VeChain Price Forecast: VET fights for crucial support as correction to $0.024 lingers

- VeChain uptrend is still in jeopardy, especially with overhead pressure surging under the 100 SMA.

- If descending parallel channel’s middle-boundary support is shattered, a breakdown will likely extend to $0.024.

- VET opportunity to avert the breakdown lies with defending support at the 50 SMA and the 100 SMA.

VeChain has generally sustained a downtrend for over two weeks and there is no sign of recovery. Its upside seems strongly barricaded, limiting price movement. On the downside, bulls are in the middle of a fierce fight to secure higher support. However, a massive breakdown still looms in the direction of $0.024.

VeChain is on the verge of another breakdown

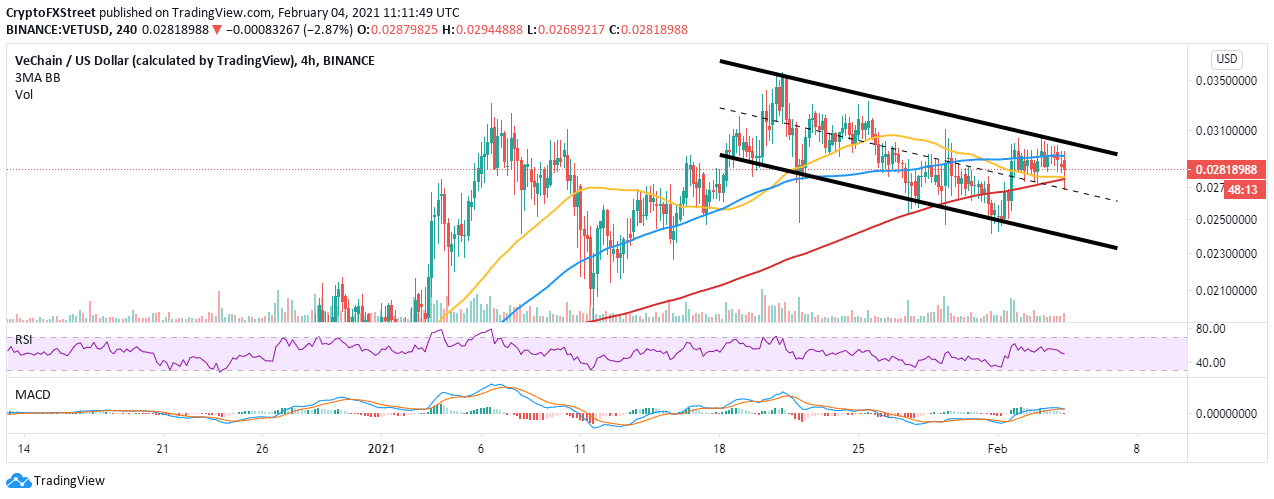

The VET 4-hour chart brings to light the formation of a descending parallel channel. This pattern began forming after VeChain hit a barrier at $0.035 in January. Recovery attempts have been rendered unsuccessful, with losses testing $0.024.

For instance, the most recent attempt to reverse the trend lost steam at the 100 Simple Moving Average, a resistance reinforced by the channel’s upper boundary. Currently, a retreat is underway with VET struggling to balance at the 50 SMA and 200 SMA confluence.

Realize that losing control over this support will put more pressure on the ascending parallel channel’s middle boundary. Besides, if VeChain slices through this critical zone, a massive breakdown would ensue. Support at $0.024 may come in handy to stop the losses, but VET’s downtrend could be unstoppable until it meets the buyer congestion area at $0.02.

VET/USD 4-hour chart

The Moving Average Convergence Divergence or MACD on the same 4-hour chart emphasizes the bearish outlook. While the MACD (blue line) is in the positive region, it is about to cross under the signal line, a bearish signal and a call to sell. Moreover, the Relative Strength Index shows that selling pressure is getting stronger.

Looking at the other side of the fence

VeChain has a couple of key areas to hold onto to avert the potential breakdown and these are the ascending parallel channel’s middle boundary and the confluence formed by the 50 SMA and the 200 SMA.

Another bullish signal would be making a daily close above the 100 SMA. Such price action may trigger more orders to create enough tailwind behind VET for gains toward $0.035.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren