- Vechain price has seen a massive pump in the past two weeks rising by more than 180%.

- The digital asset can continue climbing higher according to various metrics.

Vechain was trading inside a downtrend since August 2020 and remained flat during the Bitcoin rally in December before finally seeing a massive price explosion by the end of 2020. Several metrics and indicators show that VET can still rise higher in the short-term.

Vechain price can continue rising towards $0.04

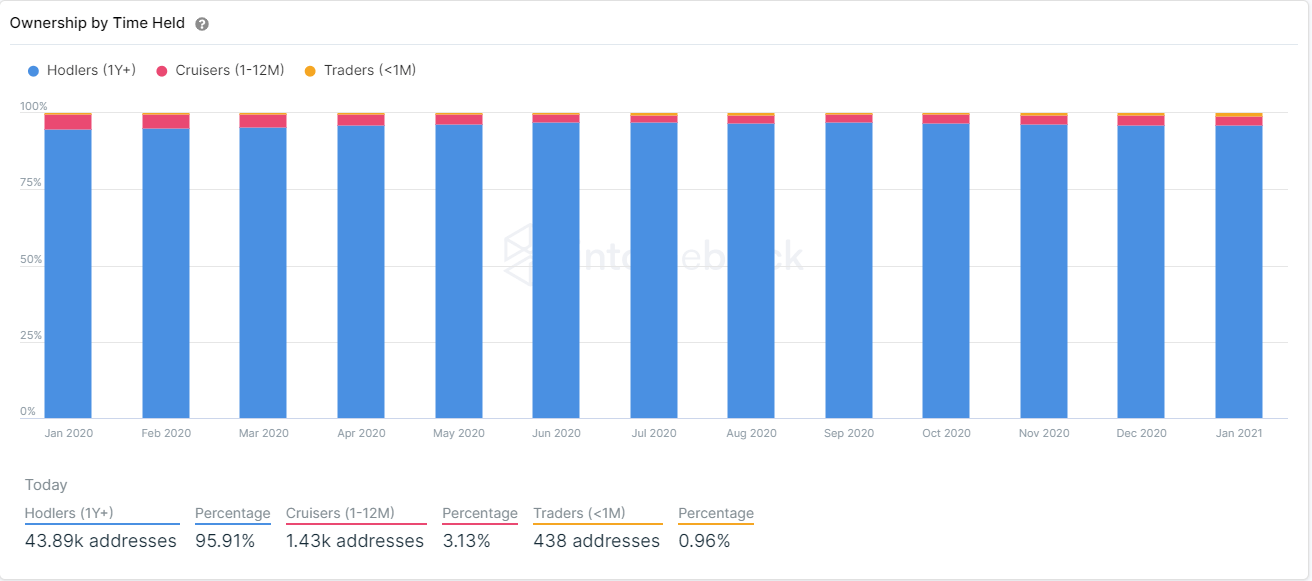

Despite the massive rally towards $0.0322 several indicators continue to show that VET can go higher. The ownership of VET coins by time held hasn’t changed much in the past few months and around 95.91% of addresses have been holders for at least one year, which indicates they arae expecting the price of Vechain to rise even higher.

VET Ownership by Time Held chart

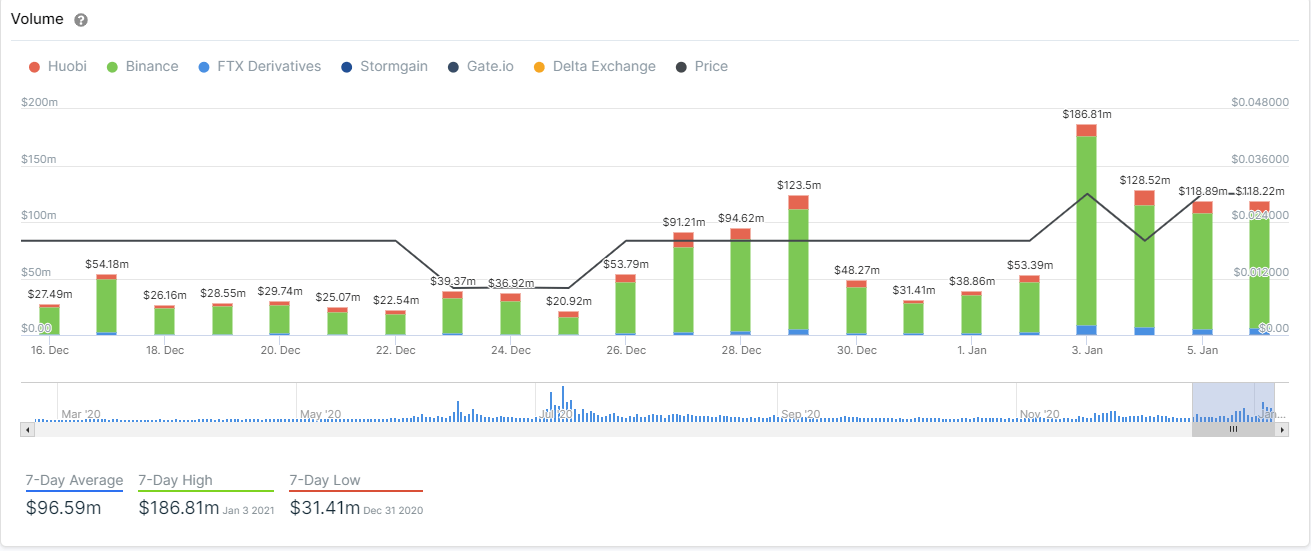

The interest in VET coins seems to have increased significantly over the past few days as the derivatives trading volume hit $186 million on January 3, a number not seen since July 2020.

VET Derivatives Volume chart

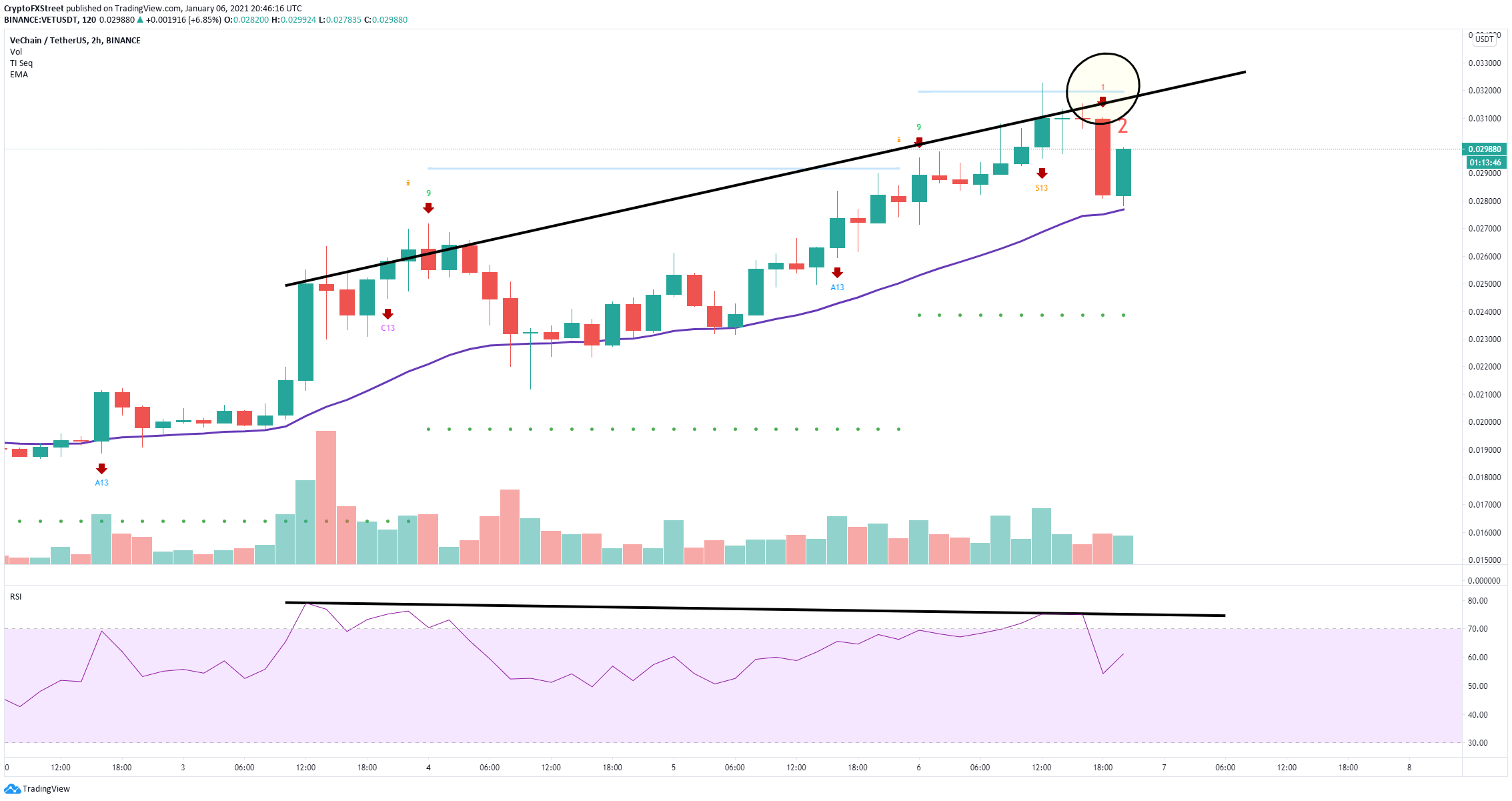

However, on the 2-hour chart, the TD Sequential indicator did present a sell signal which has seen a lot of continuation to the downside. So far, the 26-EMA has served as a support level at $0.027. If bears can push Vechain price below this point, it can quickly drop towards $0.023.

VET 2-hour chart

Additionally, it seems that the RSI and the price have established a bearish divergence on the 2-hour chart. Vechain price hit several higher highs while the RSI established lower highs, creating the divergence and adding credence to the bearish outlook.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.