Uniswap Elliott Wave technical analysis [Video]

![Uniswap Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/crypto-coins-1_XtraLarge.png)

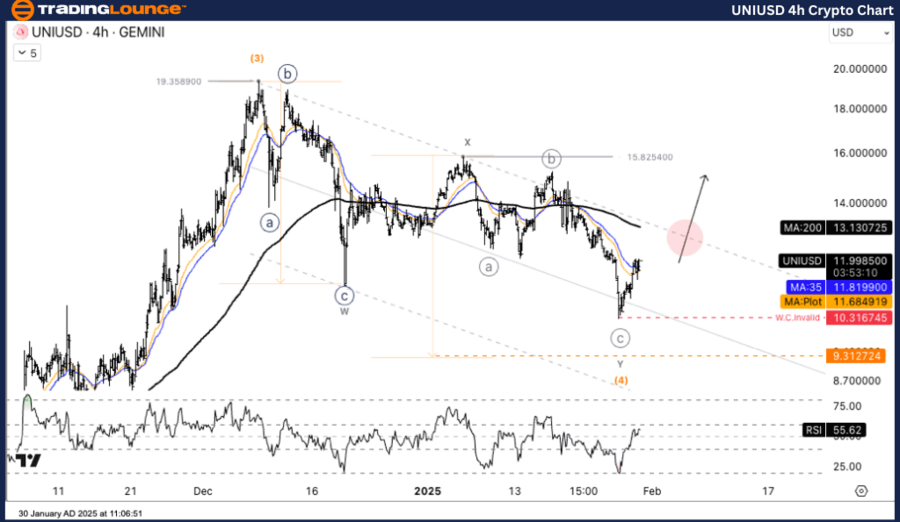

Uniswap/ U.S. dollar(UNIUSD).

UNI/USD Elliott Wave technical analysis

Function: Counter trend.

Mode: Corrective.

Structure: Double Corrective.

Position: Wave (Y).

Direction next higher degrees: Wave ((4)).

Wave cancel invalid level:

Uniswap/ U.S. dollar(UNIUSD)Trading Strategy:

UNI/USD is likely to rebound into wave (5) with key targets at $15.82 - $19.00. Investors should closely monitor price action around the resistance levels in the Channel range to capture buying opportunities at the start of the wave.

Trading strategies

* Buy Strategy (Long Position):

* Buy when the price is still in the range of $10.50 - $11.50 with a stop loss at $9.31

* Set a profit target at $15.82 and $19.00

* Risk Management:

* If the price breaks 10.281, it will confirm that wave (4) has been violated and the trend will change to down.

Uniswap/ U.S. dollar(UNIUSD)

UNI/USD Elliott Wave technical analysis

Function: Counter trend.

Mode: Corrective.

Structure: Double Corrective.

Position: Wave (Y).

Direction Next higher Degrees: Wave ((4)).

Wave cancel invalid level:

Uniswap/ U.S. dollar(UNIUSD).

UNI/USD is likely to rebound into wave (5) with key targets at $15.82 - $19.00. Investors should closely monitor price action around the resistance levels in the Channel range to capture buying opportunities at the start of the wave.

Uniswap/ U.S. dollar(UNIUSD)Trading Strategy:

UNI/USD is likely to rebound into wave (5) with key targets at $15.82 - $19.00. Investors should closely monitor price action around the resistance levels in the Channel range to capture buying opportunities at the start of the wave.

Trading strategies

* Buy Strategy (Long Position):

* Buy when the price is still in the range of $10.50 - $11.50 with a stop loss at $9.31

* Set a profit target at $15.82 and $19.00

* Risk Management:

* If the price breaks 10.281, it will confirm that wave (4) has been violated and the trend will change to down.

Technical analyst: Kittiampon Somboonsod.

UNI/USD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.