- VeChain's technical picture suggests that the token is poised for a recovery.

- VET needs to stay above $0.016 to confirm the bullish stance.

VeChain (VET) is changing hands at $0.016, having gained about 2% at the time of writing since Monday. The token takes 26th place in the global cryptocurrency market rating with the current capitalization of $1 billion.

VET is the native token of a blockchain-powered supply chain platform named VeChain, which was launched in 2016. It aims to solve supply chain management issues with the help of distributed governance and the Internet of Things (IoT) technology.

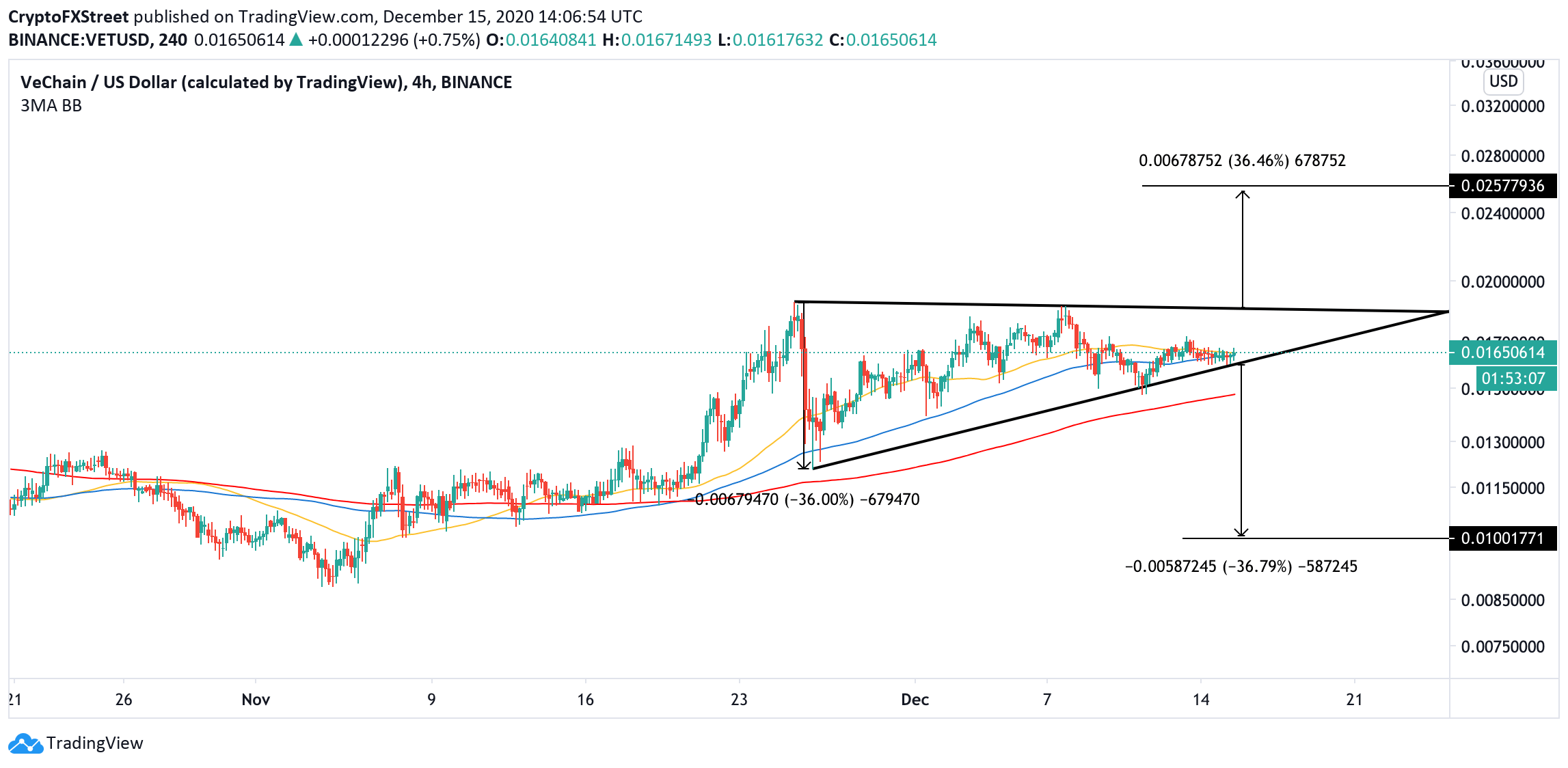

VET locked in an ascending triangle

On the 4-hour chart, VET is trading inside an ascending triangle. This bullish formation implies that the asset is positioned for a strong recovery, provided that the support created by the hypotenuse stays unbroken. Currently, the support comes at $0.016.

A rebound from this area will bring the x-axis of the triangle at $0.0186 into focus, with the eventual estimated bullish target at $0.025.

VET, 4-hour chart

Meanwhile, if $0.016 gives way, the immediate bullish scenario will be invalidated, opening the way to a sharp sell-off towards $0.01. However, the 4-hour 200 EMA at $0.014 may slow down the decrease and push the price back inside the triangle pattern.

The In/Out of the Money Around Price (IOMAP) data confirms the support at $0.014 as 4,000 addresses purchased nearly 89 million VET between $0.014 and $0.012. This area may absorb the selling pressure and initiate a recovery.

VET's In/Out of the Money Around Price data

On the upside, the insignificant resistance lies between $0.0167 and $0.18. If the bullish momentum is sustained, VET may extend the recovery towards $0.02 at least.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20Analytics%20and%20Charts-637436386758672826.png)