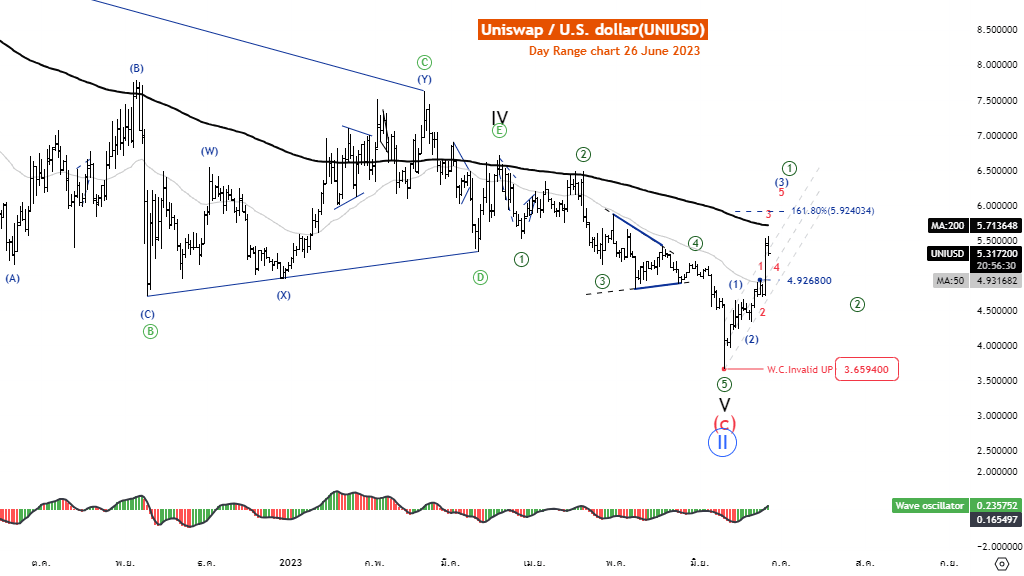

Uniswap (UNI/USD) Elliott Wave analysis

Elliott Wave analysis TradingLounge daily chart, 26 June 2023

Uniswap/U.S.dollar(UNIUSD).

UNIUSD Elliott Wave Technical Analysis.

Function: Counter trend.

Mode: Corrective.

Structure: Zigzag.

Position: Wave (C).

Direction Next higher Degrees: wave ((2)) of Impulse.

Wave Cancel invalid Level: 3.6594.

Details: Wave V is likely to end at the level of 3.6594 A five-wave rise will support this idea.

Uniswap/U.S.dollar(UNIUSD)Trading Strategy: Uniswap is likely to recover from the 3.659 level which we expect is the end of wave V. The rise will support this idea. But even so, the price is still below the MA200, it may still be pressured by selling pressure. Watch out for reversals in waves ((2)).

Uniswap/U.S.dollar(UNIUSD)Technical Indicators: The price is below the MA200 indicating a Downtrend, Wave Oscillator has a Bullish momentum.

Elliott Wave analysis TradingLounge 4H chart, 26 June 2023

Uniswap/U.S.dollar(UNIUSD)

UNI/USD Elliott Wave technical analysis

Function: Follow trend.

Mode: Motive.

Structure: Impulse.

Position: Wave (3).

Direction Next higher Degrees: wave ((1)) of Impulse.

Wave Cancel invalid Level: 3.6594.

Details: Wave 3 is usually equal to 1.618 multiplied Length of wave 1.

Uniswap/U.S.dollar(UNIUSD)Trading Strategy: Uniswap is likely to recover from the 3.659 level which we expect is the end of wave V. The rise will support this idea. Also, the price can break the MA200 line, but it may be pressured by selling pressure. Watch out for reversals in waves ((2)).

Uniswap/U.S.dollar(UNIUSD)Technical Indicators: The price is above the MA200 indicating an Uptrend, Wave Oscillator has a Bullish momentum.

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.