web3 carnival, Vitalik Buterin discusses EIP-4844, proto danksharding and emphasized on Layer 2 chains in the Ethereum ecosystem. The ETH co-founder explained the smart contract network’s future expansion plans through data availability sampling (DAS) and said that the project aims to increase capacity up to 128 blobs.

Ethereum Layer 2 chains like Manta Pacific use Celestia for data access, reducing the cost incurred by L2 when data is made available by the Ether mainnet. While this offers an alternative to developers of Layer 2 chains, Buterin left these chains out of the Ethereum ecosystem in his keynote address at a web3 carnival in Hong Kong.

The Ethereum co-founder’s presentation included L2 chains like Arbitrum, Optimism, Base, Starknet, zkSync, Metis, Linea, Scroll, Fuel and the largest of all, Polygon. Blast and Manta were missing from the diagram, despite being L2 chains and part of the ETH ecosystem.

Ethereum ecosystem diagram presentation by Vitalik Buterin

While Celestia appears superior to Ethereum as it offers data access at a lower cost, experts at Figment Research argue this may not be the case going forward as competition emerges. Other viable alternatives like Polygon Avail and Eigen Layer are currently in the works and are likely to compete with Celestia in the coming months.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.