United States adds total market cap of Bitcoin worth of debt in 15 days, fear of recession intensify

- In the past two weeks, the United States has noted an increase of $500 billion worth of debt.

- Most of this came between October 1 and 3 as debt rose by $293 billion in three days, amounting to more than half of Bitcoin’s market cap of $550 billion.

- Analysts are suggesting Bitcoin holds the potential to make the most of these market conditions amid intensifying recession concerns.

The economic and political conditions of the United States have been feeding the concerns of a recession. The fear of a government shutdown, the removal of McCarthy as Speaker, and the rising debt are increasing the worry among citizens. However, some are seeing this as an opportunity for crypto to make a bullish turn.

United States’ rising debt - a boon for Bitcoin

Over the past 15 days, the biggest economy in the world, the United States, has witnessed a substantial rise in debt. After crossing the $33 trillion mark two weeks ago, the country has noted an increase of $500 billion worth of debt to date. According to The Kobeissi Letter, this rise marks an increase of about $1.43 billion per hour for the last 15 days straight on average.

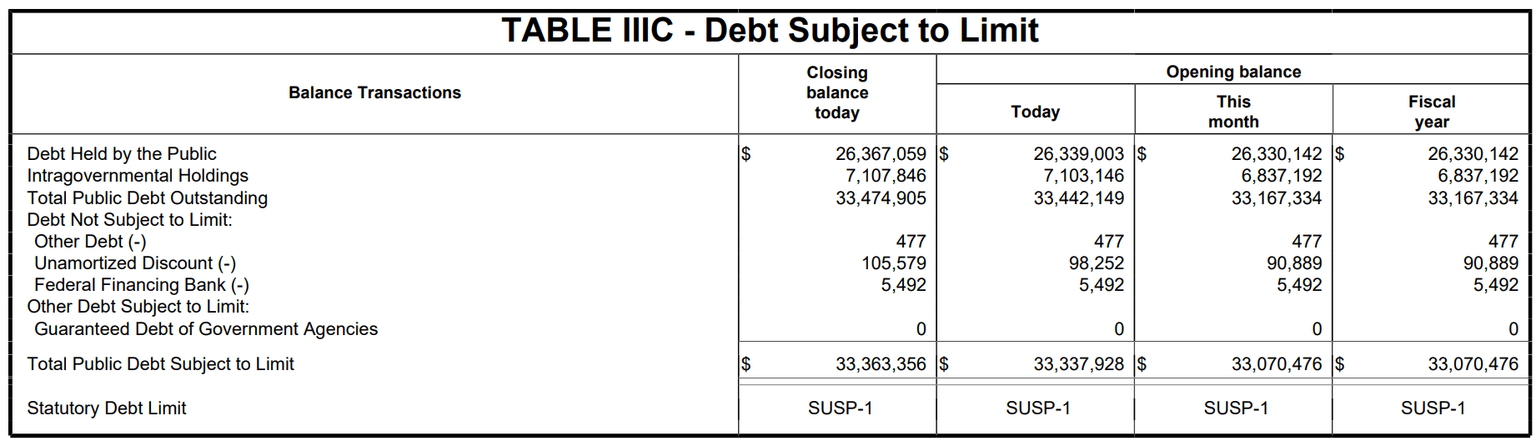

Most of this increase came between October 1 and 3, when the US added nearly $293 billion worth of debt in three days. The amount of debt recorded in these three days amounts to more than half of Bitcoin’s entire market capitalization, according to the official US Treasury Statement. Adding to this notion, The Kobeissi Letter noted that the US national debt is now growing faster than its GDP by the largest margin in history.

US Treasury Statement October 3

Although the debt increase has been faster than the GDP growth for nearly ten years at this point, the current debt-to-GDP ratio, at 120%, is just below its 135% peak in 2020 when the COVID-19 pandemic hit the world.

US Debt-to-GDP ratio

Interestingly, the Federal Reserve Chair Jerome Powell has continuously maintained the central bank’s stance of a sound economy. However, during a meeting with community and business leaders in York, Pennsylvania, Powell stated that the US is still coming through the other side of the pandemic.

Furthermore, according to a model that predicts the decision-making process of the National Bureau of Economic Research, the group responsible for determining whether the US is in a recession from Bloomberg Economics, the chances of a recession this year are around 50%. However, the increasing debt might worsen this probability.

Bitcoin has a chance to come out on top

Amidst the economic chaos, Bitcoin holds the potential to emerge as a viable alternative for investors, given the condition of the stock markets and the Dollar Index. While the S&P 500 Index (SPX) is showing signs of a bullish divergence, standing around $4,200, the US Dollar Index (DXY) is slowing down and hinting towards a bearish divergence.

The crypto market, on the other hand, particularly Bitcoin, is holding steady, which is a positive sign. Trading at $27,411 at the time of writing, BTC is showing signs of a recovery, looking at the Relative Strength Index (RSI) standing in the bullish zone above 50.0.

BTC/USD 1-day chart

Some upside movement could send Bitcoin price above $28,000, but if the market overheats and corrections arrive along with a cool down, the cryptocurrency could see some downside.

Regardless, the crypto market is considering the development to date as a positive sign for Bitcoin’s adoption going forward.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.