USDC being trialed by German software giant SAP for cross-border payments, revival ahead?

- USDC is being touted as a solution to the cross-border payment hassle faced by mid-sized enterprises.

- The EU adopting MiCA has motivated companies in the bloc to adopt crypto and digital assets.

- If successful, cross-border usage of USDC would boost its supply in the market, which has fallen by over $16 billion since the beginning of the year.

USDC has had a rather difficult six months after losing its domination in the stablecoin space due to multiple reasons, including increasing regulator scrutiny and the March 2023 banking crisis. However, with the changing environment in the European Union regarding crypto acceptance, the Circle-issued stablecoin might have a shot at regaining its lost dominion of the crypto market.

USDC finds support in Germany

In a change of fortunes, USDC has been announced as the token that will be used to test cross-border payments by the German software giant SAP. The reason behind using a stablecoin for conducting transactions with other countries, as described by the company, is to solve the challenges faced by businesses when sending money beyond their borders.

Discussing the same, product expert at SAP, Sissi Ruthe, noted in her blog post,

“Today, cross-border payments are a hassle for many small and mid-sized enterprises with international business partners. These major challenges can get solved with Digital Money as a means of settlement and Blockchain as the underlying technology.”

The European Union is currently being touted as one of the most fertile areas for the crypto market to grow and thrive. The reason behind this is the MiCA regulation being successfully passed. Markets in Crypto Assets (MiCA) has bestowed confidence in many crypto and digital-asset enthusiasts in the country, enabling the tests.

Beyond the users, USD Coin (USDC) could itself significantly benefit if the trial is successful and the digital asset payment system is integrated into SAP’s systems. The stablecoin would not only find new users but also largely increase circulation in the crypto market.

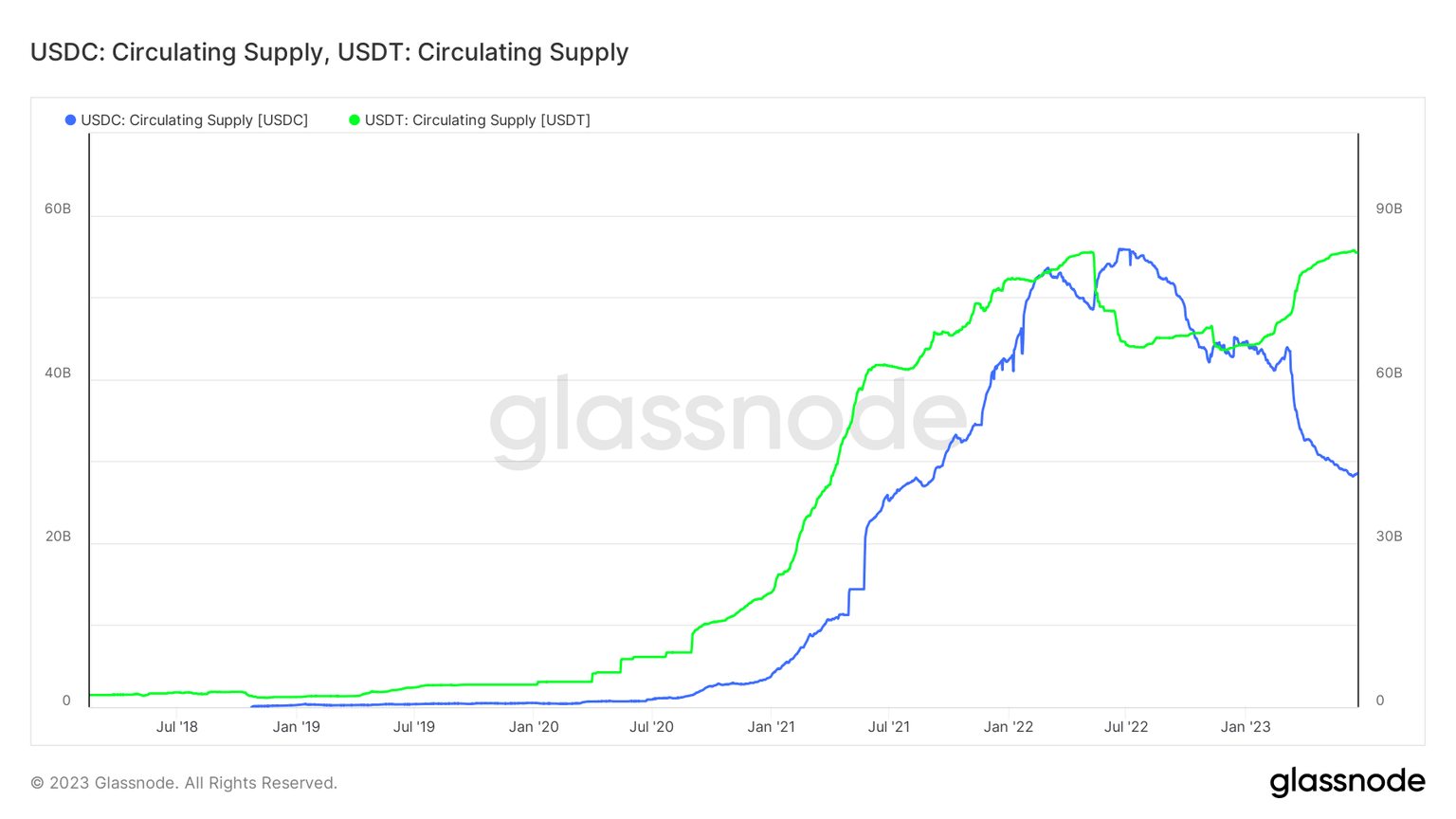

USDC, at one point towards the end of 2022, was nearly in competition with Tether (USDT), which had a circulating supply of 66.2 billion at the time. USDC’s dominance, on the other hand, was also at a high, with a circulating supply of over 42 billion tokens.

USDC vs USDT circulating supply

However, come 2023, the depegging of the asset and the collapse of Silicon Valley Bank led to USDC losing its footing in the stablecoin space for a while resulting in a sharp decline in its circulation around March this year.

At the time of writing, after consistent declines, USDC’s supply stands at 28.2 billion while USDT, which picked up the supply USD Coin lost, rose to note a market capitalization of $83.5 billion.

With the SAP cross-border payment test, however, there is hope of USDC reclaiming its crown.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.