VanEck files for Bitcoin Strategy ETF as SEC Chair expresses preference for BTC futures products

- VanEck has filed for a new Bitcoin Strategy ETF that is tied to BTC futures products.

- The investment manager’s Bitcoin ETF approval has been stalled by the SEC.

- This move comes after Gary Gensler stated that he is more open to ETFs based on BTC futures traded on the CME.

Global investment manager VanEck has filed for a new exchange-traded fund (ETF) tied to Bitcoin after its BTC ETF has been under review and delayed by the US Securities & Exchange Commission (SEC).

VanEck changes Bitcoin ETF direction

VanEck filed for a new Bitcoin Strategy ETF earlier this week that would provide investors with exposure to BTC future contracts.

According to the asset manager, the Bitcoin Strategy ETF would allow exposure to cryptocurrency ETFs traded in Canada, including the crypto products from Purpose Investments and Evolve Funds Group.

VanEck previously was unsuccessful in listing a similar fund with the SEC in 2017, and the investment company has amended the application, and it has been resubmitted given the recent developments with the regulator.

SEC chair Gary Gensler recently stated that he would be more open to accepting Bitcoin-related ETFs if they are based on BTC futures rather than direct exposure to the new asset class. Gensler may have given the strongest sign of support for crypto ETFs so far.

In response to Gensler’s statement, Invesco also announced its intention to launch a Bitcoin ETF without direct exposure to the leading cryptocurrency.

So far, the SEC has not accepted any Bitcoin ETF proposals and has delayed decisions and extended the window for deliberation on the matter.

Bitcoin price awaits golden cross to continue its rally

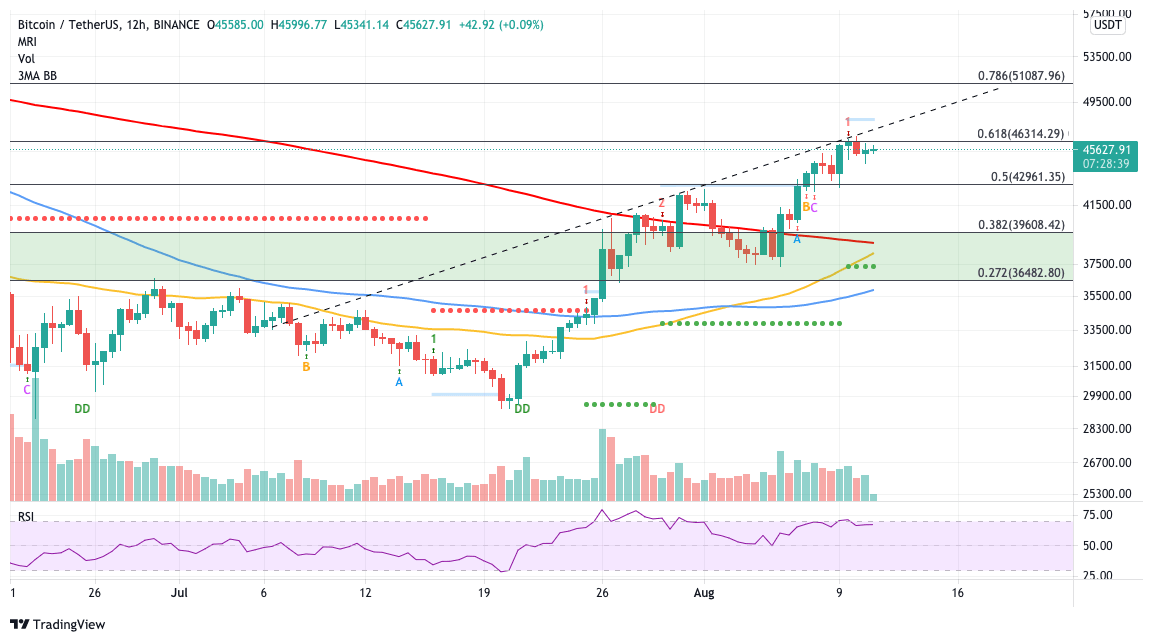

Bitcoin price has been able to secure a 22% gain since its swing low on August 5 at $37,261. Although the rally appears to have slowed down, BTC may consolidate in the near term before its next rally.

The Momentum Reversal Indicator (MRI) has printed an MRI top signal, suggesting that Bitcoin price expects a trend reversal toward the downside.

However, the Relative Strength Index (RSI) indicates that BTC is less overbought than the rally to the previous swing high on July 31 at $42,553, hinting that the bull run is not over.

On the 12-hour chart, Bitcoin price is expecting a golden cross in the coming days, which could act as an incentive for the bulls.

BTC/USDT 12-hour chart

A spike in buying pressure may see BTC test the diagonal resistance level, and a break above the trend line could encourage Bitcoin price to tag the breakout line given by the MRI at $48,053.

Bitcoin price may find support at the 50% Fibonacci extension level at $42,961 should BTC consolidate. Further selling pressure could take the leading cryptocurrency lower toward the 38.2% Fibonacci extension level at $39,608.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.