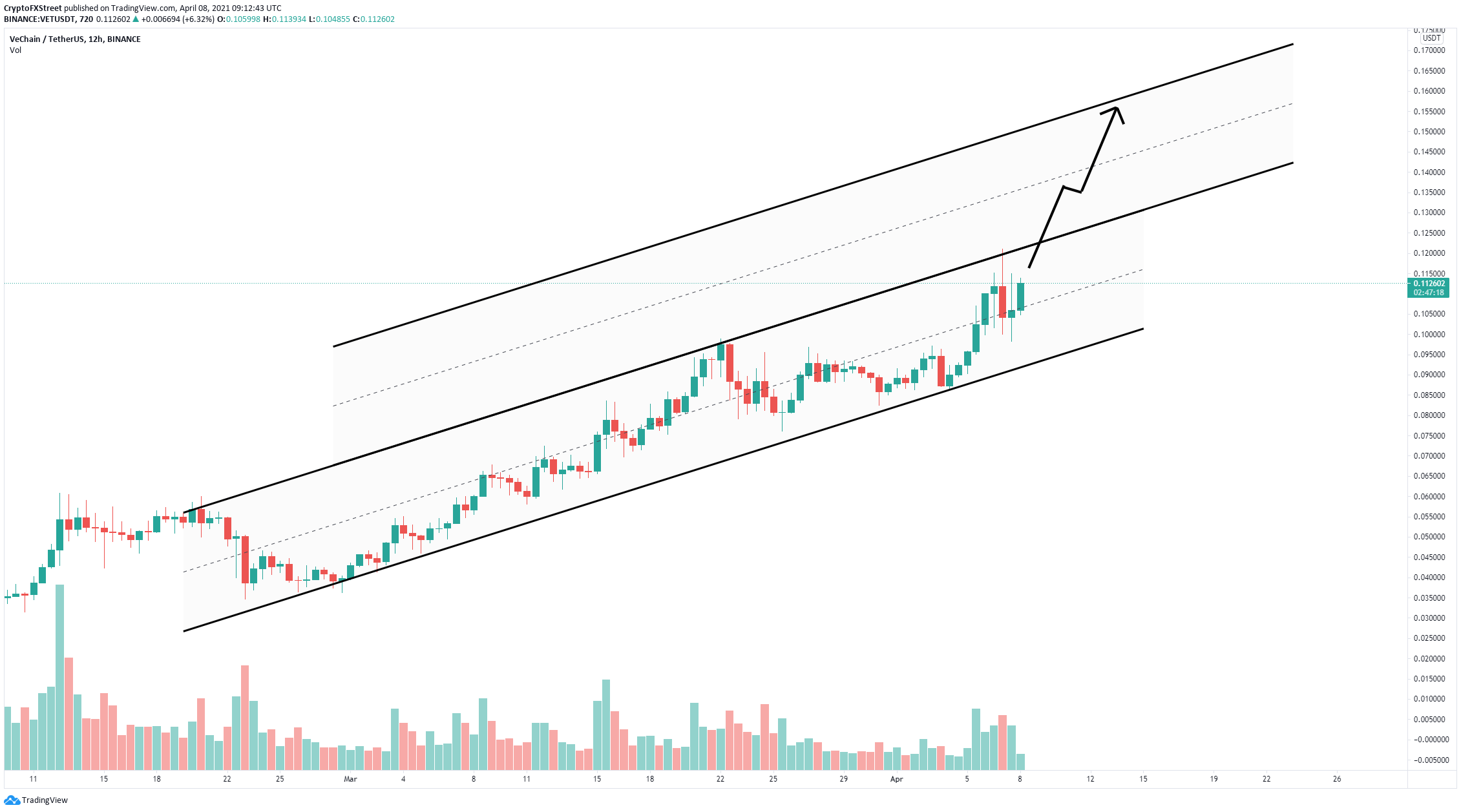

- Vechain price is trading inside an ascending parallel channel on the 12-hour chart.

- A breakout above the upper boundary of the channel will lead VET to new all-time highs.

- VET has been trading inside a robust daily uptrend for the past two months.

Vechain established an all-time high at $0.121 on April 7, continuing to trade inside the daily uptrend that started in mid-February. VET bulls defended a significant support level in the past 48 hours and are now aiming for a new leg up to new all-time highs.

Vechain price primed for significant upswing if key barrier is cracked

On the 12-hour chart, Vechain has established an ascending parallel channel that can be drawn by connecting the higher highs with a trendline and the higher lows with another one.

VET/USD 12-hour chart

VET has managed to stay above the parallel channel's middle trendline and aims for a breakout of the key resistance at $0.123. After a move above the upper boundary, a new channel can be drawn, projecting the next price target at $0.14, followed by $0.16 in the long-term. There is practically no real resistance ahead as Vechain is in price discovery mode.

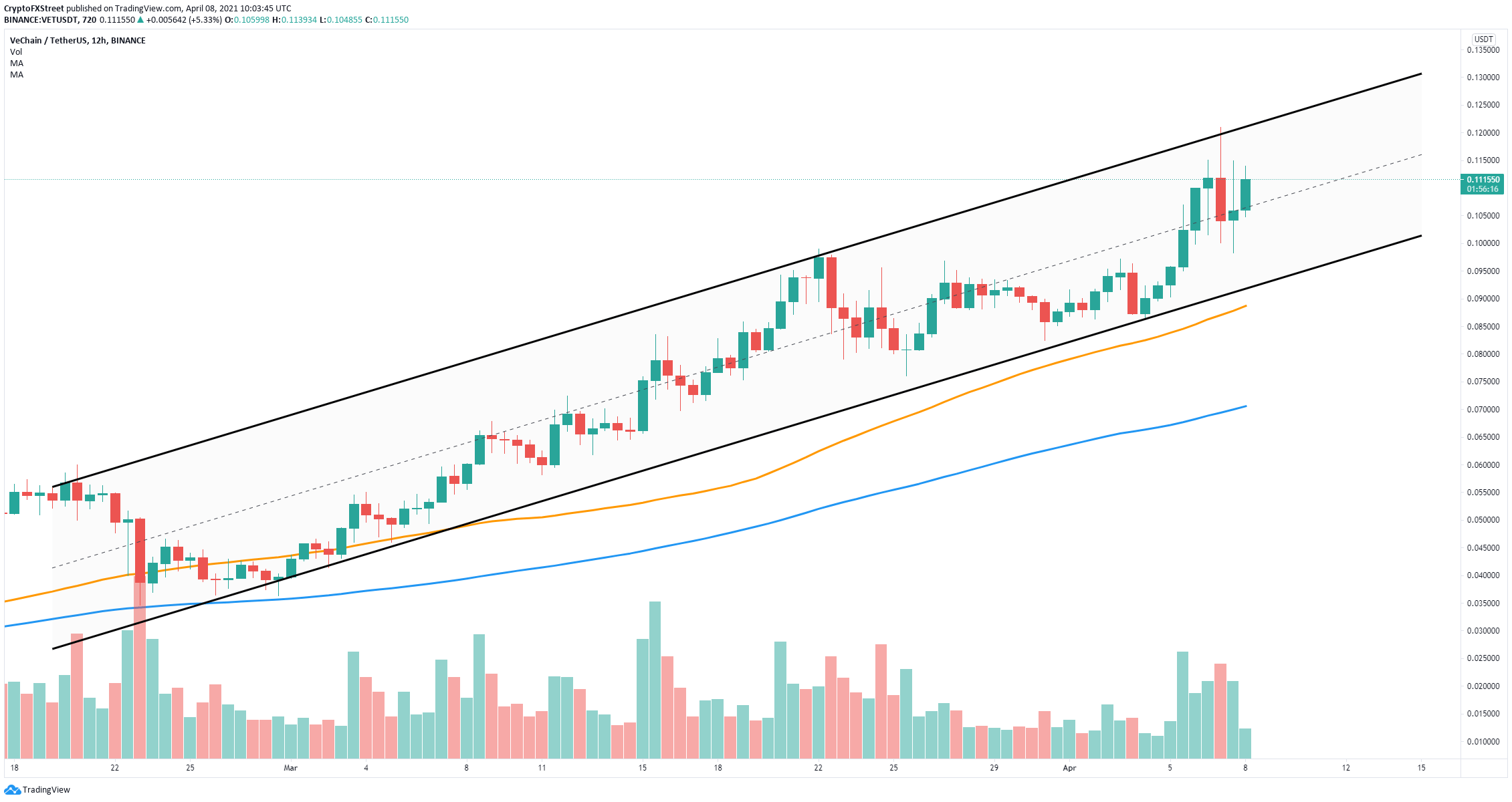

VET/USD 12-hour chart

To invalidate the bullish outlook, bears need to push Vechain below the middle trendline at $0.108. This breakdown will lead VET down to the parallel channel's lower boundary at $0.09, coinciding with the 50-SMA support level.

Losing this key support point would be notable, with the potential to drive Vechain price down to the 100-SMA support level, located at $0.07 at the time of writing.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.