Vechain price betting on crucial support to keep triggering bounces

- Vechain price erases in full the gains of Thursday.

- VET sees bulls counting on support from monthly S3 support in order to trigger bounce.

- Expect to see break lower as support vanishesfdf and VET price prints new low near $0.017.

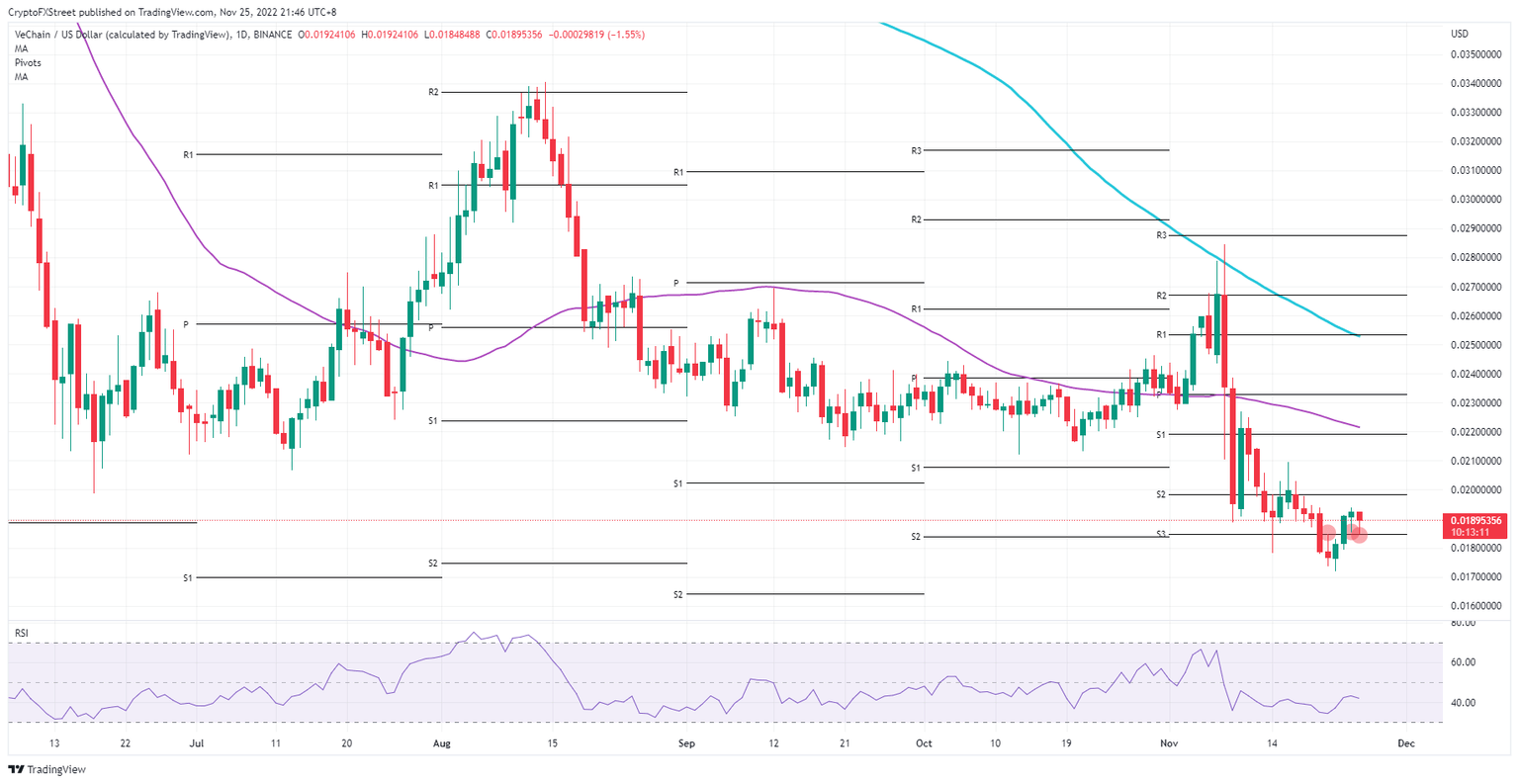

Vechain (VET) price is going nowhere as price action keeps pulling back to the support of the monthly S3 support level that has been pivotal this week. As markets are trading with thin liquidity through the holiday week in the United States, it looks like markets are not looking for cheap selling or a final rally for the year just yet. Instead, Vechain traders are using the S3 support for November as a honey pot, where they keep tapping up the volume to trigger pops higher, with the honey pot starting to dry out.

VET price sees bulls coming back for more, but for how long?

Vechain price cannot trade away from $0.01848, the value of the monthly S3 for November. It acted as resistance first after VET broke below it on Sunday and got rejected when trying to break above it on Monday. Once the bulls could break above it on Wednesday, a logic test and bounce higher came on Thursday.

VET could be a bit in trouble here as the daily candle for Friday opened with a flat top which points to bears quickly rushing in to run price action back into the ground. Expect smaller highs over the weekend, with a squeeze to the downside. What will follow is a break below that monthly S3 and a test of $0.017 for a new low for November, bearing 12% losses.

VET/USD daily chart

In case the S3 support level holds, the next bounce would need to break above the high of this week, and preferably test $0.0200 on the topside. That would result in a broke and close above the monthly S2, and open a reange to gain another 11% at the monthly S1 and with the 55-day SMA. The quote board for VET would then print around $0.0220.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.