US Fed interest rate preview: Two scenarios for Bitcoin and Ethereum prices

- Bitcoin and Ethereum prices are close to key psychological levels, $34,400 and $1,800, ahead of the Federal Reserve’s interest rate decision.

- Cryptocurrencies in the top 10 by market capitalization noted an increase in their prices in the week leading up to the Fed’s decision.

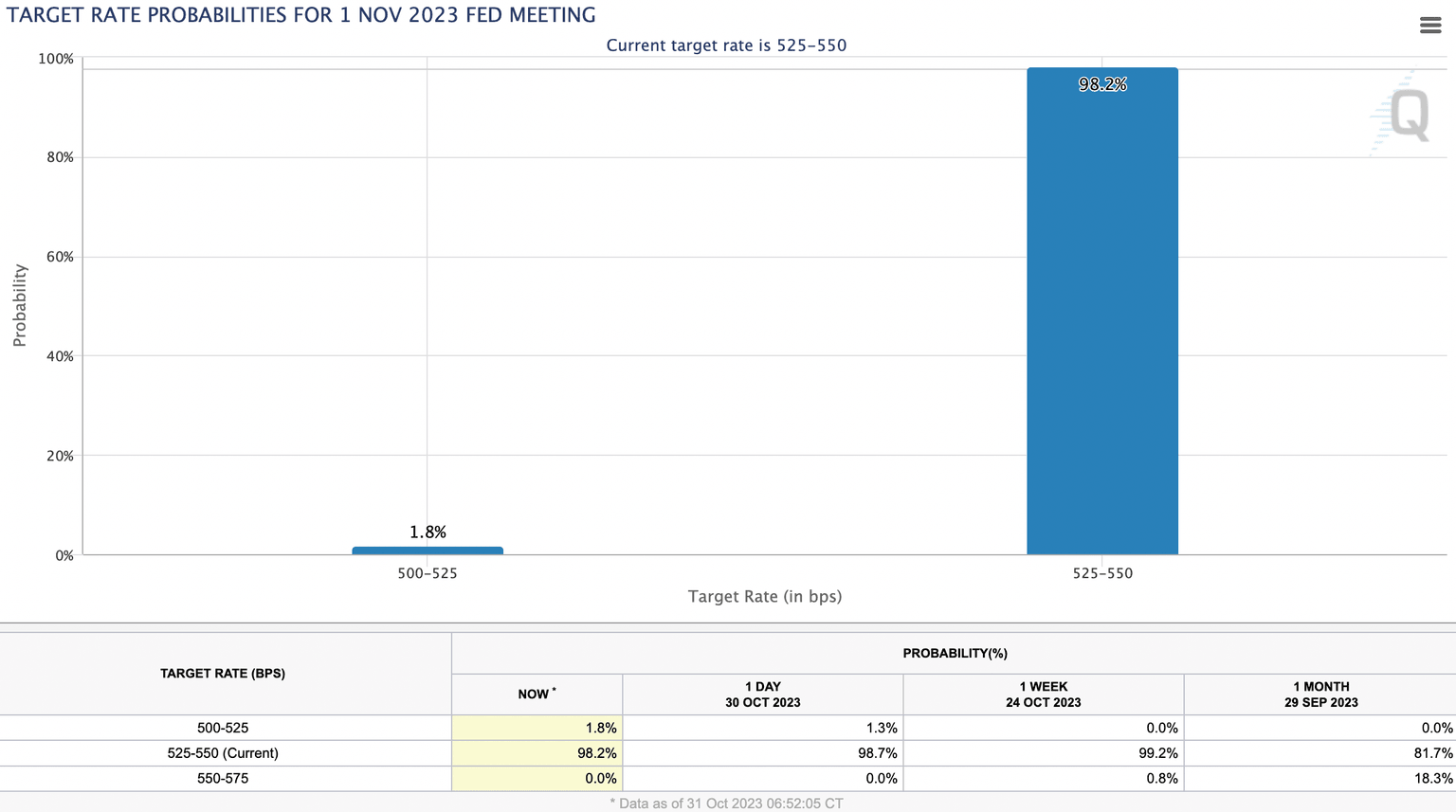

- Traders foresee a 98.2% probability that the US Federal Reserve will leave interest rates unchanged on Wednesday.

Bitcoin price rallied throughout October 2023, marking another profitable month for BTC holders. The upcoming US Federal Reserve interest rate decision has the potential to make or break Bitcoin’s price rally.

Altcoins like Ethereum will probably follow Bitcoin’s coattails. A vast majority of market participants expect the interest rate to remain unchanged and a small percentage anticipate a rate cut by the US central bank.

Also read: Federal Reserve Preview: Powell set to lift US Dollar by leaving door open to more hikes

US Fed interest rate preview: Two scenarios for Bitcoin and cryptocurrency prices

Scenario 1: US Fed leaves rates unchanged

According to the CME Fed Watch Tool, there is a 98% probability that the US Ccentral bank will leave interest rates unchanged on November 1. In September 2023, Bitcoin price noted no stark movements as the Fed left interest rates unchanged. A similar outcome is expected, in response to the Federal Reserve’s November 1 decision.

CME Fed Watch tool and expectation of interest rate hike

Bitcoin price could witness short-term volatility, with BTC hovering close to the $34,400 level. BTC is likely to momentarily retrace its weekly gains of 4.33%, a recovery in the asset’s price could follow soon after.

Bitcoin’s rally is largely driven by the anticipation of a spot BTC ETF approval by the US financial regulator Securities and Exchange Commission (SEC). The SEC’s decision could therefore influence BTC price directly, as opposed to unchanged interest rates.

Scenario 2: US Fed cuts interest rates

Market participants believe that there is a 1.8% probability of an interest rate cut. In the event of a rate cut, risk assets like Bitcoin and altcoins are expected to rally. Typically, a rate cut makes it cheaper to borrow funds and engage in leveraging risk assets like Bitcoin for gains. An increase in demand and inflow of funds to the asset likely drive prices higher.

It is important to note that the interest rate cut is highly unlikely. Investors are focused on Fed Chair Jerome Powell’s speech to identify whether more interest rate hikes are on the horizon.

Expert analysis on likelihood of further rate hikes

Yohay Elam, lead analyst at FXStreet analyzed the Fed’s interest rate decision and the possibility of future rate hikes in his post here. Elam notes that the Federal Reserve's overnight rate stands at a range of 5.25%-5.50%, above both measures of inflation. The US Central bank has slowed the pace of its rate hikes and settled for one interest rate increase in the past three meetings.

While market participants expect another “no change” decision from the US Fed, the Central bank left room for another hike in 2023. Elam says,

“The bank's dot plot showed a target of 5.6% by year-end, leaving the door open to another move. With no new forecasts at this juncture, Fed Chair Jerome Powell will likely insist on another move, leaving his options open. One reason to do that is the buoyant jobs market.”

Bitcoin and Ethereum prices hover at crucial levels

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization are hovering around crucial levels, ahead of the bank’s decision on Wednesday. Bitcoin price sustained above $34,400 while Ethereum is trading above its $1,800 psychological level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.