Vitalik Buterin dumps airdropped MOPS, CULT, SHIK ahead of Shanghai upgrade, triggers liquidity drain

- Vitalik Buterin shed his non-Ethereum shitcoin holdings of MOPS, CULT, and SHIK in exchange for nearly 440 ETH.

- With the Shanghai upgrade around the corner, the Ethereum founder cleaned his portfolio of small market capitalization holdings, shitcoins.

- Projects send free tokens to Buterin, while the Ethereum founder sells it, draining the liquidity of the low market capitalization projects.

Vitalik Buterin has shed his non-Ethereum small market capitalization holdings of tokens like MOPS, CULT, SHIK ahead of the Shanghai upgrade. The Ethereum Shanghai upgrade is key to the altcoin’s ecosystem as it precedes ETH token unlock.

Also read: Ethereum blockchain deploys feature to help ETH users recover crypto if they lose private keys

Vitalik Buterin sheds MOPS, CULT, SHIK holdings in exchange for Ethereum

Vitalik Buterin, the founder of Ethereum is gearing up for ETH Shanghai upgrade. Buterin cleared his portfolio of small market capitalization tokens, “shitcoins” that projects airdrop to his wallet address.

A shitcoin is a cryptocurrency with little to no value that has no discernible utility or purpose. Buterin sold tokens like Mops (MOPS), Cult DAO (CULT), Shikoku (SHIK), exchanging them for nearly 440 ETH worth $691,000.

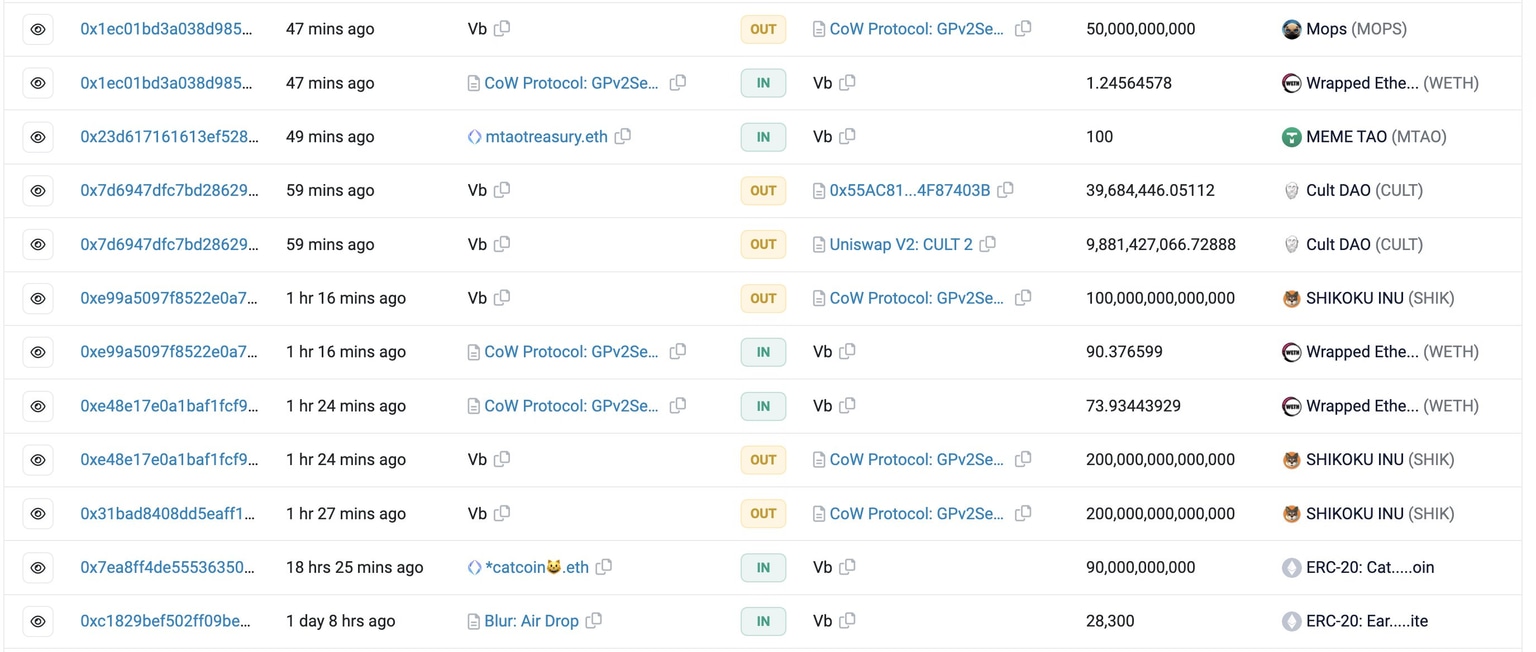

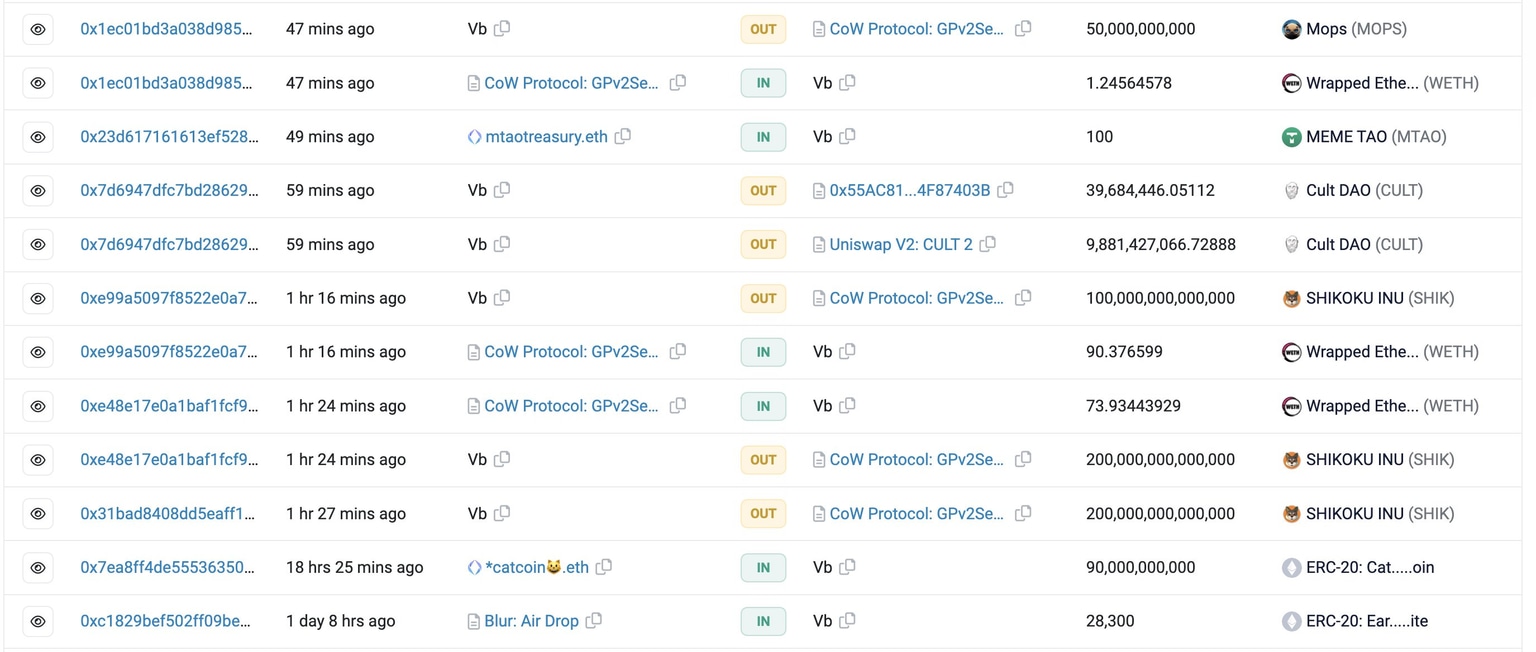

Vitalik Buterin’s sale of shitcoins

Shitcoin projects typically send their tokens to Buterin’s wallet address for increasing their popularity and relevance in the crypto community. Most of the shitcoins have a relatively low market capitalization, therefore Buterin’s sale drains their liquidity and triggers a massive price drop.

The Ethereum founder sold 50 billion MOPS for 1.25 ETH, 10 billion CULT for 58 ETH and 500 Trillion SHIK for 380 ETH. Post Buterin’s sale, CULT and SHIK witnessed an 8% and 58% drop in their prices respectively.

Crypto Twitter is disappointed with Buterin for the sale of the shitcoins as it has a massive impact on the low-value projects and its token holders. Buterin is aware that selling free shitcoins can tank prices and drain liquidity massively. Market participants believe the Ethereum founder is selling to cover his expenses as this could count as income on his tax sheet.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.