- The US Department of Justice notified Judge Kaplan about their decision to waive one of the eight charges against FTX founder Sam Bankman Fried.

- The decision was in obligation to a treaty with the Bahamas, which did not intend to extradite Sam Bankman-Fried until this particular charge was dropped.

- The former FTX CEO is already facing the probability of going back to jail for leaking private documents and intimidating witnesses.

FTX founder Sam Bankman-Fried is set to face multiple criminal charges in two months from now. But the disgraced former Chief Executive Officer (CEO) of the bankrupt exchange should be thanking his lucky stars as he has been saved from a lengthier sentence thanks to United States' legal obligations.

Sam Bankman-Fried saved from one criminal charge

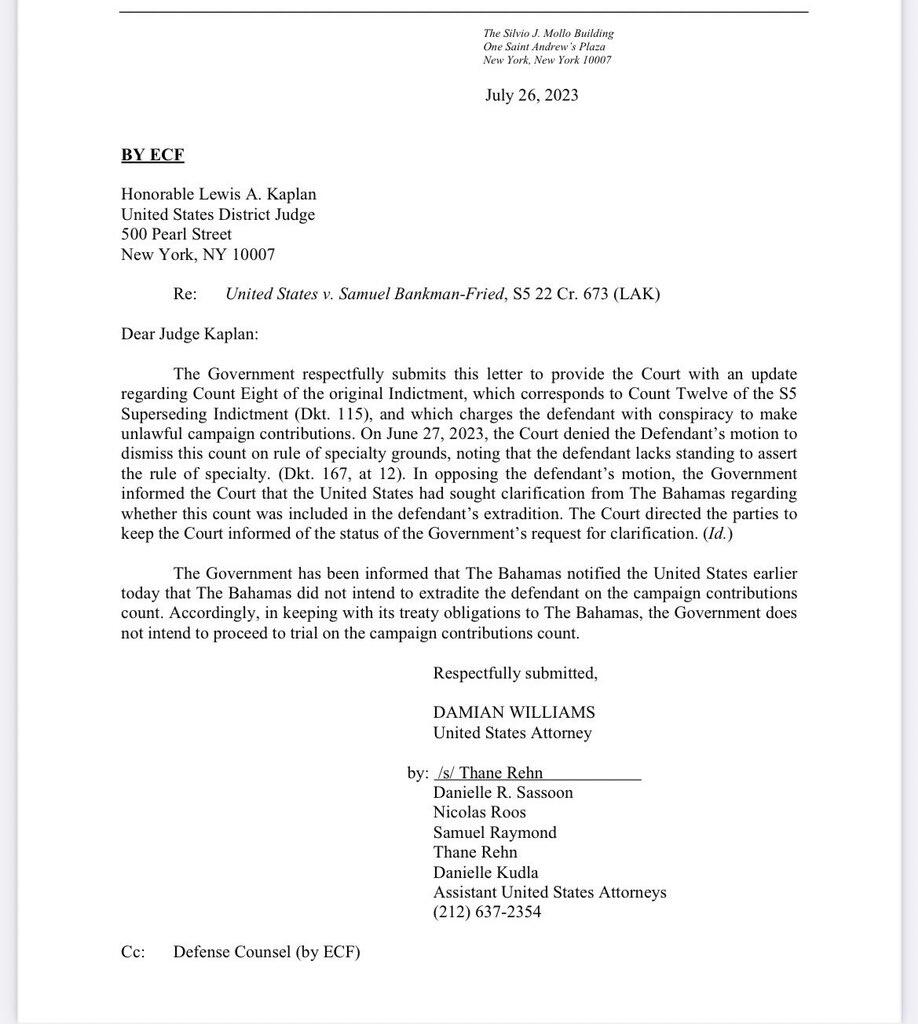

Sam Bankman-Fried can breathe a sigh of relief as the United States Department of Justice has decided to drop the political campaign criminal charges against him. The federal agency made the decision after the Bahamas denied Sam Bankman-Fried’s extradition on the campaign contributions count. The DoJ, in line with the same, informed Judge Kaplan of their intention to waive the charges.

Since the United States government has a treaty with the Bahamas government, they are obliged to drop the charges. Consequently, during the trial, set to begin in October, the campaign contribution count will not be included in the eight criminal charges against Sam Bankman-Fried.

US Department of Justice notice to Judge Kaplan

The political campaign charge being withdrawn by the DoJ was placed on Sam Bankman-Fried after revelations the FTX executive made a $93 million donation to US politicians. These funds were among the stolen customer deposits that were also used by Sam Bankman-Fried for saving sister company Alameda Research.

The government's treaty obligations have emerged favorably for Sam Bankman-Fried for the second time since his arrest. Back in December 2022, the former FTX CEO was saved from an additional five charges, including bank fraud and bribery, as they were blocked by a court in the Bahamas.

However, Sam Bankman-Fried is still facing the probability of being sent back to jail, according to a court hearing from this week. Assistant US Attorney Danielle Sassoon requested the remand and revocation of the FTX executive's $250 million bail.

The reason stated by Sassoon was that Sam Bankman-Fried seemingly used his freedom to intimidate Caroline Ellison by leaking her private documents to a New York Times reporter, making over 100 phone calls.

The hearing on the revocation of the bail is scheduled for Friday, July 28.

Read more - Disgraced FTX CEO Sam Bankman-Fried under fire for leaking documents, intimidating witnesses

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.