US NFP reaction: Bitcoin price wavers as investors reassess Fed expectations after jobs report

- US NFP data for June is downbeat, with the addition of 209,000 Nonfarm Payrolls, below market expectations.

- The unemployment rate dropped to 3.6% as expected, raising doubts about further rate hikes by the US Federal Reserve.

- Bitcoin, Ethereum and risk assets are likely to climb higher with the US Dollar coming under renewed selling pressure.

US Nonfarm Payrolls data for June revealed an addition of 209,000 jobs, below the market’s expectation of 225,000. The reading could imply fresh gains in Bitcoin, Ethereum and risk assets.

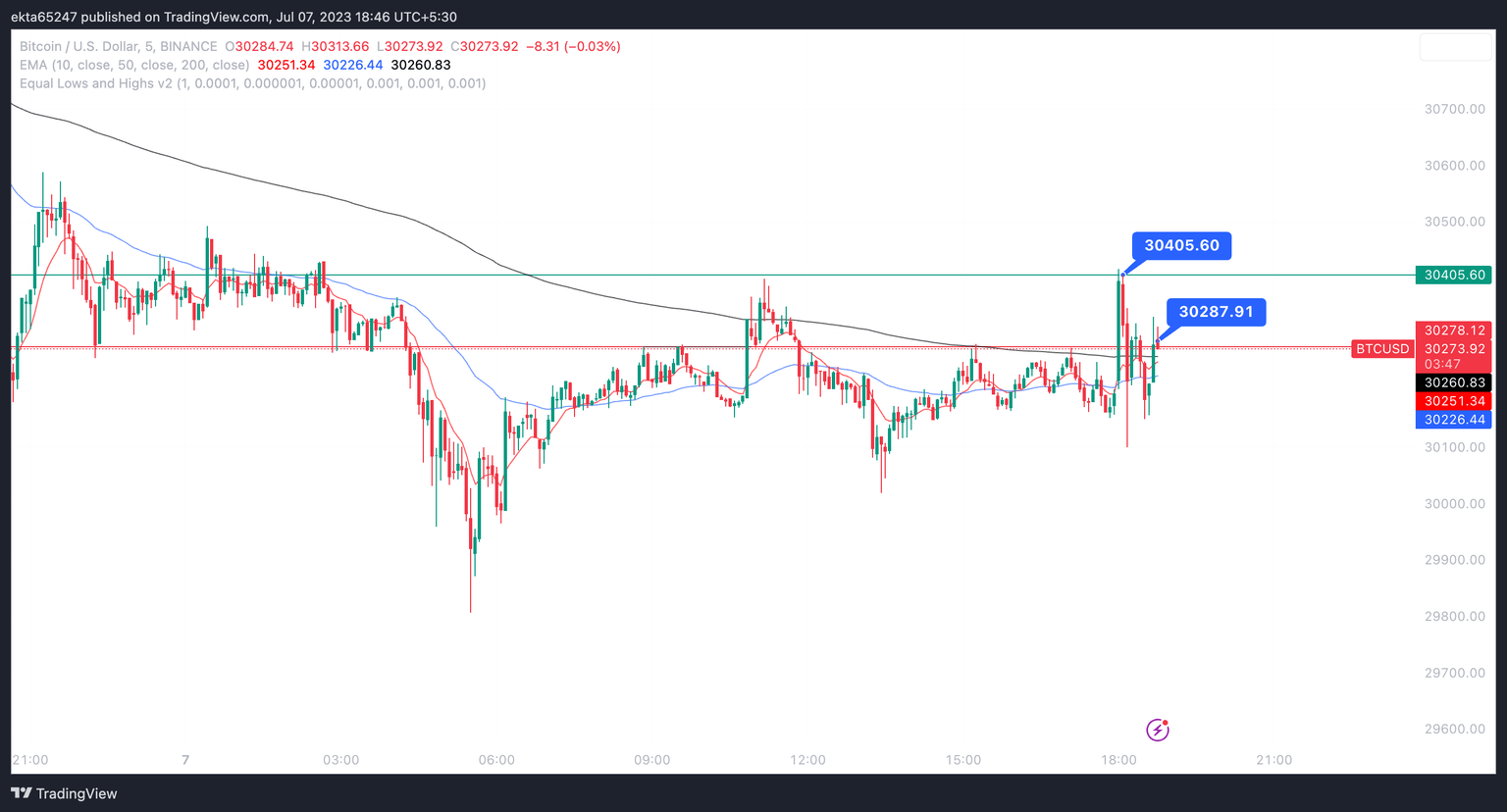

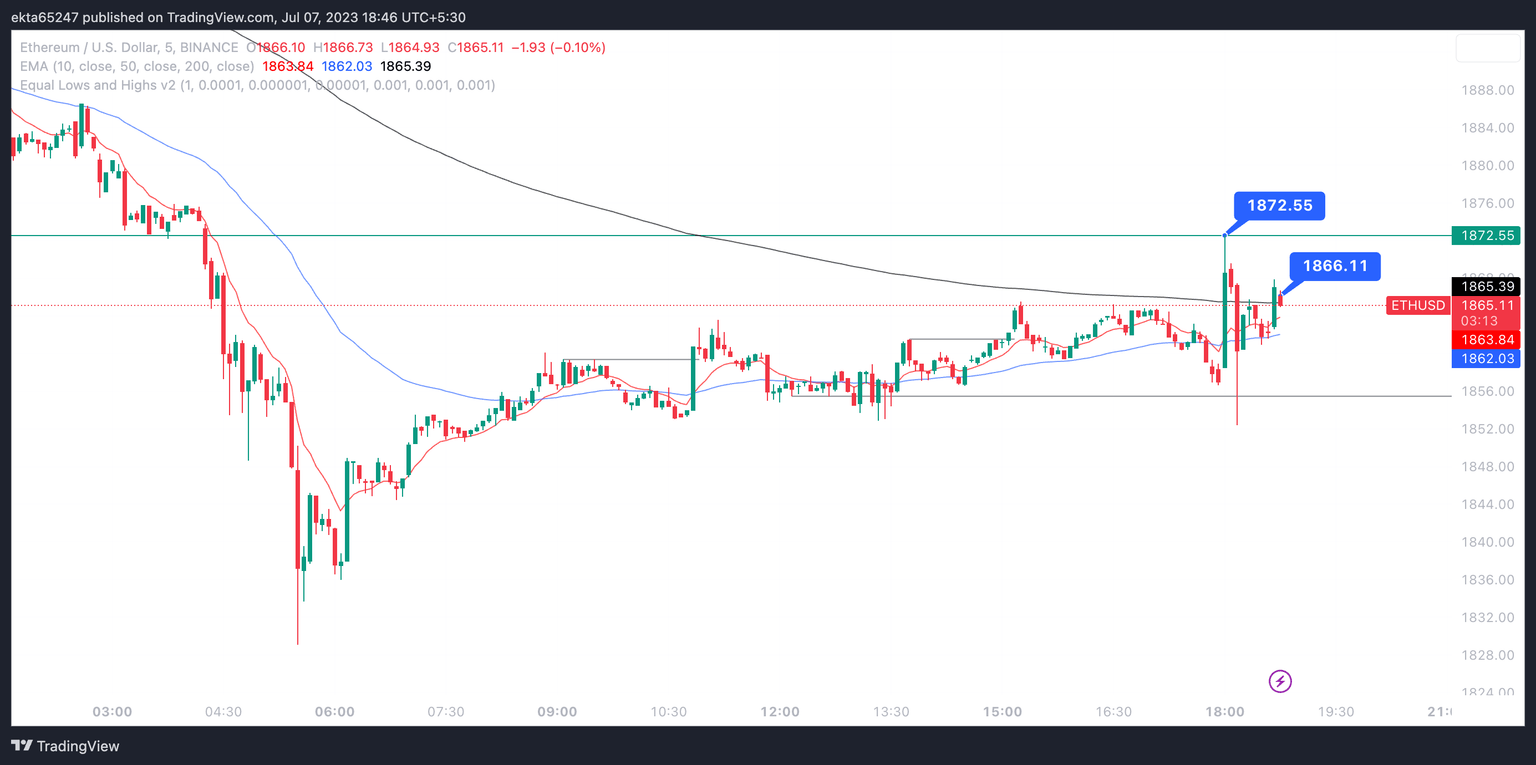

Bitcoin price sustained above the key psychological level of $30,000 and Ethereum price steadied above $1,800 in response to the US NFP data release.

Also read: US Nonfarm Payrolls Forecast: June NFP expected to show cooldown in job market

Bitcoin and Ethereum prices coil ahead of fresh gains

Bitcoin and Ethereum prices are coiling in response to the addition of 209,000 Nonfarm Payrolls in the US. US NFP data came in below market expectations for the first time since April 2023. The unemployment rate edged lower, meeting the expectation of 3.6%. These data points have reduced the likelihood of future rate hikes by the US Federal Reserve.

Based on previous reactions to US NFP, a volatility-filled week lies ahead of market participants. Find out more about Bitcoin’s reaction to previous data releases here.

The report has increased the selling pressure on the US Dollar, paving the way for fresh gains in risk assets like Bitcoin and Ethereum. At the time of writing, the US Dollar index is down 0.45% for the day.

As seen in the chart below, Bitcoin price climbed to $30,405 before pulling back to $30,287. Ethereum price hit $1,872 and corrected to $1,866 at the time of writing.

Bitcoin/USD five-minute price chart Binance

Ethereum/USD five-minute price chart Binance

Market participants are expecting the outcome of the US Federal Reserve’s interest rate decision in July. The probability of a hike could reduce, given cooling job creation. Still, the Fed will be watching the US Consumer Price Index (CPI) data to be published next week before its verdict on July 26.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.