- VeChain price positions itself for a breakout to begin a rally towards new all-time highs.

- Buyers must pour into VeChain to break the resistance levels ahead.

- Failure by bulls to rally VeChain could trigger a return to $0.106.

VeChain price is poised for a big rally, pending a return to $0.15. However, conditions favor a slight pause at the present value area as bulls and bears take a breather to determine their next move.

VeChain price holds while bulls decide when – or whether – to push higher

VeChain price action has some significant resistance ahead. To confirm that a new bullish expansion phase is about to begin, VeChain must first close above the primary resistance levels above it: the subjective downtrend angle at $0.146 and the most recent swing high at $0.148. A pause in momentum and some apprehension by buyers to entering at current value area is understandable.

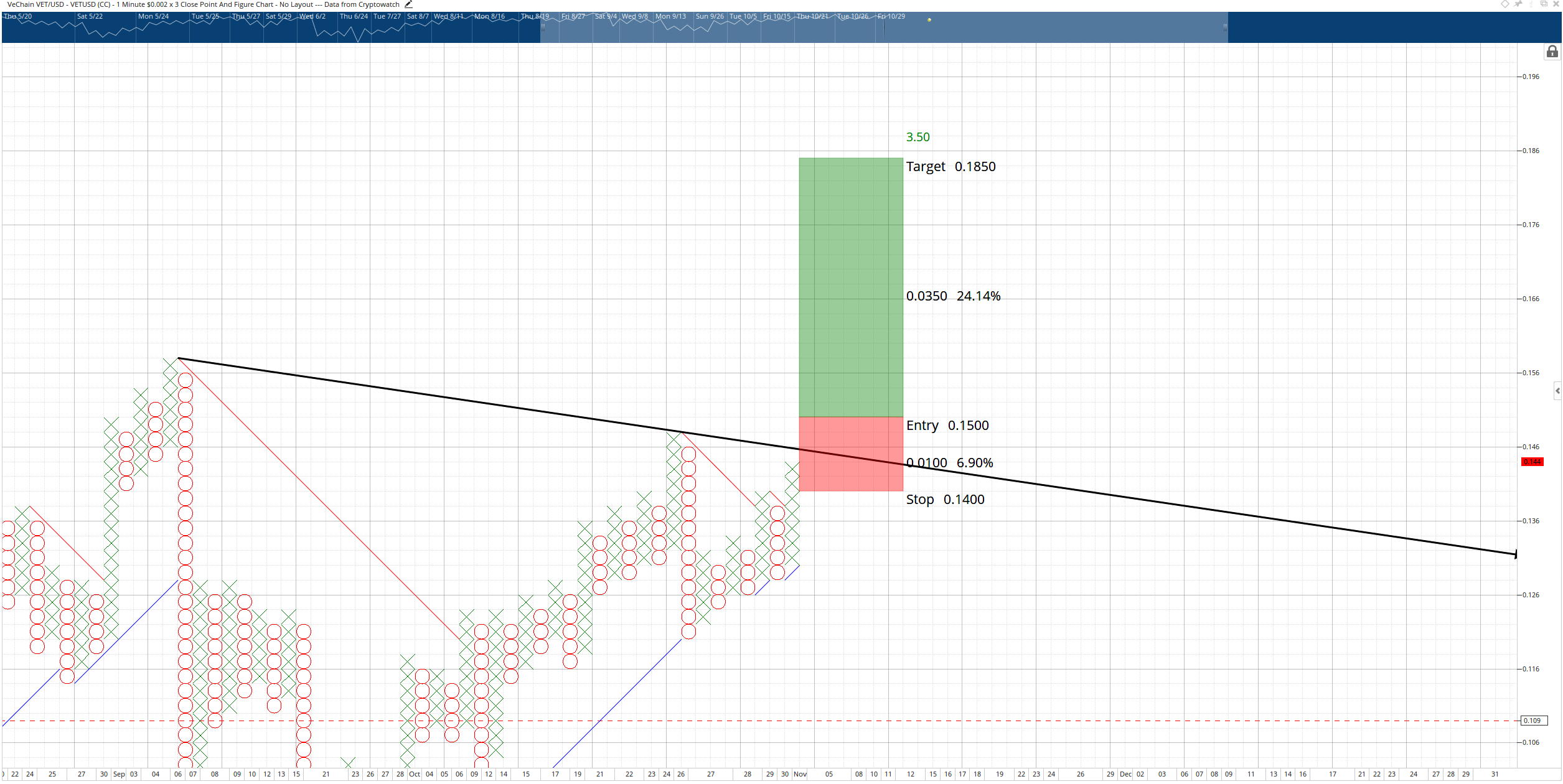

A hypothetical long trade idea would be a buy stop above the two resistance levels for an entry at $0.15. The stop loss would return VeChain price below the trendline at $0.14 with a projected profit target at $0.1850. Of course, it is entirely possible that $0.1850 may get run over amidst some FOMO buying, but $0.1850 has a collection of Fibonacci and volume profile levels indicating likely selling pressure at that level.

VET/USD $0.002/3-box Reversal Point and Figure Chart

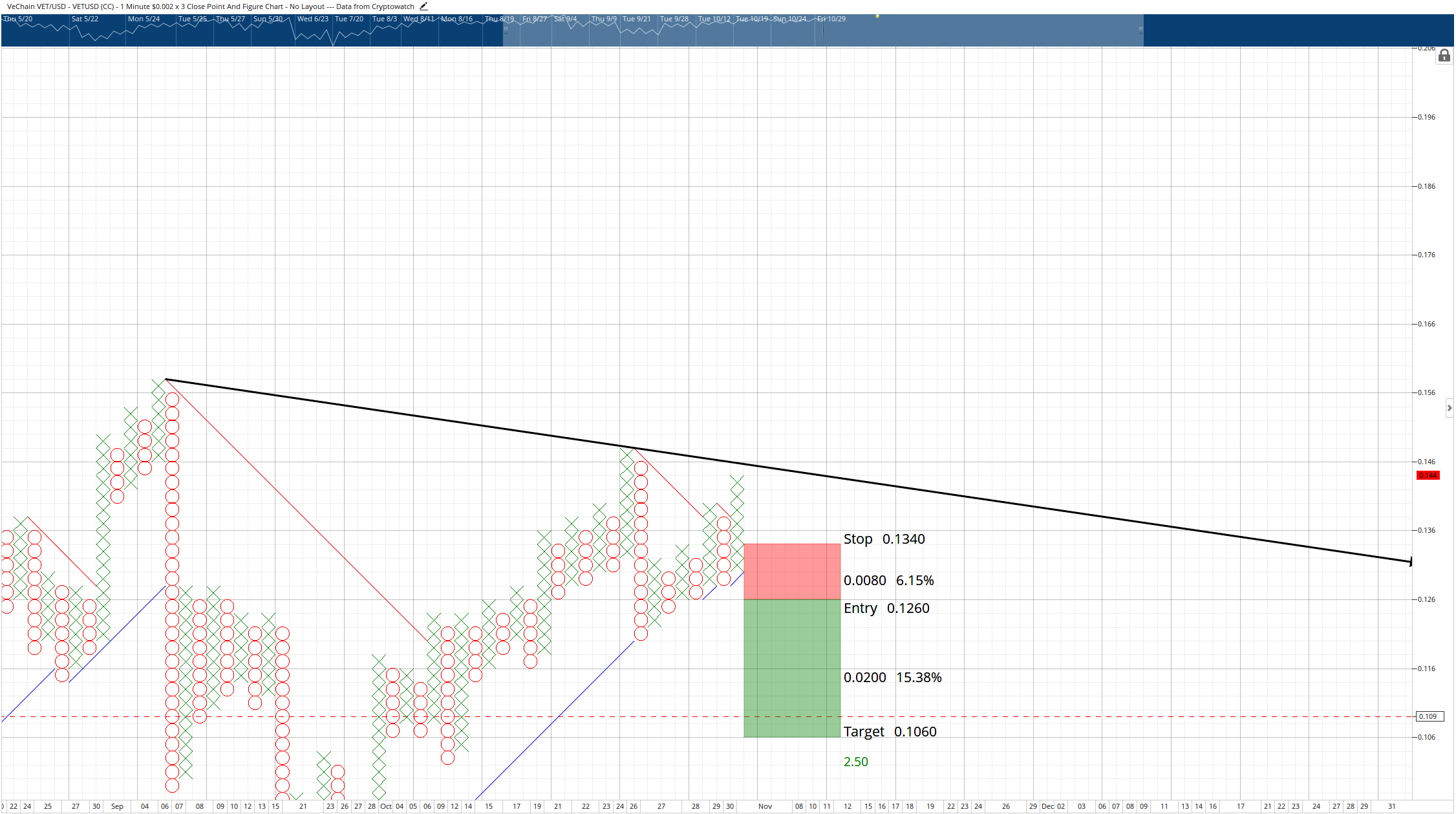

If buyers are unable or unwilling to push VeChain price above its near-term resistance, the sellers could come in and attempt to wrest control from buyers. If a new O-column develops and breaks a double-bottom at $0.128, then an extremely bearish Point and Figure pattern would be confirmed: the Bullish Fakeout. A theoretical short trade based on the Bullish Fakeout would be a sell stop at $0.126, stop loss at $0.134 and a profit target at $0.106.

VET/USD $0.002/3-box Reversal Point and Figure Chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dozens of crypto-related ETFs await SEC approval, among them those related to XRP, Litecoin, and Solana

Eric Balchunas, Senior ETF Analyst for Bloomberg, highlights 72 crypto-related ETFs awaiting SEC approval. The diversity of these ETFs encompasses major cryptocurrencies, such as XRP, Litecoin, and Solana, as well as meme-based memecoins.

Aptos price extends gains on broader crypto market recovery, presence in Osaka expo

APT token rises for the second consecutive day amid a widespread crypto recovery and expectations of growing adoption. Aptos powers the official digital wallet of Expo 2025 in Osaka, processing over 588,000 transactions with 133,000 new accounts.

Bitcoin bullish momentum builds as premium exceeds 9% for first time in three months

Bitcoin price is extending its gains, trading above $94,000 at the time of writing on Wednesday, following a two-day rally of 9.75% so far this week. BTC rally gathers momentum as trade war fears ease, following US President Donald Trump’s downplaying of tensions with China.

Solana and Sui surge, igniting interest in DeFi as TVL rebounds

Altcoins like Solana (SOL) and Sui gain strength on Wednesday, buoyed by several factors, including a significant recovery in the networks' Total Value Locked (TVL) in Decentralized Finance (DeFi).

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.