- A pension fund in the United States has decided to allocate $25 million to cryptocurrencies.

- The Houston-based pension fund invested in Bitcoin and Ether through a partnership with NYDIG.

- The chief investment officer of the HFRRF believes that this allocation is a method of managing the fund’s risks.

Institutional interest in cryptocurrencies continues to rise as a pension fund in the United States has made a substantial purchase in Bitcoin and Ether as the leading cryptocurrencies recently reached new all-time highs.

Crypto became an asset class the fund ‘could not ignore’

The Houston Firefighters Relief & Retirement Fund (HFRRF), which has over $4 billion in assets, recently invested $25 million in Bitcoin and Ether through the New York Digital Investment Group (NYDIG), a subsidiary of asset management firm Stone Ridge.

The chief investment officer of HFRRF, Ajit Singh, stated that the recent investment in the top two cryptocurrencies by market capitalization was a tool to manage risks and that it has a positive expected return with little correlation to every other asset class.

Singh added that he preferred direct tokens rather than investing in futures-related products. He expects that with more institutional adoption in the crypto market, there would be an increase in dynamics that develop for supply and demand. He further stated that holding the physical assets would give the fund the possibility of income generation potential.

The firm has been studying the new asset class before adding Bitcoin and Ether to its investment portfolio. Singh concluded that cryptocurrencies became an asset class that the fund “could not ignore anymore.”

JPMorgan Chase & Co. strategists believe that inflation concerns acted as the main fuel behind the crypto rally, driving Bitcoin and Ether to all-time highs rather than the hype generated by the first BTC exchange-traded fund (ETF) launch in the United States.

The strategists added that the perception of Bitcoin as a better inflation hedge than gold is the main reason for the recent cryptocurrency surge, as investors have shifted away from gold ETFs into BTC funds since Q3.

Ethereum price retraces following all-time high

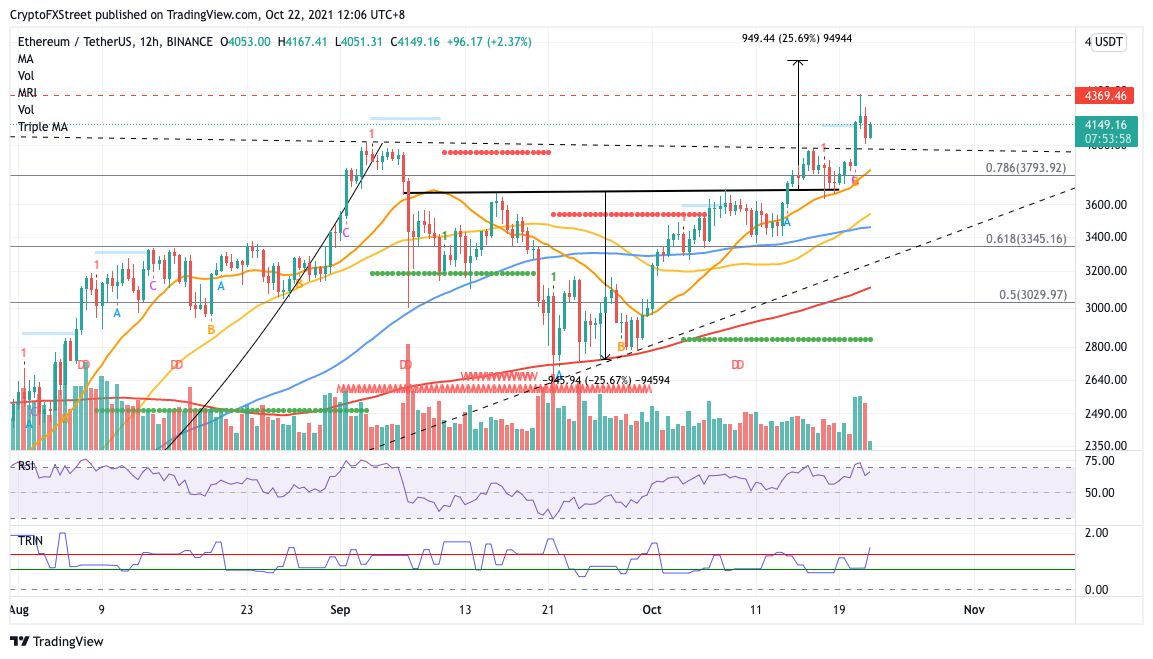

Ethereum price is searching for a foothold following its new all-time high that was reached on October 21. The prevailing inverse head-and-shoulders pattern projects a 25% rise from the chart pattern's neckline, with a bullish target at $4,639.

The first line of defense for Ethereum price is at the support trend line at $3,974. Further support will emerge at the 78.6% Fibonacci retracement level at $3,793. Slicing below this level may see ETH tag the neckline of the technical pattern at $3,690.

ETH/USDT 12-hour chart

However, the bullish outlook would be ruined if Ethereum price falls toward the 50 twelve-hour Simple Moving Average (SMA) and 100 twelve-hour SMA at $3,545 and $3,463, respectively.

Ethereum price must climb above the resistance level at $4,369 to put the optimistic target on the radar.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.