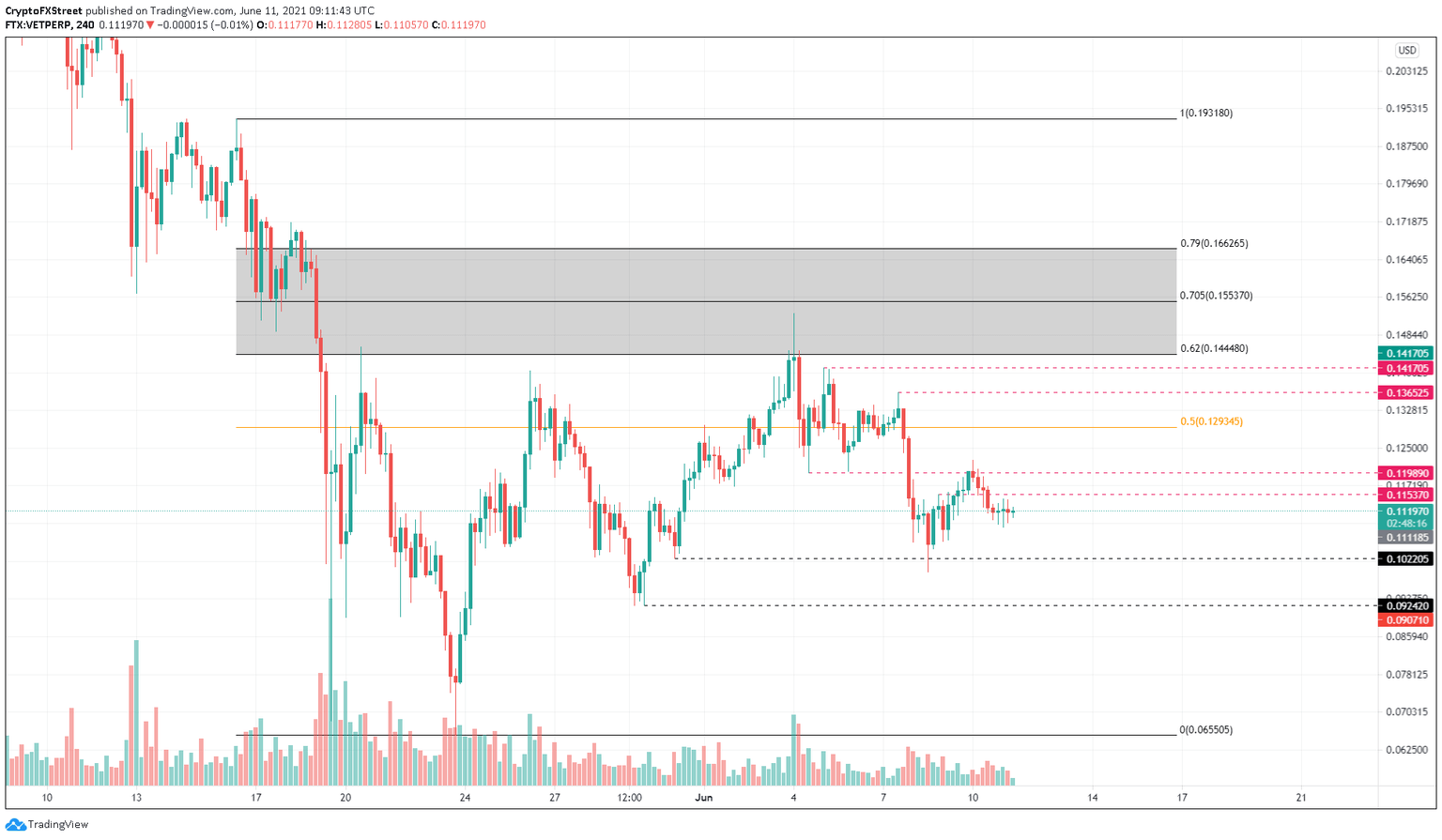

VeChain Price Prediction: VET forms potential bottom, eyes 30% upswing

- VeChain price shows the formation of a higher low, indicating a reversal in trend.

- A 30% upswing to $0.144 seems likely if $0.129 is shattered.

- VET will turn bearish if the bears produce a decisive close below $0.0924.

VeChain price retraces to a stable demand level as investors book profits after a minor upswing. VET will face an uphill battle with multiple swing highs to take out. Therefore, investors can expect this rally to be a slow run-up.

VeChain price needs to reclaim a critical supply barrier

VeChain price slid nearly 11% from $0.122 to $0.109 over the past 24 hours. VET awaits the formation of a higher low, which suggests a potential upswing could be developing.

Although unlikely, investors can expect a sweep of the support level at $0.102 before kick-starting the potential run-up.

The buyers will face stiff resistance at $0.115 and $0.120 before facing the 50% Fibonacci retracement level at $0.129. Breaching these barriers will signal the start of an uptrend and signal the sidelined investors to jump aboard.

If this were to happen, VeChain price might tag the swing high formed on June 7 at $0.136 and the local top at $0.141 set up on June 5.

VET might extend the rally to $0.144 or the 62% Fibonacci retracement level if the buyers continue to bid.

The leg-up from the current position, $0.11 to $0.144, is nearly 30%, but investors need to keep a close eye on the $0.115 and $0.120 levels, which might hinder the progress. VeChain price rally is likely to slow down or halt at these levels if the buyers fail to follow through.

VET/USDT 4-hour chart

The downside for VeChain price is relatively empty; therefore, a breakdown of the support barrier at $0.092 could trigger a steep sell-off.

In a bearish case, if VET produces a decisive 4-hour candlestick close below $0.092, market participants could expect a swift 30% crash to the range low at $.0655.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.