VeChain adoption continues to pay off as VET price eyes 51% ascent

- VeChain price reversal is likely as it approaches the range low at $0.0596.

- The partnership with ReSea Project helps prevent a million kilos of plastic from polluting oceans.

- If VET breaks below the $0.0495 support level, the bullish thesis will face invalidation.

VeChain price has been free-falling since June 30, leading it toward the range low. A retest of this level will be the second time VET has approached this level over the past month.

ReSea Project, VET and DNV make progress

ReSea Project, an initiative to clean up the oceans and rivers from plastic pollution, utilizes VeChain’s blockchain technology to collect, record and monitor data. This stored information is then validated independently by DNV as proof of the progress.

Roughly two months ago, the initiative had cleaned up 305 tonnes of plastic waste, but the number currently stands at 506 tonnes as of this writing. This development is a result of just six months, which suggests the impressive progress made by the initiative.

With VeChain’s low-cost, reliable and easy-to-use blockchain technology, the data stored is time-stamped and immutable, which will prevent any false claims and help trace and track the initiative’s progress.

Moreover, VeChain’s partnership with DNV aims to help transition clients and their businesses toward a green and circular economy, which could help promote new digital ecosystems.

VeChain price at inflection point

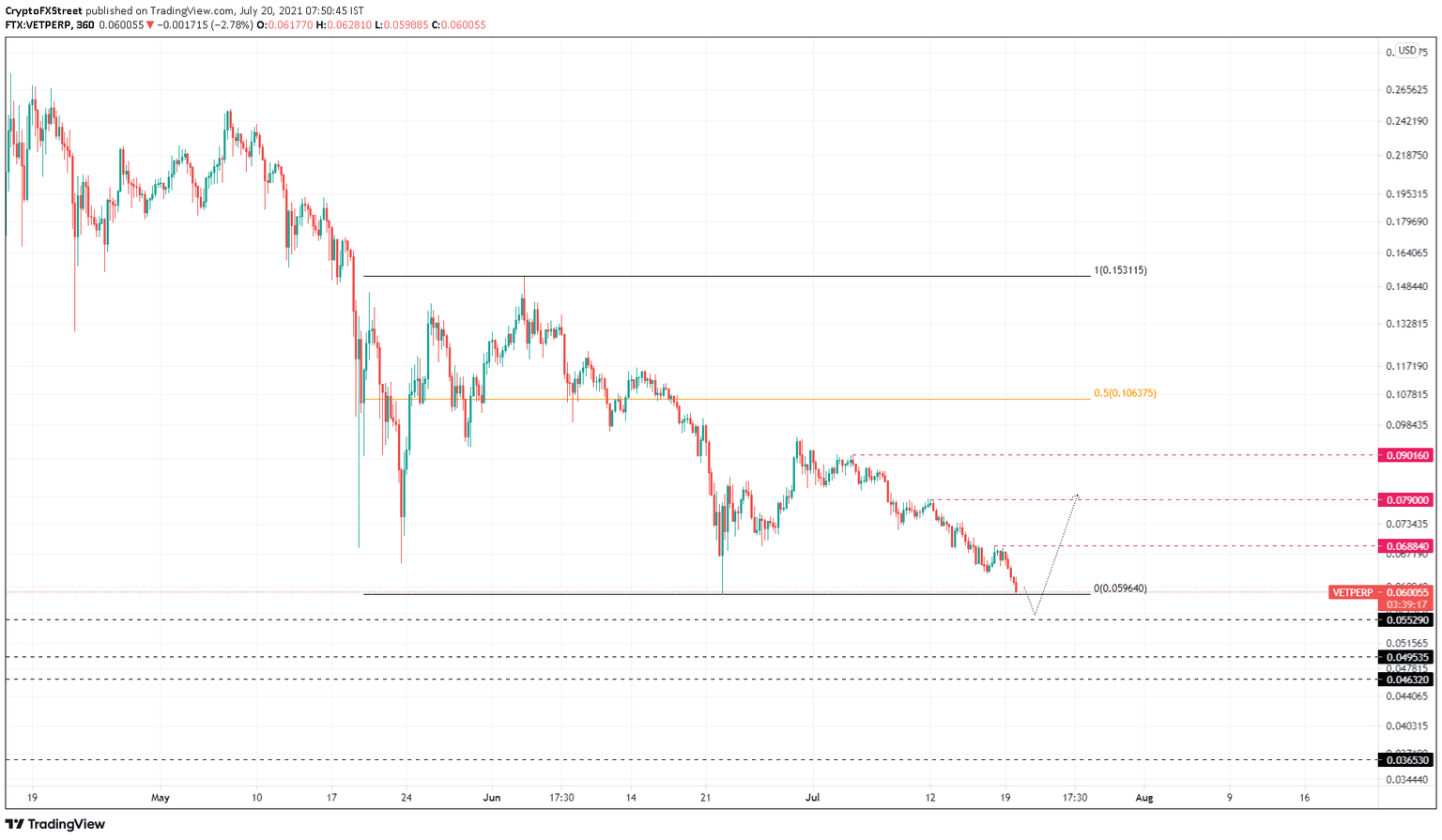

VeChain price is currently testing the range low at $0.0596 after crashing 38% over the past 20 days. This dip below $0.0596 will allow the market makers to collect liquidity before reversing the trend.

It is likely VET will retest the $0.0553 support level before heading higher. Such a move could trigger the sidelined investors to jump on the bandwagon.

If this were to happen, VeChain price will see a sudden burst in buying pressure that could propel it roughly 25% to tag the July 18 swing high at $0.0688. Shattering this barrier will allow VET to rally another 14% to retest the $0.0790 resistance level. In total, this move represents a 42% upswing from $0.0553.

Here, VeChain price could either slow down and retrace or if the bullish momentum is enough, climb another 14% to retest $0.0901.

VET/USDT 6-hour chart

While the upswing narrative seems likely, market participants should note that a breakdown of the range low with the inability of the buyers to reclaim it would indicate weak bullish momentum.

In such a case, VET is likely to drop to the $0.0553 support level. If the selling pressure continues to build up, leading to a breakdown of the said barrier, it will invalidate the bullish thesis and potentially result in a downswing to $0.0463.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.