VeChain price flips crucial barrier, triggering 63% breakout to new all-time highs

- VeChain price looks ready for a volatile move as it breaks above a crucial barrier at $0.152.

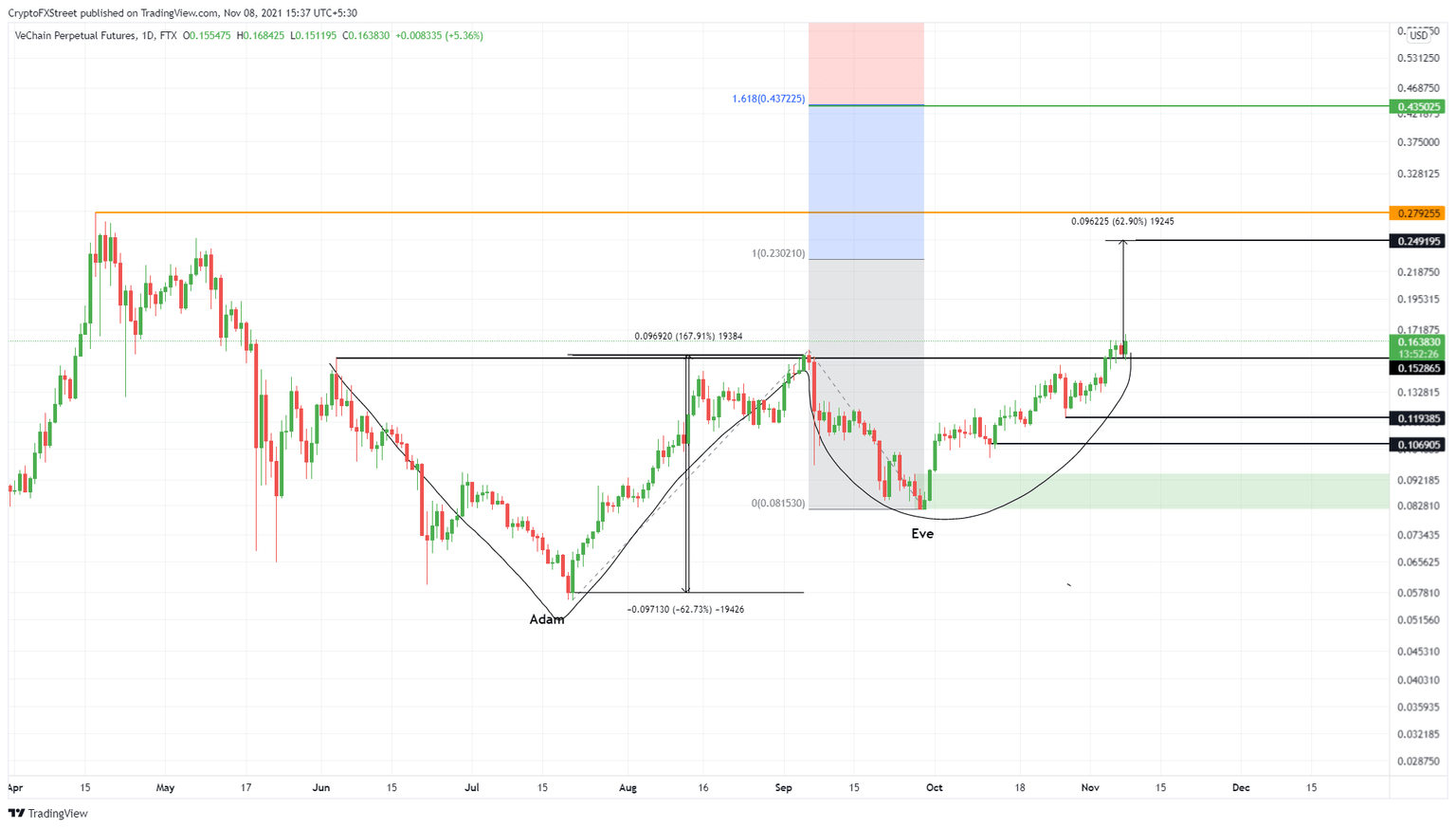

- This move confirms a breakout from the Adam and Eve pattern that forecast a 63% ascent to $0.249.

- A breakdown of the $0.119 support floor will invalidate the bullish thesis.

VeChain price has been stuck under a stiff resistance level for roughly five months but recently managed to break above and flip it into a support level. This development screams a massive uptrend is on its way.

VeChain price eyes retest of an all-time high

VeChain price crashed 63% from $0.15 to $0.056 between June 4 and July 20. The downtrend ended with a v-shaped recovery but failed to push above $0.15. As a result, this move was followed by a 46% descent that formed a rounding bottom, pushing VeChain price to revisit the $0.15 resistance barrier.

Together, this price action from VET is known as an Adam and Even pattern. This technical formation forecasts a 63% upswing to $0.249, obtained by adding the distance between the horizontal resistance level at $0.15 and the lowest point of Adam and adding it to the breakout point.

Currently, VeChain price has flipped the $0.15 hurdle into a foothold, triggering the start of an uptrend. Going forward, investors can expect VET to continue the ascent and tag the intended target at $0.249. In some cases, the bullish momentum is likely to propel VeChain price to retest its all-time high at $0.279.

VET/USDT 1-day chart

On the contrary, if VeChain price fails to hold above $0.15 and produces a daily close below it, market participants can expect VET to descend to the immediate support level at $0.119. If the bears push VeChain price to produce a lower low below this barrier, it will invalidate the bullish thesis.

This development could trigger a further correction to the $0.106 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.