VeChain coiled and ready to break out to $0.21 if key resistance at $0.128 is surpassed

- VeChain price develops a trifecta of bullish breakout conditions pointing to a substantial drive higher.

- VeChain is likely to become a leader in the altcoin market.

- Limited immediate downside risks for VeChain exist.

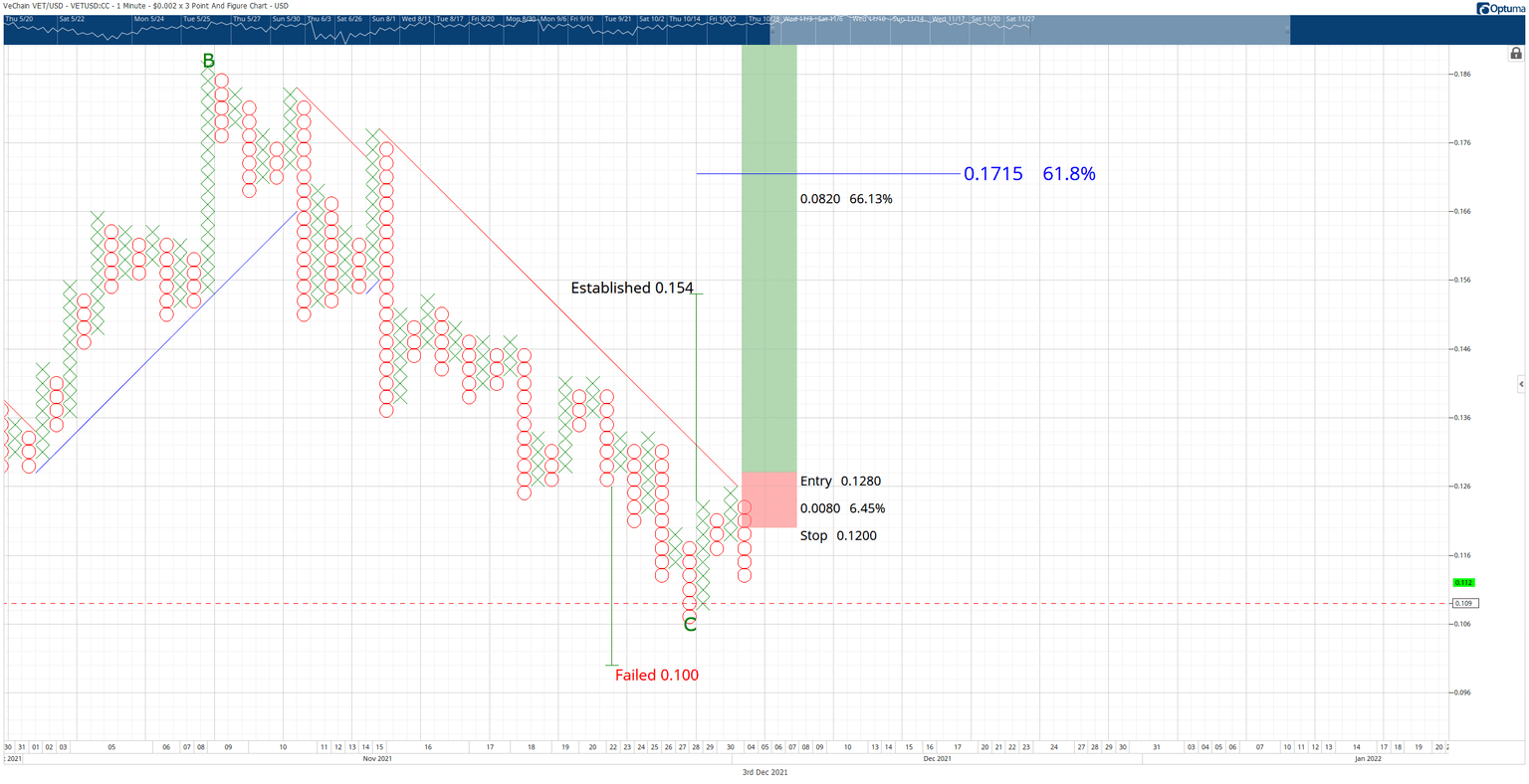

VeChain price is positioned for a massive bear trap, which would yield a spike of over 80%. The $0.002/3-box Point and Figure chart show why a breakout above $0.126 could initiate a flash-spike higher.

VeChain price is ready to pop, shattering any hopes of existing and future short-sellers

VeChain price has a rare combination of three powerfully bullish signals on its Point and Figure chart. And all three signals are considered authentic or confirmed if VeChain hits the entry of the hypothetical long setup. The three signals are as follows:

- An entry at $0.128 confirms an ascending triple-top breakout.

- An entry at $0.128 confirms a Bear Trap Point and Figure pattern.

- An entry at $0.1280 breaks the dominant bear market angle and converts VeChain into a bull market.

It is rare to have such a substantial collection of bullish reversal signals present at the same price level. Because of these three signals, they exacerbate the projected profit target from the Vertical Profit Target Method. Consequently, the profit target of $0.21 is just a hair below the 100% Fibonacci expansion at $0.212.

The theoretical long entry is a buy stop order at $0.128, a stop loss at $0.120, and a profit target at $0.21. The long trade idea is invalidated if VeChain price moves below the $0.106 value area.

VET/USDT $0.002/3-box Reversal Point and Figure Chart

If any weakness over the weekend (which is always a possibility during the weekend trading sessions), the downside risk should be limited to the 38.2% Fibonacci retracement at $0.072.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.