Uniswap (UNI) price jumps by 15% in DeFi, cryptocurrency market rebounds

Uniswap (UNI) was among the best performers among the top cryptocurrency tokens by market capitalization in the previous 24 hours, logging better gains than other top cryptocurrencies, namely Bitcoin (BTC), Ether (ETH) and Binance Coin (BNB).

On Wednesday, the UNI/USD exchange rate jumped 13.26% to hit a seven-day high of $25.68. Traders continued to bid higher on the pair entering Wednesday, pushing its value higher to $26.07 at one point, up more than 15% from the previous session’s open of $22.66.

Market-wide recovery behind UNI gains?

The majority of UNI’s gains in the previous 24 hours seems to have surfaced in the wake of a market-wide recovery.

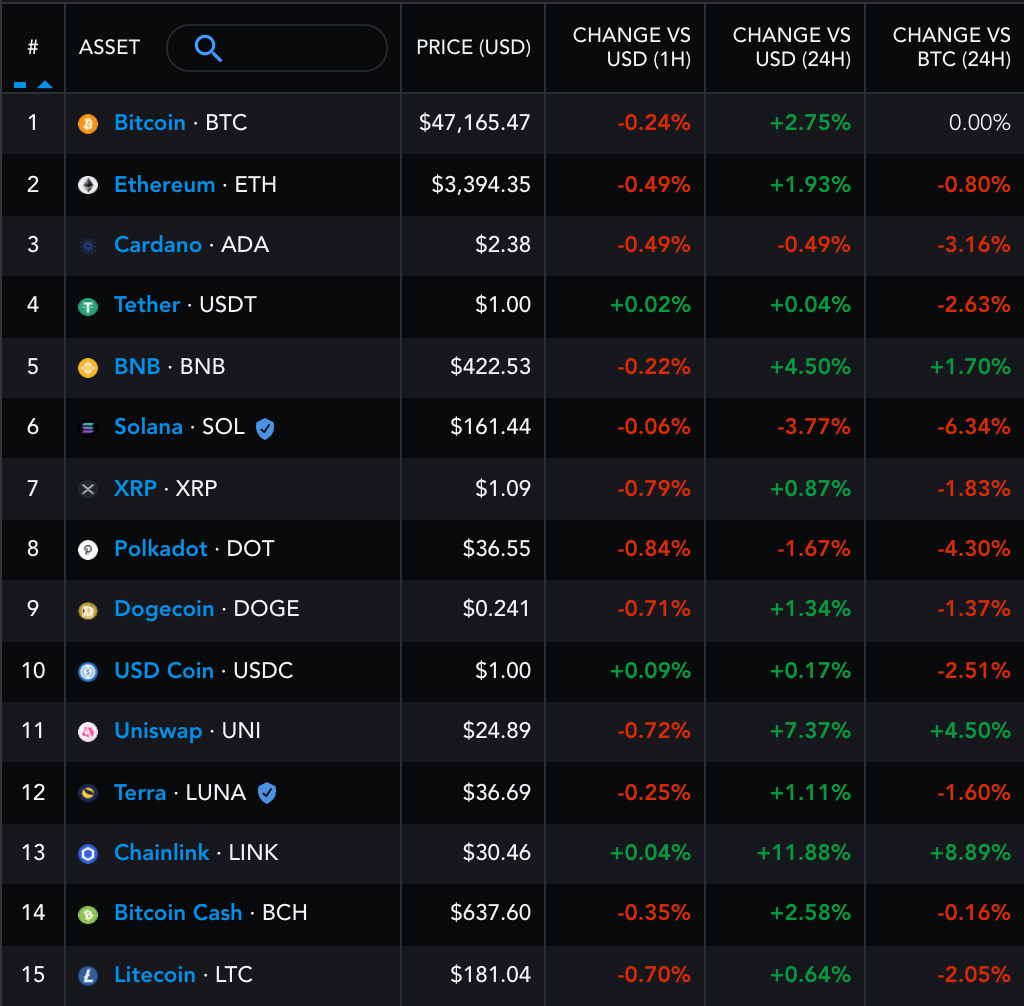

For instance, the said timeframe witnessed Bitcoin, the benchmark cryptocurrency that enjoys heavy influence on the rest of the crypto tokens, climbed above $47,000 following a 4.85% upside move on Tuesday. Meanwhile, Ethereum saw its native asset, ETH, rallying toward $3,500 in a 4.57% price jump.

Elsewhere in the crypto market, BNB, XRP, Dogecoin (DOGE), Terra (LUNA) and Chainlink’s LINK also rose. In contrast, smart contracts platform Solana’s native asset, SOL, fell 6.47% following a denial-of-service disruption on its network.

At the same time, Cardano (ADA), one of Solana’s top rivals, dropped by more than 1%.

The performance of the top 15 cryptocurrencies in the past 24 hours. Source: TradingView

At first, the gains among the top tokens, including Uniswap, looked to have been helped by capital rotations out of SOL and ADA markets.

In detail, Solana’s market cap surged by more than 400% quarter-to-date following its foray into the booming nonfungible token (NFT) sector, providing traders a decent opportunity to lock interim profits. Additionally, the network outage accelerated the profit-taking scenario.

On the other hand, Cardano attracted speculation because of its Alonzo upgrade, which made it a smart contracts platform for the first time since its launch. In addition, ADA’s 2,500% year-to-date performance gave traders adequate opportunities to “sell the news” and secure gains.

UNI holders are masters of 9.15 million MIR tokens

Uniswap’s superior performance in the previous 24 hours also took cues from speculation that holding UNI could grant them access to airdrop tokens.

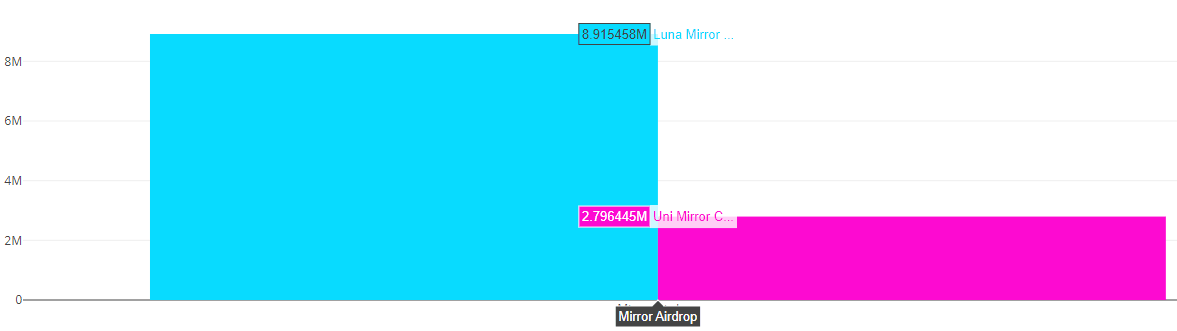

In a recent note, Brendan Murray, content marketing manager at Boston-based blockchain analysis firm Flipside Crypto, cited Twitter user Jr3225’s research. The study cited many UNI holders failed to realize that they could claim 9.15 million of the synthetic asset platform Mirror Protocol’s MIR tokens via a December 2020 airdrop.

In comparison, LUNA stakers could claim more free MIR tokens than UNI ones — MIR/USD has surged 200% this year.

Total MIR claimed on the y-axis, airdrop-type on the x-axis. Source: Twitter user Jr3225

The report, published Tuesday, coincided with the UNI price pump.

Uniswap technical outlook

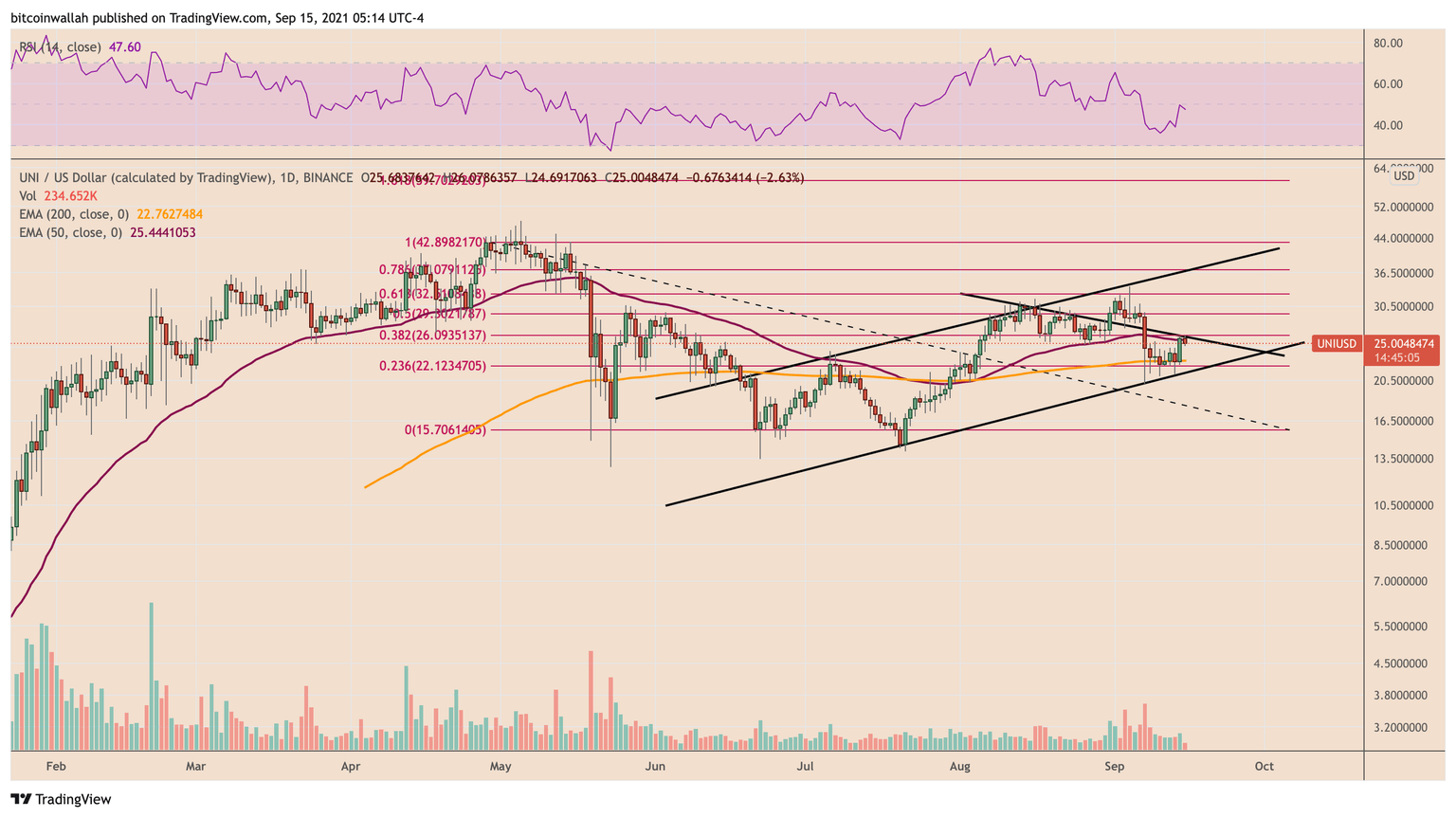

Uniswap’s latest rally had it test a support confluence made up of falling trendline resistance and the 38.2% Fib line (~$26.093) of a Fibonacci retracement graph (drawn from a $42.89 swing high to $15.70 swing low).

UNI/USD daily price chart. Source: TradingView

Sellers took control near the confluence, prompting UNI/USD to correct by 4.59% to an intraday low of $24.50. Its next support target is — again — a confluence of 23.6% Fib line ($22.12) and the ascending trendline that overall constitutes a rising channel.

An interim bullish outlook entails UNI/USD breaking above $26.09 and stepping toward the next Fib levels ($29.30, $32.51, and so on) unless the pair reaches the rising channel’s upper trendline near $42.89.

Meanwhile, a bearish setup could see UNI/USD break below the $22.12 Fib line and the channel support to target $15.70.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.