Uniswap's DeFi market share exceeds 18.5%: What's behind the project's success

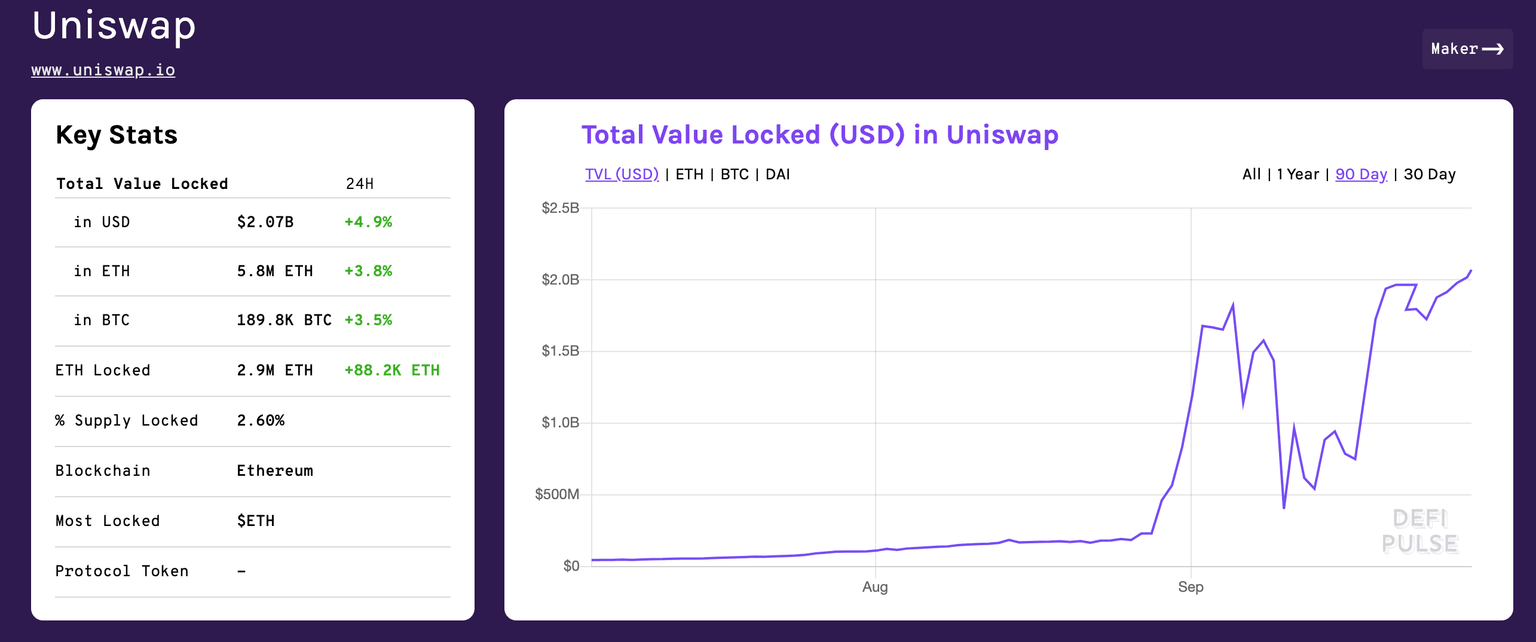

- Over $2 billion locked on the DeFi Protocol Uniswap.

- The innovative concept and the benefit of the first mover gave Uniswap a head start.

Over $2 billion is parked on the decentralized finance (DeFi) protocol Uniswap. As a result, Uniswap now accounts for 18.8% of the whole DeFi market, with a total value of $11 billion.

Uniswap's stats

Source: DeFi Pulse

The total value locked (TVL) represents the amount of money deposited in the trading pools of DeFi-protocols, the protocols in the form of loan collateral, or liquidity. This metric is used to measure how fast the decentralized finance industry is growing.

The steady TVL increase implies that the interest in DeFi services is growing fast. However, it should be noted that the USD value may be volatile as it depends on ETH's price.

What is Uniswap

Uniswap is a variation of the decentralized cryptocurrency exchange based on the Ethereum blockchain. The protocol users can swap their ERC20 tokens and ETH or provide liquidity and earn fees. The main feature of Uniswap is that it allows users to create markets for any ERC20 token and employs liquidity pools instead of order books.

Basically, anyone can create a market by providing an equal amount of ETH and ERC20 token liquidity. Initially, the exchange rate is set by the market creator; however, later on, it is adjusted by Uniswap's market maker mechanism that takes into account supply and demand features.

Currently, the protocol hosts over 11,000 tokens and has over 100 DeFi integrations, while its daily trading volume exceeds $240 million.

The secret of success

Uniswap offered an innovative concept. It allowed people to earn money by making their coins available for liquidity purposes. To put it simply, traders come to the platform to exchange tokens and pay fees to those who stake their coins and make the trade possible.

If we draw parallels with the banking sector, liquidity providers are depositors who earn interest in keeping their money on the bank account. Banks can use this capital to provide loans to borrowers, who pay interest in their turn. The critical difference is that there is no intermediary between the parties, and the interest on the deposited funds is much higher than in banks.

People loved the idea of earning passive income by simply placing their coins on the platform. Not only the project became wildly popular, but also it gave birth to the yield farming phenomena. The participants are also confident that their cons are safe and secure as they are protected by the programming code that would not allow someone stealing the money or misusing them.

Aggressive copycats

After the market discovered the formula of Uniswap's success, the competitors tried to replicate it. The notorious project SushiSwap copied Uniswap's code and created a similar decentralized platform with several new features, including the native governance token SUSHI.

Despite a lot of controversy around SUSHI and its anonymous creator Chef Nomi, the project managed to sap the liquidity from the Uniswap. The platform lost nearly two-thirds of its TVL in a single day.

Lesson learned

Uniswap managed to survive, learned its lessons, and issued its own governance token UNI. The team drove the community crazy with 400 UNI airdrop to each user registered and active on the platform. At the time of writing, UNI is changing hands at 4.58, down 3.8% in the last 24 hours.

UNI/USD chart

Source: Messari

The token price hit the historical high at $6.19 the next day after the issuance and bottomed at $3.9 on September 22. After the partial recovery, UNI has been oscillating in a tight range under $5.

UNI holders will be able to participate in the Uniswap governance decisions and influence the project's development. Apart from that, tokens can be used to pay fees for Uniswap services and stake them for liquidity mining purposes.

Author

Tanya Abrosimova

Independent Analyst