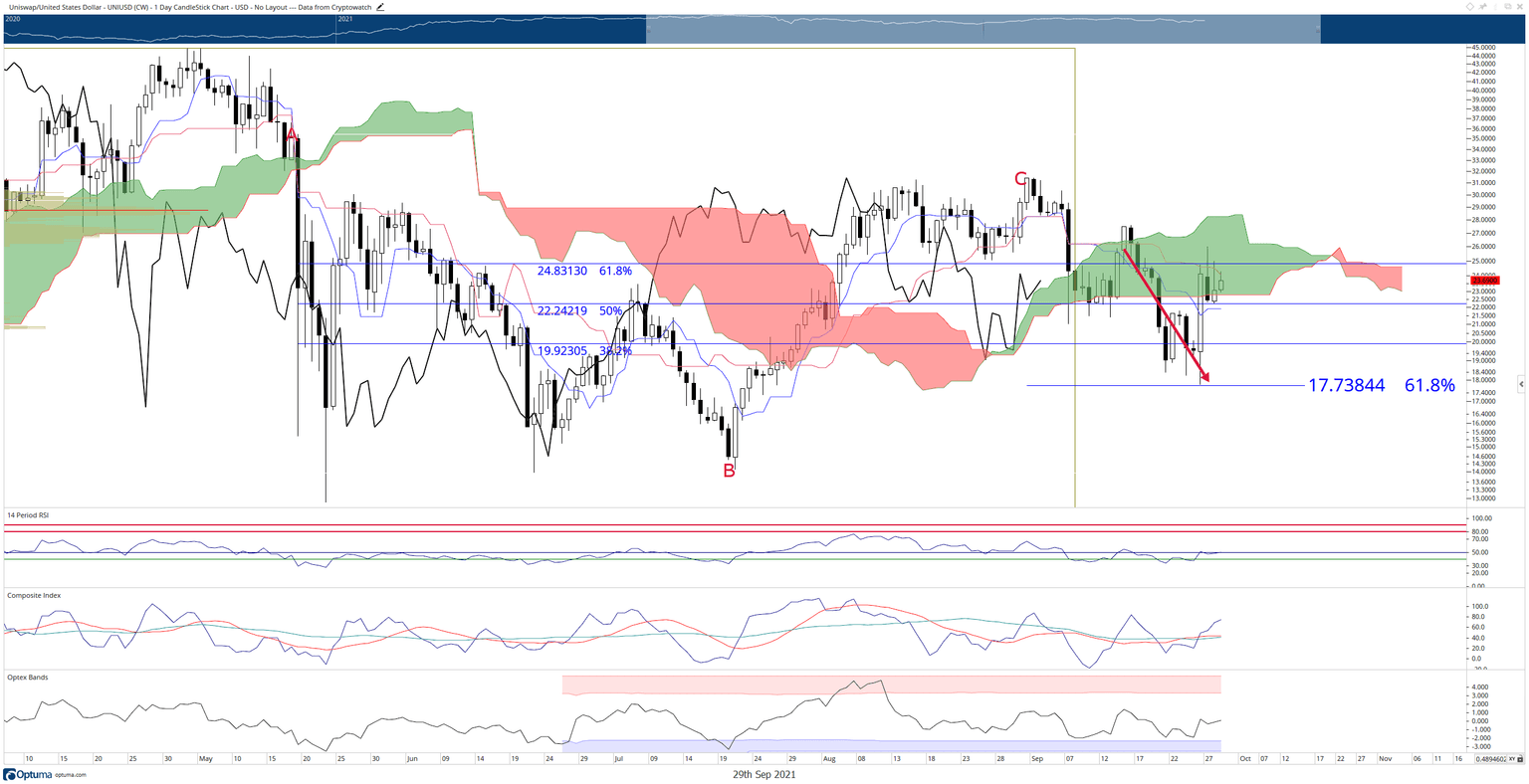

Uniswap struggles to maintain gains; UNI eyes return to $18.00

- Uniswap price experienced a massive, 46% gain from the September 26th swing low at $18.00 to hit $26.00

- Buyers have struggled to push Uniswap higher but have maintained the majority of those gains.

- Volatility and indecision persist as price action remains in the Ichimoku Cloud.

Uniswap price has outperformed the majority of its peers over the past week. While many altcoins have experienced temporary spikes, almost all have resulted in nearly 100% retracements – Uniswap is an exception. However, a return to the prior swing low at $18.00 is likely.

Uniswap price struggles to hold above Kijun-Sen, final Ichimoku support below at $22.74

Uniswap price faces continued near-term resistance against the Kijun-Sen, currently at $24.12. The Kijun-Sen was first tested as resistance on September 26th when Uniswap pumped as much as 39% that day. Every since September 26th, the Kijun-Sen has restricted and further and sustained move higher.

The near-term support for Uniswap price is the bottom of the Cloud (Senkou Span B) at $22.58. Senkou Span B is the most robust support/resistance level within the Ichimoku system. The strength of the Senkou Span B is exacerbated by any period of extended flat conditions. Therefore, it is challenging for sellers to push price below and then close below Senkou Span B.

UNI/USDT Daily Ichimoku Chart

Any daily close of Uniswap price below Senkou Span B will mean a swift return to test the prior swing low at the 61.8% Fibonacci expansion at $18.00. After that, however, bulls could easily take control.

Buyers will want to watch for conditions that favor an Ideal Bullish Breakout setup. The Ideal Bullish Breakout setup could be confirmed if bulls close Uniswap price above the Cloud and the Chikou Span above the candlesticks. The threshold for this to occur is a close at $29.53 between today and October 3rd or $27.53 on October 11th.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.