Vechain Elliott Wave technical analysis [Video]

![Vechain Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/VeChain/vechain-150x150logo-637399983192838290_XtraLarge.png)

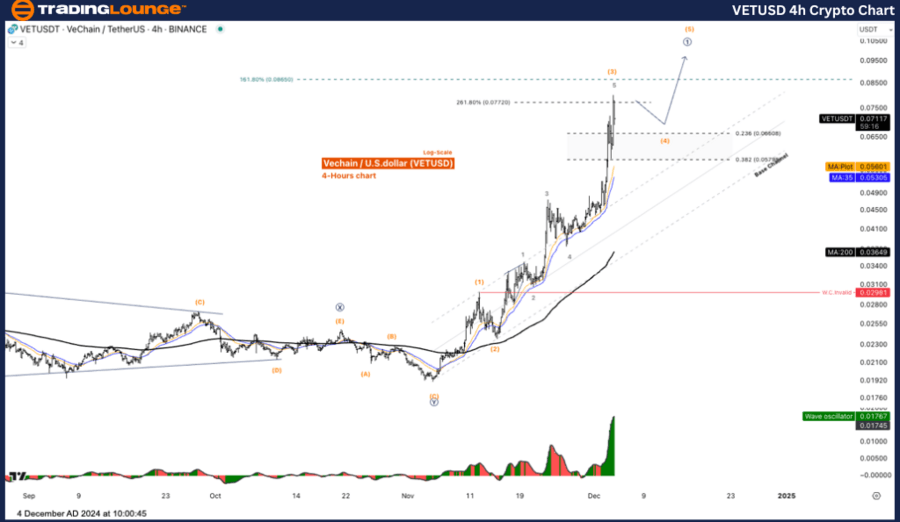

VET/USD Elliott Wave technical analysis

Function: Follow trend.

Mode: Motive.

Structure: Impulse.

Position: Wave III.

Direction next higher degrees: Wave (I) of Impulse.

Details: wave 2 is likely to end and price is rising again in wave 3.

Vechain/ US Dollar (VETUSD) Trading Strategy: Overview Vechain remains in an uptrend, with an impulsive rally, we are now in the fifth wave, which is incomplete, so the price is likely to continue to rise. Look for a rebound from the uptrend.

Vechain/ US Dollar (VETUSD) Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

VET/USD Elliott Wave technical Analysis

Function: Follow trend.

Mode: Motive.

Structure: Impulse.

Position: Wave (3).

Direction next higher degrees: wave ((1)) of Impulse.

Details: The Five-Wave increase in wave (3).

Vechain/ US Dollar (VET/USD)Trading Strategy: Overview Vechain remains in an uptrend, with an impulsive rally, we are now in the fifth wave, which is incomplete, so the price is likely to continue to rise. Look for a rebound from the uptrend.

Vechain/ US Dollar (VET/USD)Technical Indicators: The price is above the MA200 indicating an uptrend, The Wave Oscillator is a Bullish Momentum.

Vechain Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.