- The Biden administration and Republican Kevin McCarthy resumed the debt ceiling discussion hinting at a "positive outcome".

- If the US defaults on its debt, nearly 8 million job losses could be observed.

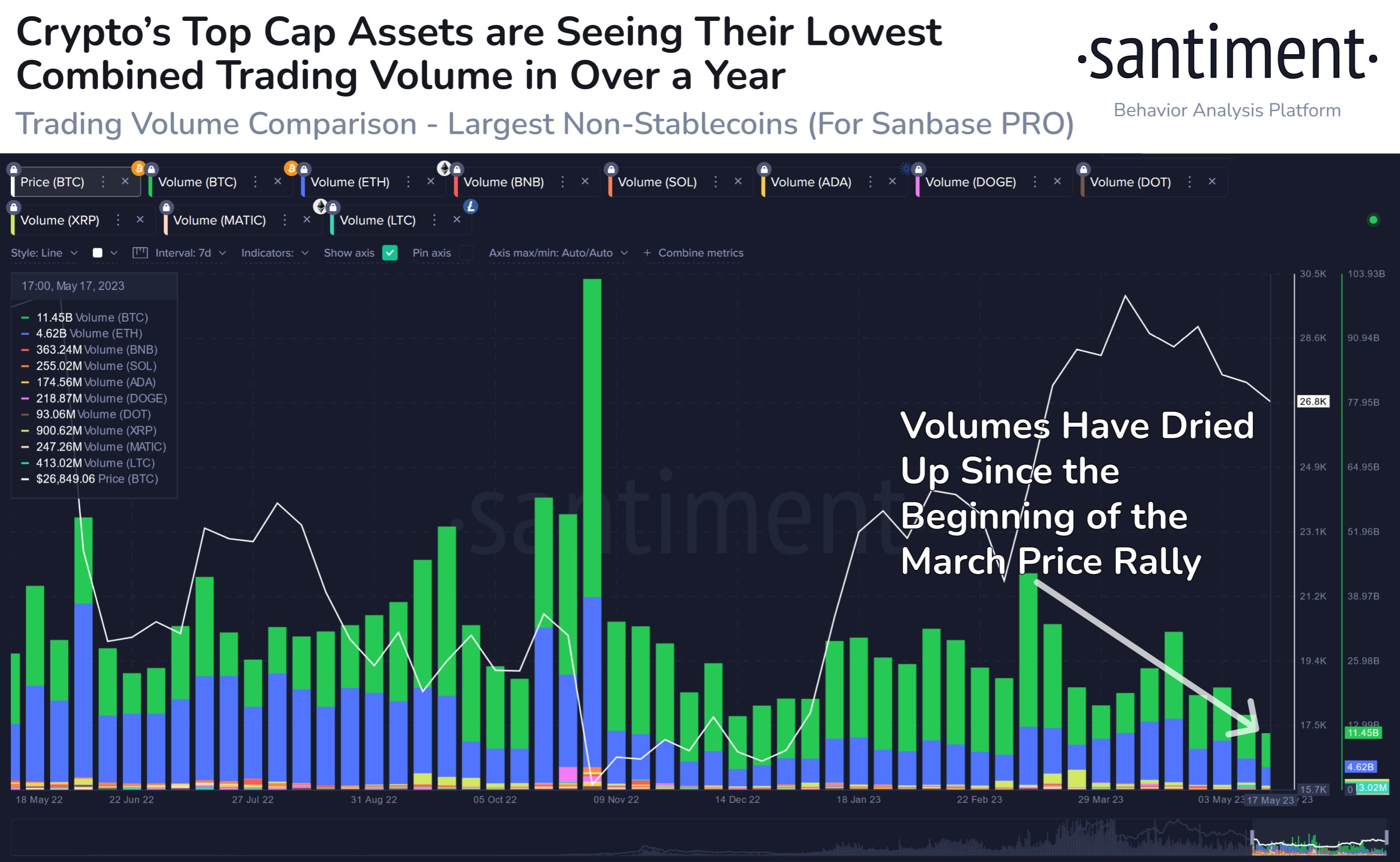

- Bitcoin and Ethereum trading volumes fall to the lowest for the second time since 2019.

The world economy is currently bracing for a terrible blow from the United States. As the Biden administration continues to negotiate with Congress to reach common ground, the stock market sits in a worry of impending doom. This fear is potentially also spreading to the crypto market.

US government nears defaulting on its debt

US President Joe Biden and top Republican Kevin McCarthy recently engaged in discussions regarding the debt ceiling on May 22. Both parties are optimistic about reaching common ground to bring an end to the deadlock over the federal debt.

Earlier this week, US Secretary of the Treasury Janet Yellen issued a warning stating that the US debt could default within the next ten days by June 1 if the talks fail to result in a favorable decision. She stated,

"It is highly likely that Treasury will no longer be able to satisfy all of the government's obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1.

Additionally, Yellen noted that even a last-minute solution must be avoided as it damages the economy at the consumer, business, and government levels.

However, McCarthy, ahead of the meeting, reiterated that while the Republicans and Biden administration still have "disagreements," they will reach a decision soon.

This needs to take place as soon as possible since it would take at least another three days to write down the agreement, read and vote on it.

The global economy is on edge as fears grow over the impending week, with the failure to raise the debt ceiling beyond the current cap of $31.4 trillion potentially leading to a US debt default.

Impact of debt default on crypto

According to a White House report, it was highlighted that a debt default could lead to over 8 million job losses. Unemployment rising by such a huge figure in an instant could negatively impact not only the stock market but the crypto market as well.

The reason behind this is that the US accounts for 10% of the worldwide crypto users. Amounting to 45 million out of the 420 million crypto users, the country’s troubles present a significant threat as crypto users who lose their job could be forced to sell their holdings prematurely.

As it is, the crypto market trading volume is currently running dry, with weekly volumes noting historical lows. Santiment noted that Bitcoin and Ethereum volumes alone combined are observing the second lowest threshold since September 2019.

Crypto market trading volume

For the same reason, Bitcoin price and Ethereum price, along with the rest of the market, have been observing sideways movement for the last few days. Investors are preparing for a move in either direction post-June 1 as the result of the talks would determine profits or losses for crypto asset holders.

BTC/USD 1-day chart

The crypto market is still rooting for the talks to reach a conclusion, as even at the risk of losing some investment, the market would be safe from severe bearishness.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.