US Dollar Index hits a ten-month high - Is Bitcoin price preparing for a crash?

- The US Dollar Index is presently at its highest point since November 2022.

- DXY rising has been a bearish signal for SPX and Bitcoin price in the past two years.

- BTC has been standing strong and sharing a negative correlation with the S&P 500 Index might prevent a decline.

Bitcoin price has always been affected by macroeconomic developments along with other major indices such as the S&P 500 Index, NASDAQ 100, and even Gold. However, this time around, the situation might differ slightly as, unlike the rest of the investment options, the cryptocurrency has held its own.

Bitcoin price avoids a steep fall

The US Dollar Index is known to impact Bitcoin price along with the stock market and precious metals’ value. Since 2021, the rise in the DXY has resulted in a drawdown in the SPX, Gold and BTC. Following this pattern, the S&P 500 index, along with Gold, noted a decline in their market value over the past couple of days.

Bitcoin price was expected to do the same, however, the cryptocurrency managed to surprise the market as it has stood firm above $26,000. The DXY hitting a ten-month high of 106.65 seems to bear no impact on BTC. What this means for the world’s largest crypto asset is that a rally might not be too far away.

US Dollar Index 1-day chart

The DXY is presently overheated, as noted on the Relative Strength Index, sitting in the overbought zone above 70.0 and is probably looking at some correction or sideways movement until the market cools off.

This would be just the opportunity needed by Bitcoin price to make a move. The development, according to market analysis platform Santiment, suggests that a breakout might be in store as BTC has managed to stay afloat above $26,000.

What moves to expect from BTC price

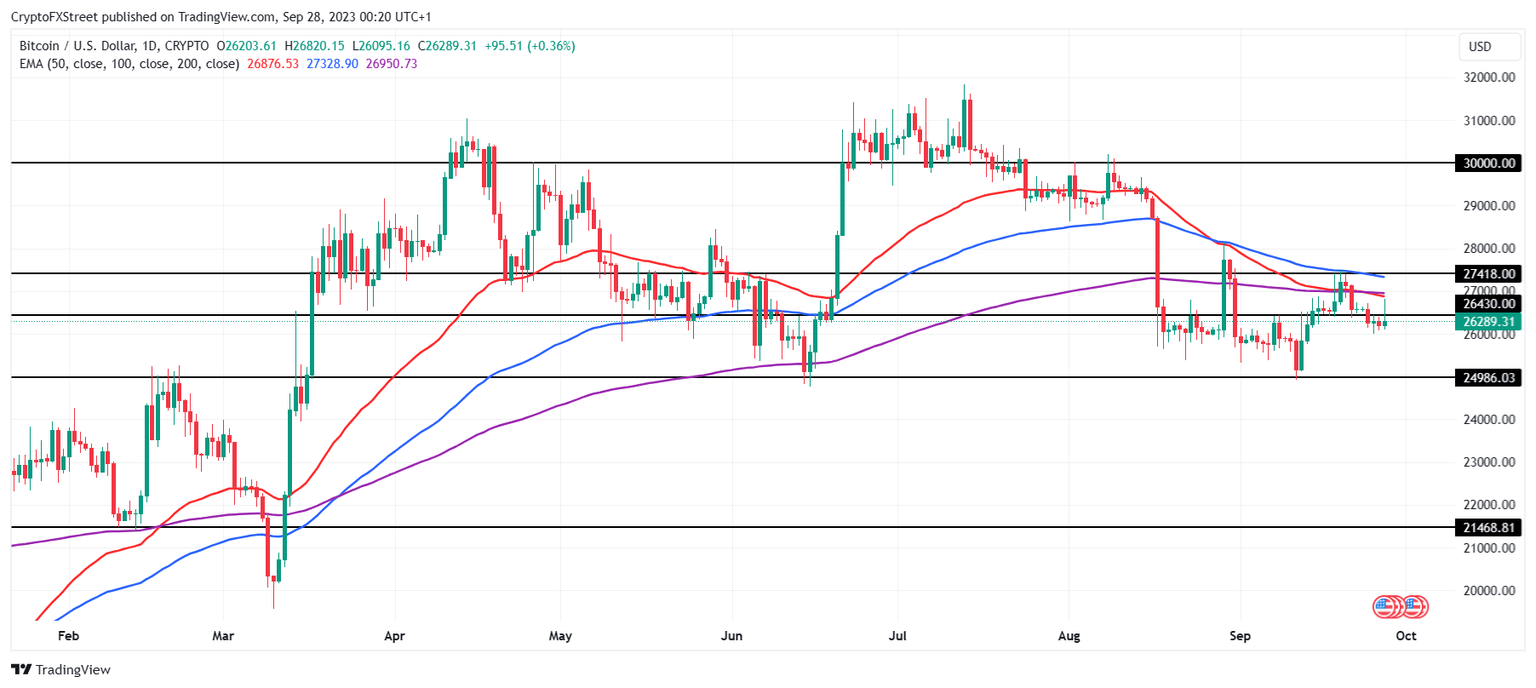

The optimism in the crypto market is building up as investors are looking for Bitcoin price to recover and post new year-to-date highs. Trading at $26,317, BTC would need a minor push to flip its 50- and 200-day Exponential Moving Averages (EMA) into a support line. This is crucial in bringing about a recovery in the value of the digital asset.

BTC/USD 1-day chart

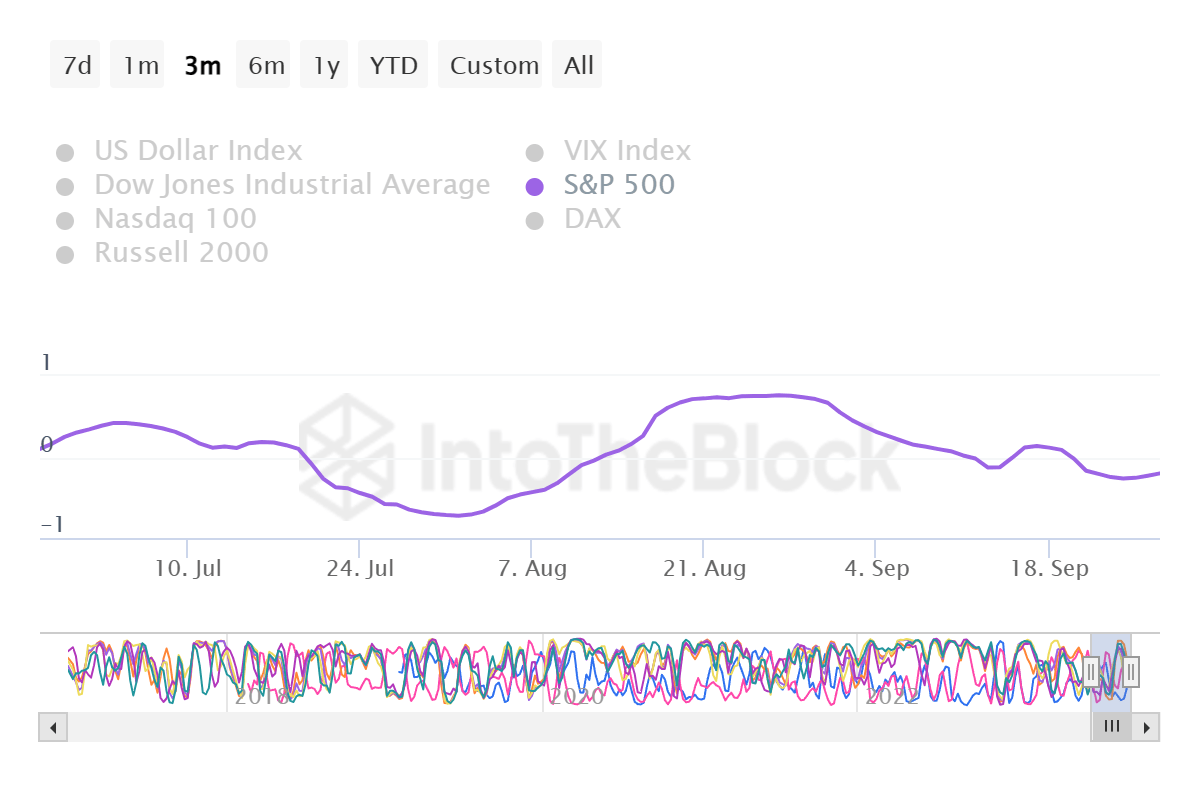

The reason why it has managed not to fall considerably akin to SPX while the US Dollar Index rallied is that it shares a negative correlation of -0.2 at the moment. This has kept the digital asset safe from noting a drop in value over the past few weeks.

Bitcoin correlation with SPX

The next major target for Bitcoin price now stands at $30,000 and is likely to reach there provided no sudden bearish development in the crypto market occurs. However, in the event that a decline does take place, it would be crucial for BTC not to fall through the support line at $24,986. This would invalidate the bullish thesis and potentially send the cryptocurrency towards $21,468.

Read more - This short-term Bitcoin holder indicator forecasts another rally for BTC

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.