VeChain price finds stable support while buyers look to test $0.10

- VeChain price finds buyers near $0.08.

- Extremely bearish Ichimoku signals could generate traps for bulls and bears.

- A possible intraday fakeout could drive VeChain lower.

Vechain price closed its Tuesday candlestick with some very bearish Ichimoku conditions. However, buyers have stepped in to support price, but there needs to be more conviction on the buy-side; prices are likely to continue south.

VeChain price finds short term support; buyers under threat of being trapped

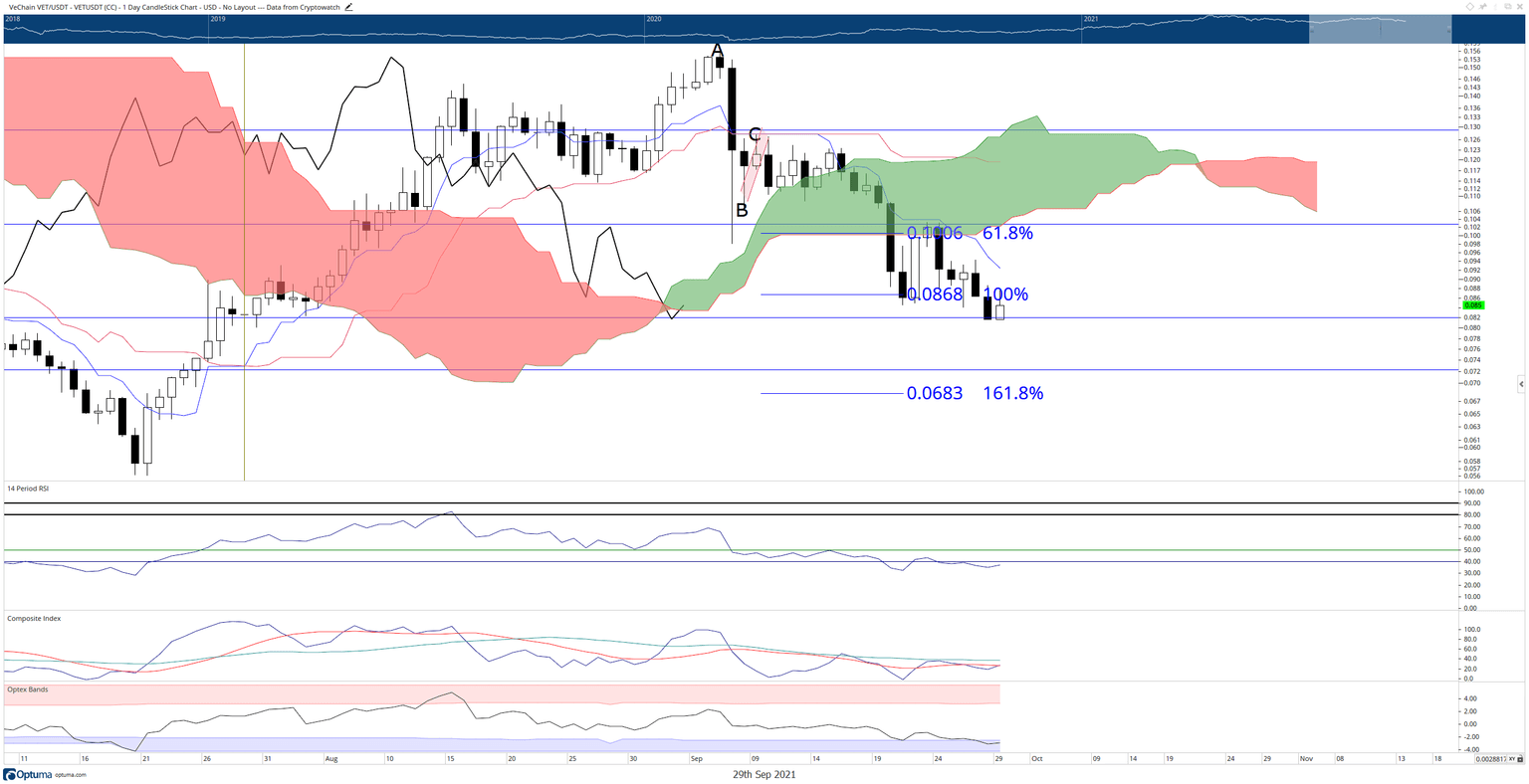

VeChain price is in one of the most precarious conditions it’s been in since early June 2021. The Chikou Span closing below the Cloud is often the primary and final trigger to define when an instrument converts into a bear market. The Chikou Span closing below the Cloud occurred on the Tuesday candlestick close.

Some short-term support, however, has come in at the $0.08 level. The $0.08 level contains two robust Fibonacci levels: the 61.8% Fibonacci retracement and the 100% Fibonacci expansion. However, within the Ichimoku system, no support now exists on the daily chart. Thus, VeChain prices are likely to continue their road south.

The next area of support for VeChain price is the $0.06 level which contains the weekly Senkou Span A and the 161.8% Fibonacci expansion. A high-volume node in this value area will also yield some support near $0.06. Don’t be surprised if the $0.05 levels get a small test as well.

VET/USDT Daily Ichimoku Chart

If bulls want to invalidate the heavy bearish bias, they’ll need to push VeChain price to significant breakout levels. The first would be a clear close above the Tenkan-Sen and a return inside the Cloud to hold Senkou Span B support ($0.10). Beyond that, bulls ultimately need to close VeChain price and the Chikou Span above the Cloud near the $0.13 value area.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.