- Uniswap’s governance token UNI has an actual circulation of only 25% even after full unlock.

- On-chain data provider EmberCN says the community treasury received 430 million UNI, and only 7% entered circulation.

- Top six holders of Uniswap have not shed their UNI tokens yet.

- UNI erases over 3% value on Wednesday, trades at $6.528.

Uniswap’s governance token for the protocol, UNI, was launched in 2020. In the last four years, even as the entire supply of UNI has been fully unlocked, only 25% has entered into circulation as of Wednesday.

The majority of the tokens are held by the six largest holders. Data from on-chain tracker EmberCN shows that the top six addresses, including a16z and Union Square Ventures, have not sold their UNI.

Whale wallet activity has an impact on price depending on whether it is accumulation or large-scale distribution of the asset.

At the time of writing, UNI trades at $6.528, down over 3% on the day.

Uniswap token could rally or crash depending on these factors

According to on-chain data, the largest wallet holders of Uniswap have not sold their UNI holdings, even as the entire supply of the governance token has been unlocked. The last unlock event kicked off on September 18, 2023, unlocking 227,040 UNI a day for 365 days.

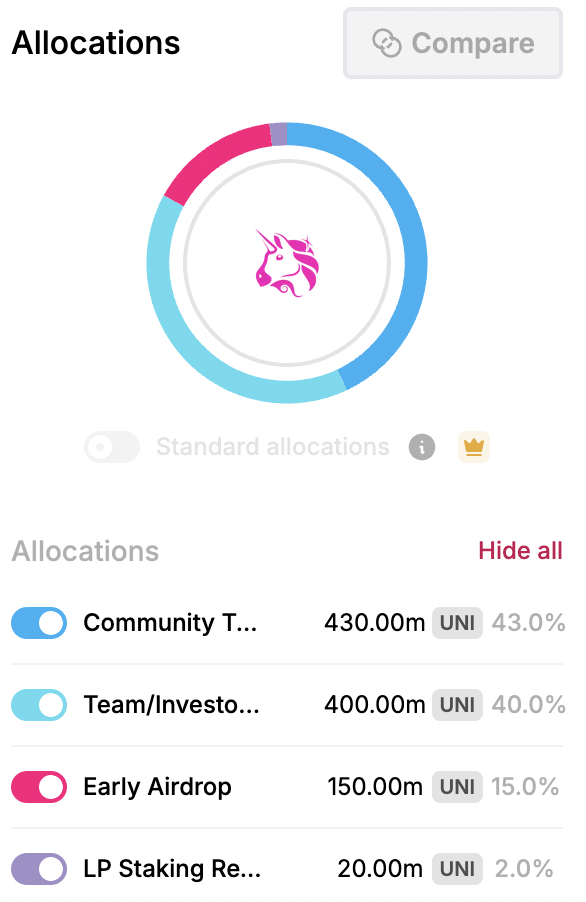

Data from Tokenunlocks app shows that Uniswap’s entire supply (maximum supply) of 1 billion tokens has been unlocked. The unlocked tokens have been allocated in the following manner:

Uniswap token allocation

Of the 430 million UNI allocated to the community treasury, the address currently holds 399,789,850 UNI tokens, per Etherscan data. This means that the difference, 30.21 million, has flown into the market.

Uniswap top holders

The rest of the tokens remain untracked, within cold wallets or exchange wallets of entities. A mere 7% of the tokens distributed to the community treasury entered circulation, contributing to low selling pressure on Uniswap across exchange platforms.

Uniswap wallets with large UNI token holdings, a16z, USV, ParaFi Capital

Coingecko data shows that UNI circulating supply is 753,766,667, however, EmberCN’s analysis of newly unlocked tokens between 2023 and 2024 shows that only about 25.83% UNI tokens are currently in circulation.

已进入全流通状态的 $UNI 链上筹码分析

— 余烬 (@EmberCN) September 17, 2024

2020 年 9 月, $UNI 发行上市。团队/投资人/顾问以及社区财库获得了共计 83% 的 UNI (8.3 亿枚) 分配,这些 UNI 有四年的解锁周期。

现如今 4 年时间已经过去,这些 UNI 已经完成解锁,UNI 成为全流通代币。我们从链上来看看这 83%… pic.twitter.com/AM3WHmg2Ub

While this appears bullish for the asset, a deeper look reveals how the stronghold of the six large entities holding UNI tokens and their actions (mass sell-off, profit taking or holding) could influence the asset’s price.

One interesting insight is that the New York State Attorney General Letitia James sent subpoenas to some venture capital firms that have invested in Uniswap. The list includes Andreessen Horowitz (widely known as a16z) and Union Square Ventures, among others. An Axios report shows that the US Securities & Exchange Commission (SEC) also had questions for Venture Capitalists earlier this year.

As regulators scrutinize entities holding a large share of the UNI token, their next steps could make or break the asset’s price trend. If the entities sold their holdings on a large scale, it could increase the selling pressure on Uniswap, pushing price down. If the venture capitalists continue to hold, and demand is sustained at current levels or rises, UNI price could either hold steady or rise in the short term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.