VeChain price nears a 120% bullish breakout

- VeChain price has one of the most bullish and ideal Ichimoku breakout charts across all altcoin markets.

- Powerful confluence zones of support limit downside risk, increasing upside potential.

- VeChain is likely to convert to bull-market conditions ahead of most altcoins.

VeChain price has made significant gains during the Thursday trade session, capitalizing on Ethereum’s bullish move to new all-time highs. VeChain itself has traded higher than 10% on the day, outperforming the majority of its peers.

VeChain price action experiences massive bullish Ichimoku breakout, rally expected to continue

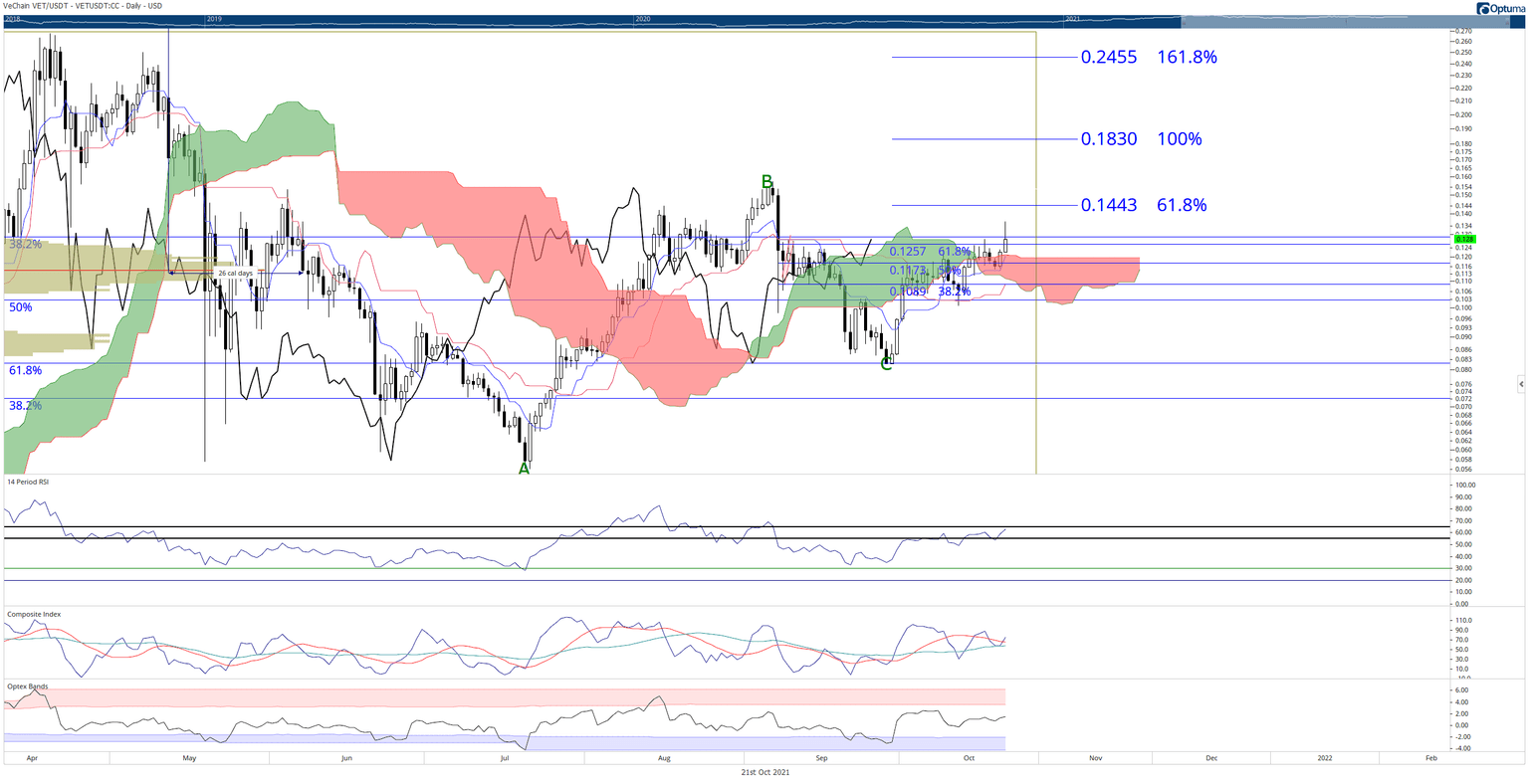

VeChain price action on its daily chart is a textbook example of what occurs after an Ideal Bullish Ichimoku Breakout setup has occurred. The conditions for the Ideal Bullish Ichimoku Breakout were fulfilled at the close of yesterday’s candlesticks. As a result, VeChain has rallied higher and has significant momentum behind to continue the current rally.

The most significant indicator of a sustained move higher can be observed in the Relative Strength Index. Currently, the bear market levels of the Relative Strength Index will remain until there is a pullback to test 40 or 50. If 40 or 50 hold as support, VeChain price will have entered a new and confirmed bull market on the daily chart. Alternatively, if the Relative Strength Index reaches 80 or 90, that will also confirm a new bull market.

The Composite Index is poised to breakout above a bullish pennant, indicating that the rally for VeChain price has just begun. The Optex Bands have not yet reached an extreme, so there is no immediate threat to a strong sell-off.

VET/USDT Daily Ichimoku Chart

VeChain price first needs to close above the prior swing high at $0.15. From there, the 2021 Volume Profile becomes very thin until $0.20. As a result, bulls may face some resistance at the $0.20 value area before moving higher to test the prior all-time highs at $0.27.

Invalidating the current bullish outlook will require extreme selling pressure by the bears. The 2021 Volume Point Of Control shifted higher over the past two weeks to 0.12. Short sellers would need to push VeChain price to a close below the 2021 VPOC and ultimately to $0.09 to deny VeChain any further upside potential.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.