VeChain Price Forecast: Comeback from VET bulls could trigger 13% rally

- VeChain price is likely to witness a sharp move to the upside, technicals suggest.

- The RSI indicator shows strength while AO follows in its footsteps, revealing a possible breakout rally to $0.0178.

- Invalidation of the bullish outlook will occur if VET flips the $0.0147 support level into a resistance.

VeChain price saw an 11% daily candlestick on Tuesday, in what looks as the first sign of a bullish resurgence for the blockchain’s token. If bulls are persistent, VET could bounce off a key support level and trigger another rally.

VeChain price prepares for next leg high

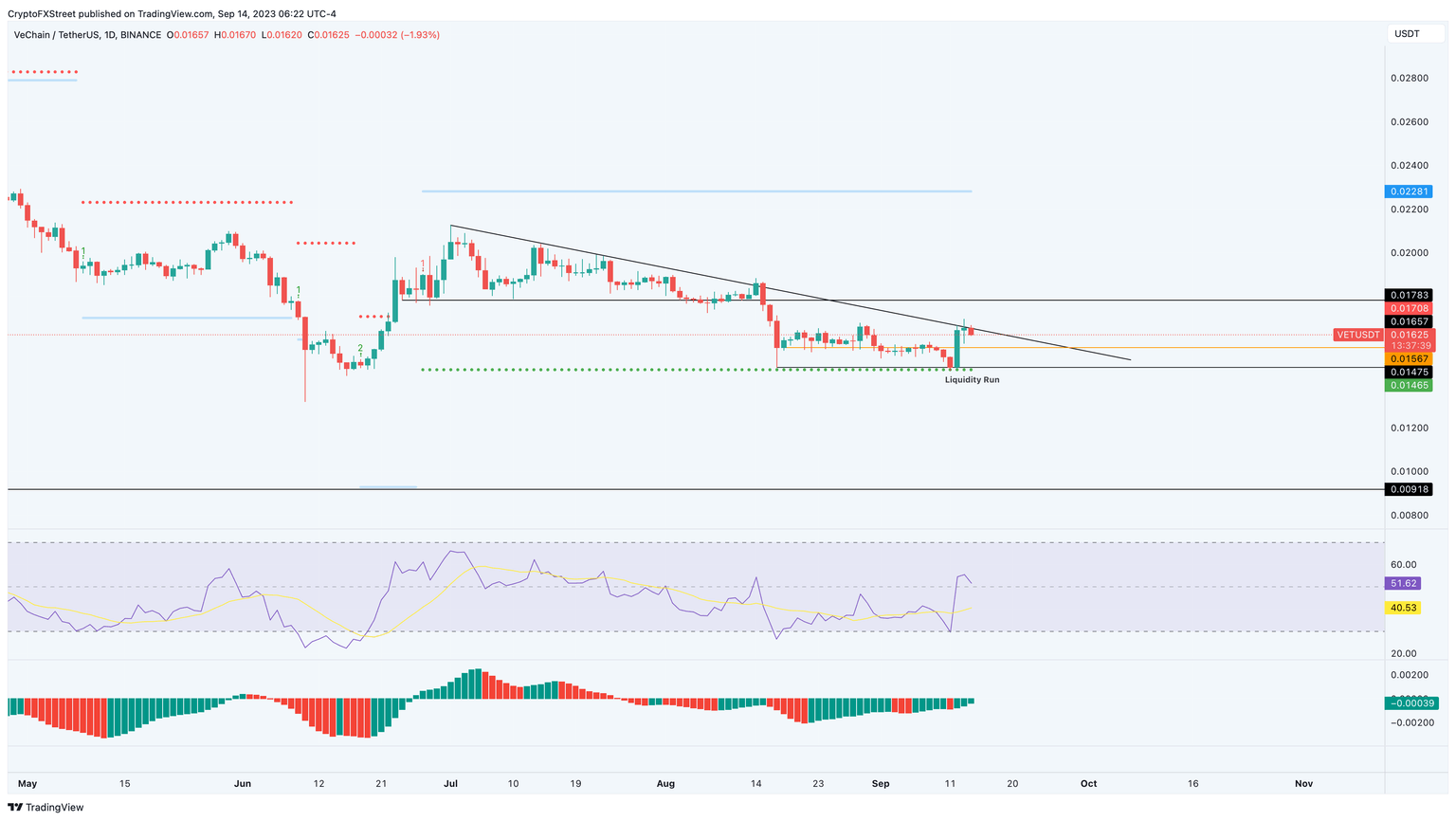

VeChain price swept the August 17 low on September 12, but the dive kickstarted an 11.59% rally. This move retested VET’s long-standing downtrend, which has created five lower highs since July 1. Investors can expect a minor pullback to the immediate support level at $0.0156, which is a key buying area.

The Relative Strength Index (RSI) has already flipped above the mean level, indicating a strong comeback from bulls. Furthermore, the Awesome Oscillator (AO) is receding from below the zero line, suggesting a decline in bearish momentum. A flip of the zero line would suggest the presence of buyers.

Hence, market participants can expect a bounce from the $0.0156 support floor that could propel VeChain price by 13% to retest a key resistance level at $0.0178. Beyond this hurdle, the $0.0204 and $0.0222 are other key barriers that investors can focus on.

VET/USDT 1-day chart

While the outlook for VeChain price is bullish, a breakdown of $0.0156 support floor would be the first sign of failing buyers. In such a case, market participants should focus on the $0.0147 barrier.

A daily candlestick close below this level that flips it into a resistance level would invalidate the bullish thesis for VET. In such a case, a revisit to the $0.0091 support – roughly 37% lower than the $0.0147 barrier – is likely.

Also read: Crypto miners debate $500k Bitcoin fee refund to paxos for 'fat-fingers' error

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.