Vechain Price Forecast: VET targets 30% breakout with no barriers ahead

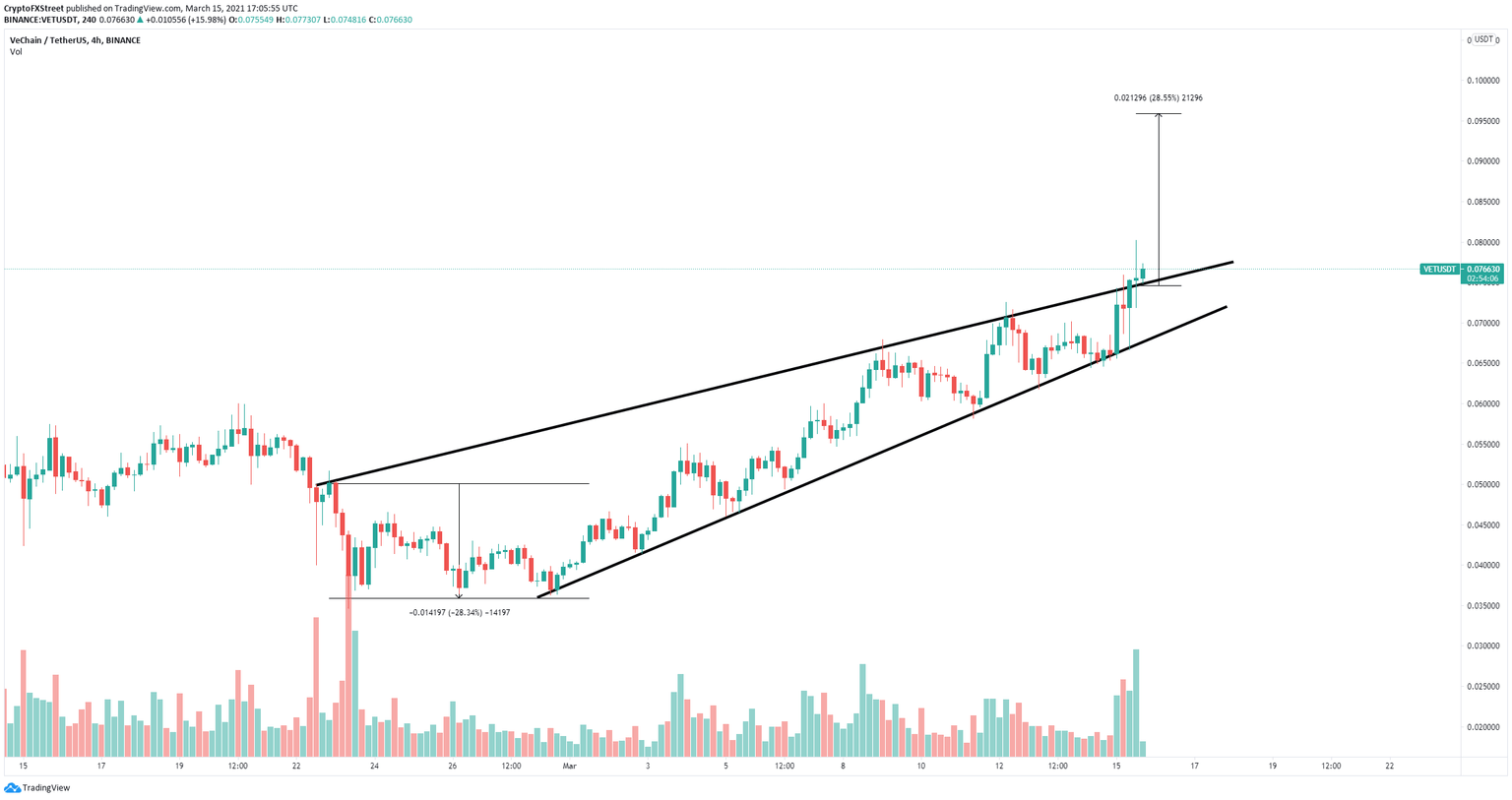

- Vechain price had a significant breakout from an ascending wedge pattern on the 4-hour chart.

- The digital asset has a price target of $0.096 in the long-term as it faces weak resistance ahead.

- VET bears still have the chance of coming back if they can crack key support level.

Vechain has continued to outperform the market and posted a new all-time high at $0.08. The digital asset still has a higher target in the long-term all the way up at $0.096.

Vechain price faces no resistance above $0.08

On the 4-hour chart, Vechain price has just broken out of an ascending wedge pattern which has a price target of $0.096. This 30% breakout is calculated using the height of the pattern as a reference point from the beginning of the pattern's upper trendline to the beginning of the lower trendline.

VET/USD 4-hour chart

Considering that these are new all-time highs for Vechain, the digital asset faces practically no real resistance ahead as long as it can hold the previous resistance trendline.

VET/USD 4-hour chart

To invalidate the bullish target, bears will need to push Vechain price below the previous resistance trendline at $0.0745. This could drive VET towards the lower trendline at $0.07 at first and as low as $0.051 if this level cracks.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.