VeChain Price Prediction: VET readies itself for 20% gains

- VeChain price has been on a slow downtrend over the past two weeks.

- Investors can expect a massive breakout move that pushes VET up by 20% to $0.144.

- If the selling pressure produces a decisive 4-hour candlestick close below $0.112, it will invalidate the bullish thesis.

VeChain price has seen its volatility dry up over the past two weeks as the sell-off continued. Although this development was bearish in the short term, it could become a precursor for a massive upswing.

VeChain price anticipates a bull rally

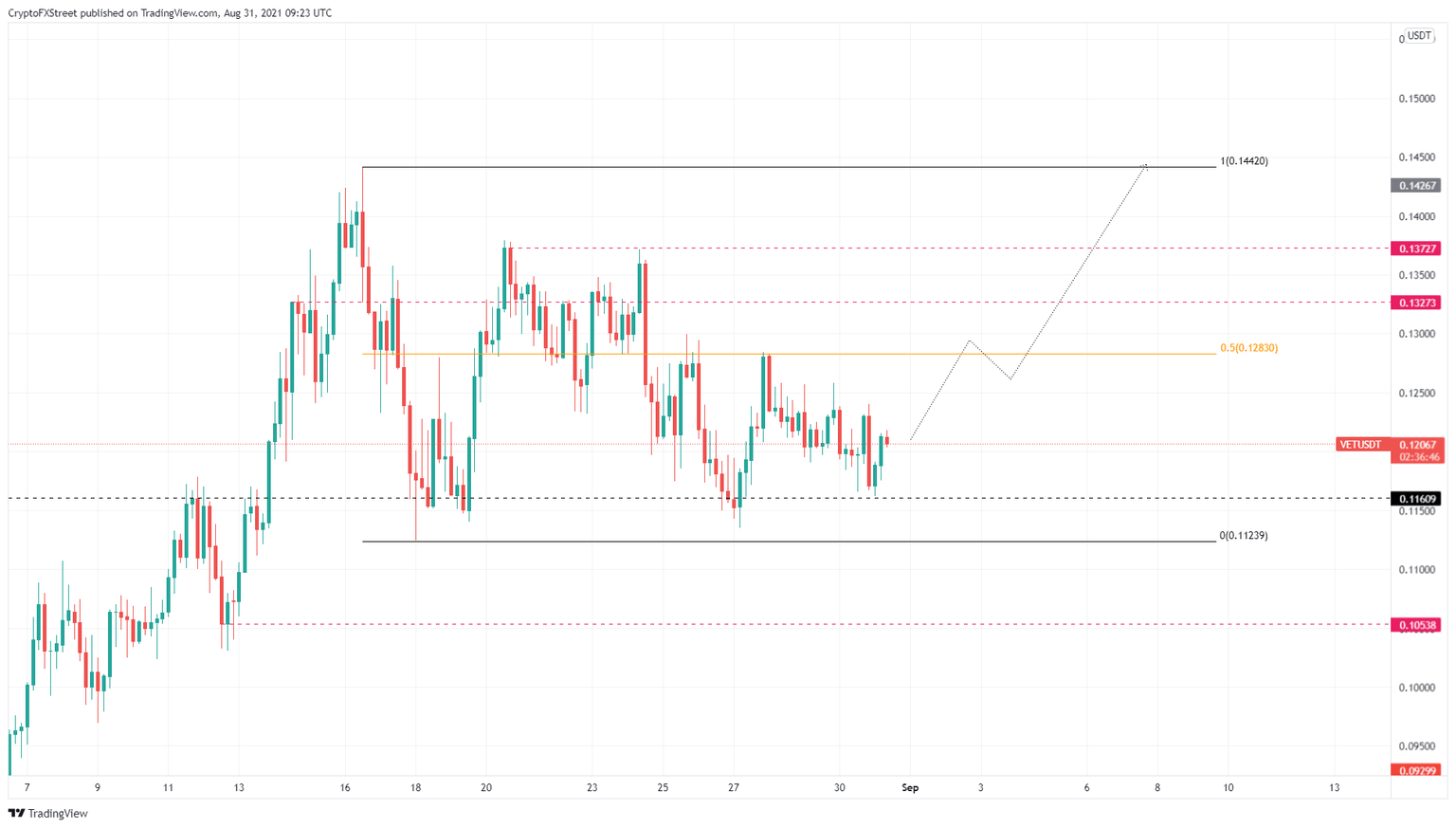

VeChain price has dropped roughly 16% since the August 16 swing high at $0.144. This downtrend is a result of multiple lower highs and VET price is currently trading at $0.121. From a big picture view, the three swing lows formed on August 19, 27 and 31 seem to represent a triple bottom pattern, suggesting a bullish outlook for VET.

Assuming the bulls make a comeback, investors can expect VeChain price to encounter the $0.128 resistance level, coinciding with the 50% Fibonacci retracement level. Clearing this barrier will put the $0.133 and $0.137 supply areas in the bulls’ path.

These levels will serve as a test of the momentum, and flipping these ceilings into a support floor will indicate that a move to $0.144 is inevitable. Assuming VeChain tags $0.144, it would represent a 20% upswing from the current position.

VET/USDT 4-hour chart

While things seem to be looking up for VeChain price, a breakdown of the $0.116 support floor will indicate an increased selling pressure without enough investors willing to scoop up VET at a discount. Such a move suggests that the demand for the token is currently less, which might push it to the range low at $0.112.

A decisive 4-hour candlestick close below $0.112 will invalidate the bullish outlook and potentially trigger a 6% crash to $0.105.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.