Vechain Price Forecast: VET sees a breakout and defends crucial support level aiming for $0.034

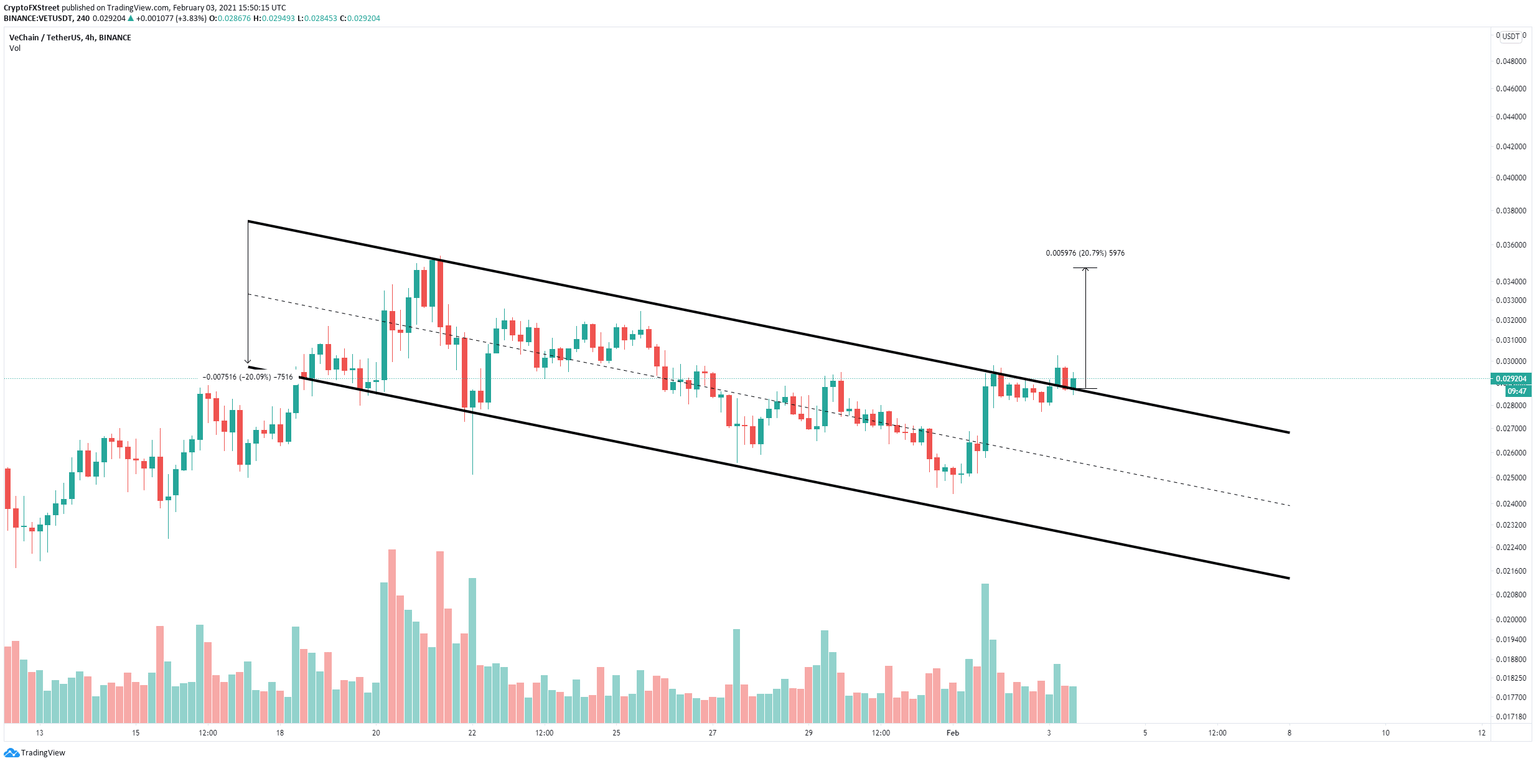

- Vechain price was contained inside a descending parallel channel on the 4-hour chart.

- The breakout has a price target of $0.034 which is a 20% move from current levels.

- The digital asset has a lot of bullish momentum behind it.

After a rally towards $0.035 that peaked on January 21, Vechain has been under a consolidation period hitting a low of $0.024 on February 1. Since then, the digital asset has recovered significantly and broke out of a parallel channel.

Vechain price has no barriers to prevent it from reaching $0.034

On February 3, Vechain price broke out of a descending parallel channel and briefly re-tested the previous resistance trendline, managing to hold it. The digital asset is primed for a 20% move towards $0.034.

VET/USD 4-hour chart

Additionally, on the 1-hour chart, Vechain seems to have formed an inverse head and shoulders pattern which is a bullish indicator. A breakout above $0.03 gives us similar price targets as the pattern above, which adds more credence to the bullish outlook.

VET/USD 1-hour chart

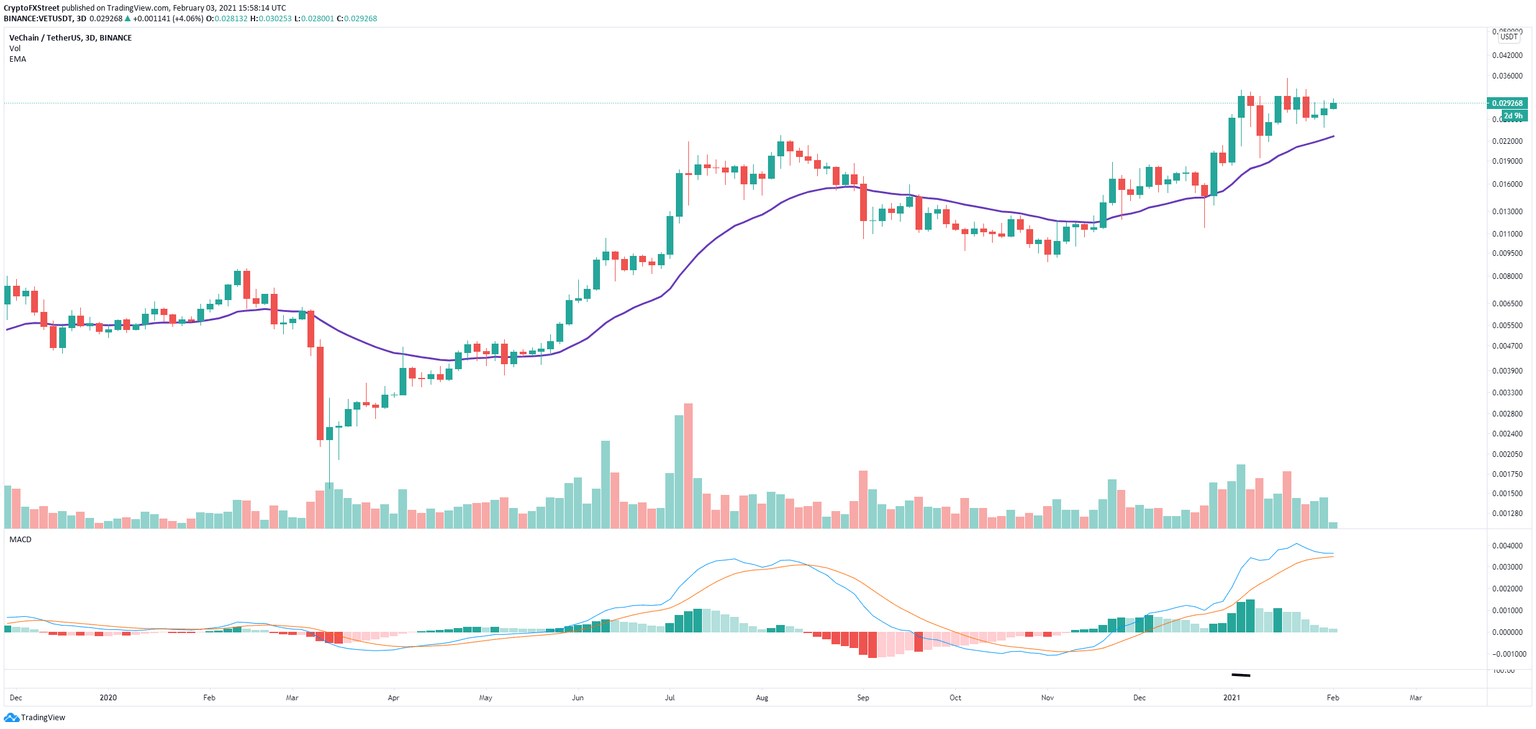

However, on the 3-day chart, Vechain price seems to have topped out as it has failed to close above $0.03 for the past two weeks. Additionally, the MACD is on the verge of a bear cross for the first time since August 16, 2020.

VET/USD 3-day chart

If VET gets rejected from $0.03 again, it could fall towards the 26-EMA on the 3-day chart which is currently located at $0.022.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.