US Judge denies SEC request to inspect Binance.US

- The SEC faced a setback in its pursuit of Binance.US as Judge Faruqui stated he was not inclined to allow the inspection.

- The regulatory body has been attempting to gain access to the exchange’s documents since filing a lawsuit in June.

- Binance.US has been losing its users, with the trading volume falling to an average of $10 million from $150 million in June.

The Securities and Exchange Commission (SEC) faced challenges following its partial loss in the Ripple lawsuit. While the agency has been spearheading the “regulation by enforcement” policy, by the looks of it, many, including the justice system, are not in agreement with it.

Read more - Binance Coin price at risk as FUD surrounding a Binance collapse intensifies

SEC loses another battle against Binance

The SEC has been attempting to make a move against the US arm of the world’s biggest crypto exchange, Binance. The regulatory body first sued Binance.US in June this year and has since been attempting to gain access to the documents to proceed with its case of a potential violation of Securities laws.

However, federal Magistrate Judge Zia Faruqui does not think the SEC has a strong enough case to allow access to Binance.US’ documents. In line with the same, the judge rejected the agency’s request for gaining immediate inspection access to the exchange’s software. Judge Faruqui noted that the SEC needs to come up with more tailored requests and speak with additional witnesses.

The regulatory body has been unable to gain information from Binance.US ever since it filed the lawsuit against it, as well as Binance and its CEO Changpeng Zhao (CZ). On the other hand, the lawyers for the exchange have been reluctantly resisting the deposition of its top executives. Calling the SEC’s pursuit a “fishing expedition”, the lawyers noted that the executives have no knowledge about the security and custody of customer assets.

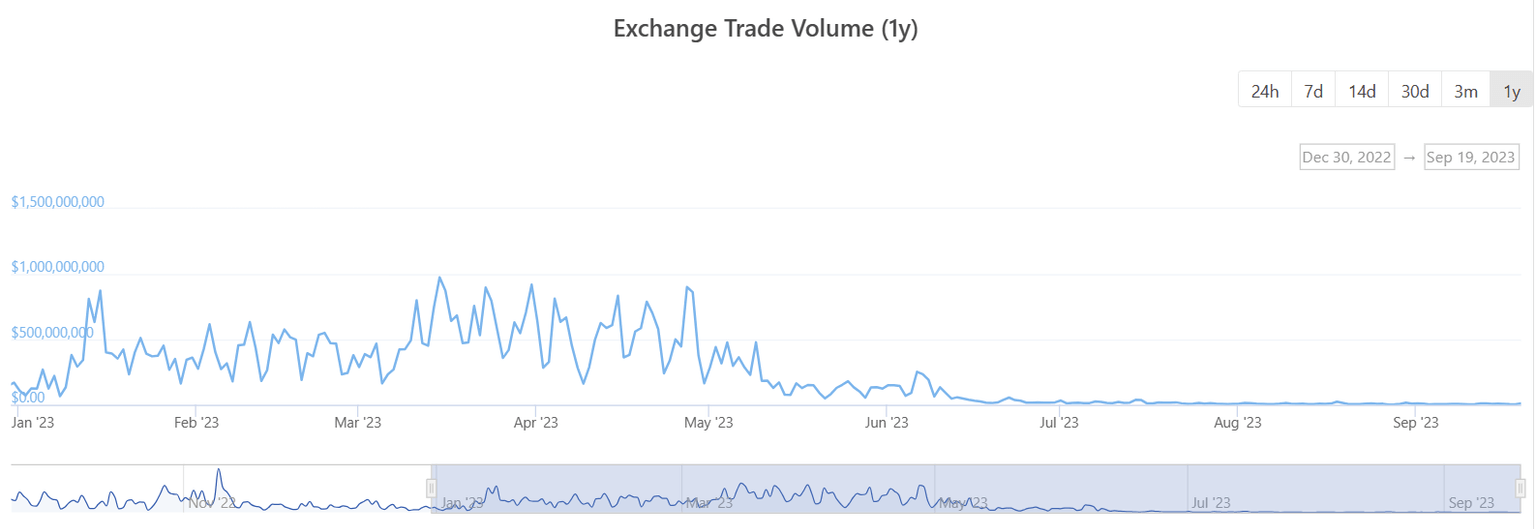

Regardless, Binance.US has been losing the support of its customers since the lawsuit was filed in June, the evidence of which can be seen in the trading volume.

Binance.US trading volume falls starkly

According to data obtained from Coingecko, since June, the average daily trading volume of the exchange has seen a sharp decline. The exchange was averaging well above $500 million in May and around $150 million in June. However, at the time of writing, the exchange has been struggling to maintain an average of $10 million on a daily basis.

Binance.US average daily trading volume

In addition to this, recently, the CEO of Binance.US, along with the Head of Legal and Chief Risk Officer, stepped down, filing reports of a potential collapse. However, Binance CEO CZ refuted these rumors, saying that Binance.US CEO Brian Shroder was taking a deserved break and that the exchange was not on the verge of a collapse.

Read more - Binance CEO clears FUD regarding Binance.US CEO Brian Shroders’s exit, calls it a “deserved break”

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.