Uptober was great, but party may not be over as November is historically best performing month for Bitcoin

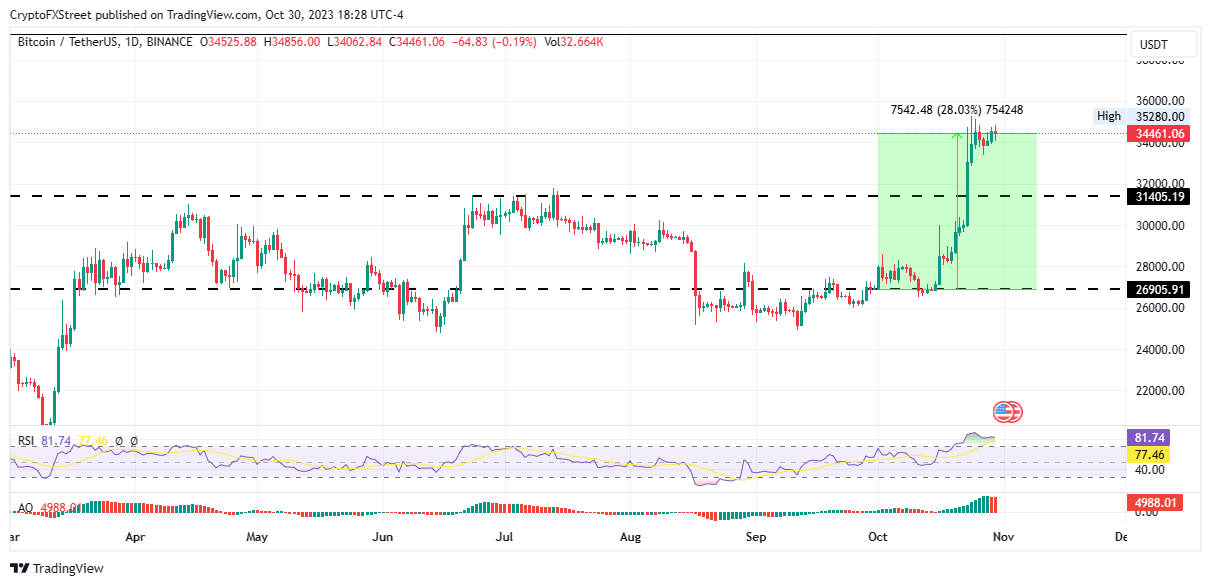

- Bitcoin price has pumped 30%, moving from $26,900 on October 1 to the current price of $34,465 on October 31.

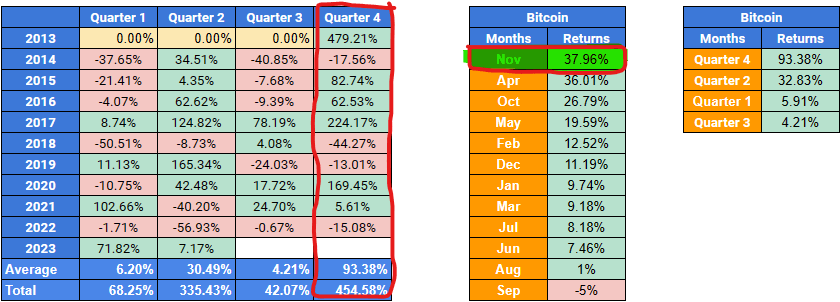

- BTC’s historic data reveals the best performance in November, suggesting upward potential in the coming month, FXStreet calculations show.

- With Q4 recording the biggest returns, November ranks first on the leaderboard with almost 38% in gains after April.

Bitcoin (BTC) price has recorded a rather volatile year in 2023, riding the waves of different narratives, from banks collapsing to macroeconomic events, and eventually a growing interest by institutional players to venture into the space. With the latter, exchange-traded funds (ETFs) became the theme of the third and fourth quarters (Q3 and Q4 respectively). Besides the three, investors also have their eyes peeled for the BTC halving barely six months out.

November could be just as good as October for Bitcoin, if not more

Bitcoin (BTC) price boasts a commendable move north in October, sending BTC holders back above the enviable $30,000 level. At the time of writing, Bitcoin price is $34,461, after recording the highest weekly close in 78 weeks.

As Aaryamann Shrivastava, an expert reporter at FXStreet, puts it, the surge in Bitcoin price “has induced optimism in investors after the recent rally resulted in significant profits for them.” Read the full analysis here.

BTC 1-day chart

Meanwhile, as October bids farewell, and with it, the “Uptober” narrative, the party may not be over yet as November has historically proven to be the best performing month for the king of crypto.

According to tabulations and subsequent calculations by the FXStreet team, Bitcoin has recorded average monthly returns of 6.20% in Q1, 30.49% in Q2, 4.21% in Q3, and 93.38% in Q4 over the last ten years. The numbers point to BTC garnering momentum between the second and fourth quarters, with Q4 proving to be the best at 93.38%.

The adjacent tabulation corroborates the story, showing that Q2, with April standing out, has always been a good month for Bitcoin price, but not as good as Q4, specifically November.

Bitcoin quarterly returns between 2013 and 2023

It is worth it to recognize that in all these years, there was no spot BTC ETFs providing hindwings for Bitcoin. If history does repeat, and with the current optimism for an approval from the US Securities and Exchange Commission (SEC) fueling investor appetite, November could exceed expectations for investors.

With November boasting a track record of impressive performances, Wednesday could kickstart the season for HODLers to get excited, potentially initiating a victory march for “Movember.” Are we just getting started?

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.