Uniswap smashed its record for monthly volume across Ethereum layer 2s as decentralized finance (DeFi) buffs flooded back into the ecosystem.

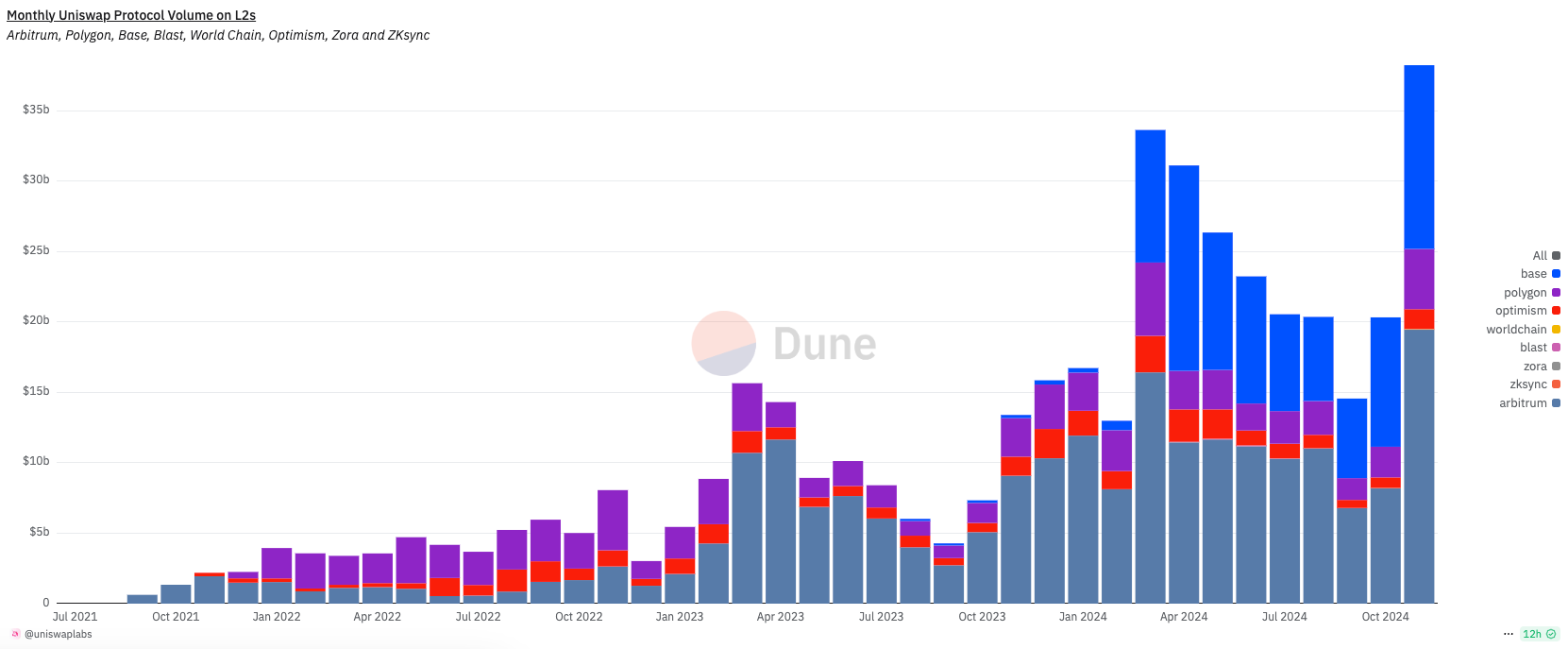

According to data from Dune Analytics, Uniswap generated a record $38 billion in volume across major Ethereum layer-2 networks, including Base, Arbitrum, Polygon, Optimism and several others.

The November record surpassed its previous highest month, set in March, by $4 billion.

Uniswap saw record monthly volume in November across Ethereum L2s. Source: Dune Analytics

Henrik Andersson, the chief investment officer at Apollo Crypto, told Cointelegraph that volumes for Uniswap on Ethereum layer 2s could be traced back to an increased demand for assets and stablecoins in the broader DeFi ecosystem.

“[This is] in line with the DeFi renaissance and the recent increase in ETH/BTC. Onchain yields are also rising,” Andersson said.

Andersson added that this recent uptick could be the start of a period of long-awaited outperformance for the Ethereum ecosystem.

Every time Bitcoin closes in on 100k, we have seen Ethereum and DeFi coins starting to move.

Uniswap witnessed its largest monthly volume on Arbitrum at $19.5 billion, while Coinbase-incubated network Base followed in a close second at $13 billion.

As of the time of publication, Uniswap stands as the sixth-largest protocol when ranked by fees, raking in over $90 million in fees in the last month, outpacing other protocols, including the Solana memecoin launchpad Pump.fun and major networks like Tron and Maker.

The price of Uniswap’s native UNI token (UNI $12.67) has reflected the uptick of activity for the protocol, gaining more than 42% in the last week. At the time of publication, UNI is changing hands for $12.58, up 10% in the last 24 hours.

Overall, UNI stands as the outperformer among decentralized exchange tokens, surpassing the growth of Solana-based Raydium (RAY $5.41), which is down 2.2% in the last week, as well as Jupiter (JUP $1.09), which is up 7.7% within the same timeframe.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Top 3 meme coins: Dogecoin, PEPE, BONK lead meme rally amid growing disapproval from industry leaders

The meme coin sector rallied on Wednesday as top tokens, including Dogecoin (DOGE), PEPE and BONK, led the charge. With growing anticipation of a DOGE ETF in the US next year, industry experts weighed in on the future of investing in meme coins.

Ripple's XRP eyes rally to $2.58 as whales step up buying pressure

Ripple's XRP rallied 6% on Wednesday following increased buying pressure among whales in the past two weeks. The remittance-based token could stage a move to $2.58 amid increased institutional interest in the launch of an XRP exchange-traded fund (ETF) in the US.

Ethereum Price Forecast: ETH surges 10% with increased capital inflows, bulls set sights on $4,522

Ethereum (ETH) rallied 10% on Wednesday following increased capital inflows into ETH ETFs and a major uptick in its open interest and futures premium. If the bullish momentum sustains, ETH could overcome its yearly high resistance of $4,093 and rally to $4,522.

Biotech ETF (XBI) ended a diagonal: Looking for buying dips

The SPDR S&P Biotech ETF (XBI) is an exchange-traded fund that tracks the biotechnology segment of the S&P Total Market Index. This ETF allows investors to gain exposure to large, mid, and small-cap biotech stocks. If you’re interested in biotechnology, XBI could be worth exploring further.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.