Uniswap price sinks by 8% despite DEX’s launch on Binance BNB Chain

- Uniswap price corrects lower following the 15% rise in price over the last four days.

- Uniswap launches on the BNB Chain, ensuing support from 55 million UNI holders.

- The deployment will enable Uniswap users to leverage BNB’s lower transaction as opposed to the current option of Ethereum.

Uniswap, the world’s biggest decentralized exchange (DEX), launched its version 3 (V3) on the BNB Chain on Wednesday. BNB Chain, developed by the world’s biggest cryptocurrency exchange Binance, is also the second biggest Decentralised Finance (DeFi) chain right after Ethereum. However, the impact the launch was expected to bear on Uniswap price did not materialize, given other forces in play in the crypto market at the moment.

Uniswap comes to Binance BNB Chain

Uniswap V3 launched on BNB Chain following overt support from the community. The proposal, which was submitted in February, was met with a positive response and received approval from the majority of over 55 million UNI token holders. The proposal was initiated by 0x Plasma Labs following Uniswap’s attempt at extending its reach.

Being built on Ethereum, Uniswap users have long faced problems arising due to the L1’s high fees. To eradicate this issue, Uniswap decided to expand to other DeFi chains bringing it to BNB Chain. With this deployment, the DeFi protocol’s users will be able to leverage the low transaction fees that come with Binance’s BNB Chain to trade and swap tokens.

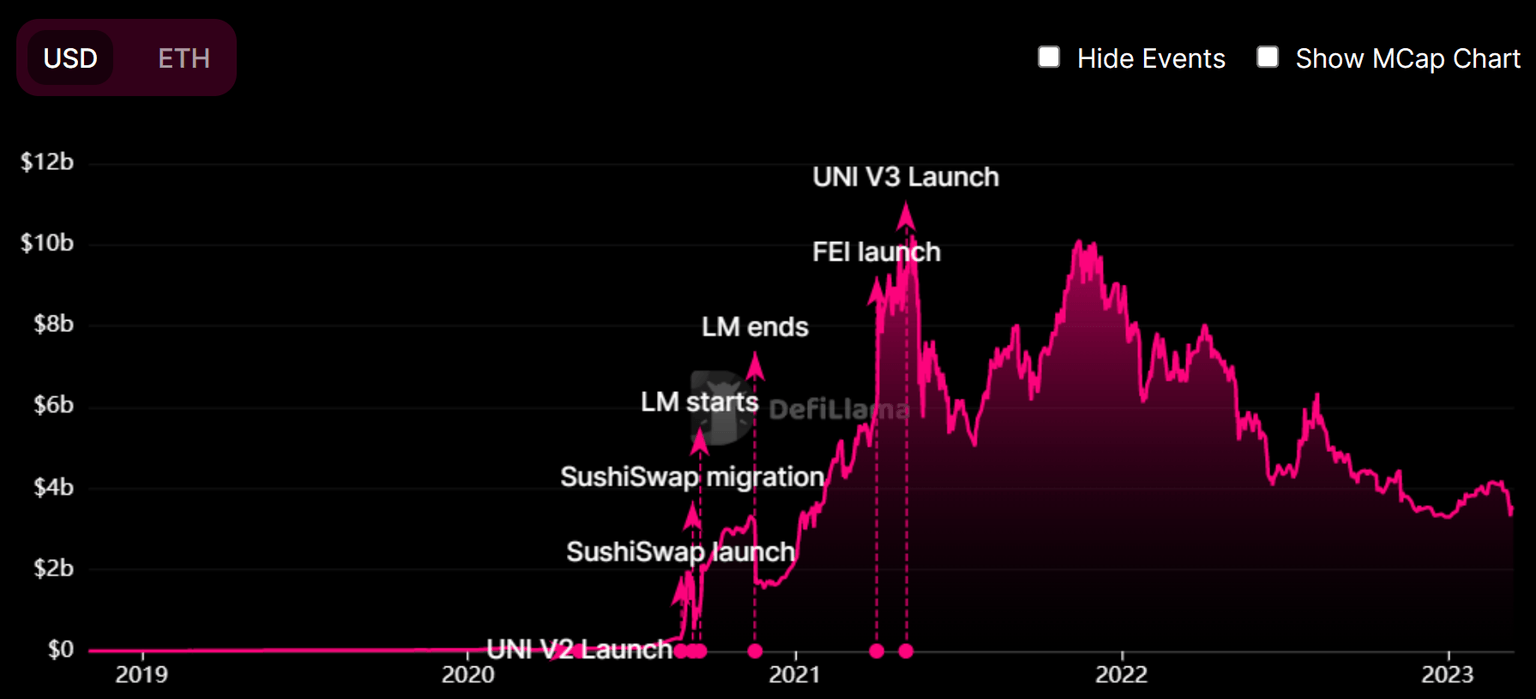

At the moment, Binance’s DeFi chain supports nearly 555 protocols, which combined have over $5.02 billion locked in them. The total value locked (TVL) on Uniswap across all its versions, on the other hand, is a little under $3.5 billion.

Uniswap total value locked

The bridge between Uniswap and BNB Chain was awarded to Wormhole following governance voting. The same bridge was also the victim of one of the biggest hacks of 2022 when exploiters managed to steal nearly $320 million worth of Wrapped ETH (wETH).

Uniswap price fails to benefit from the launch

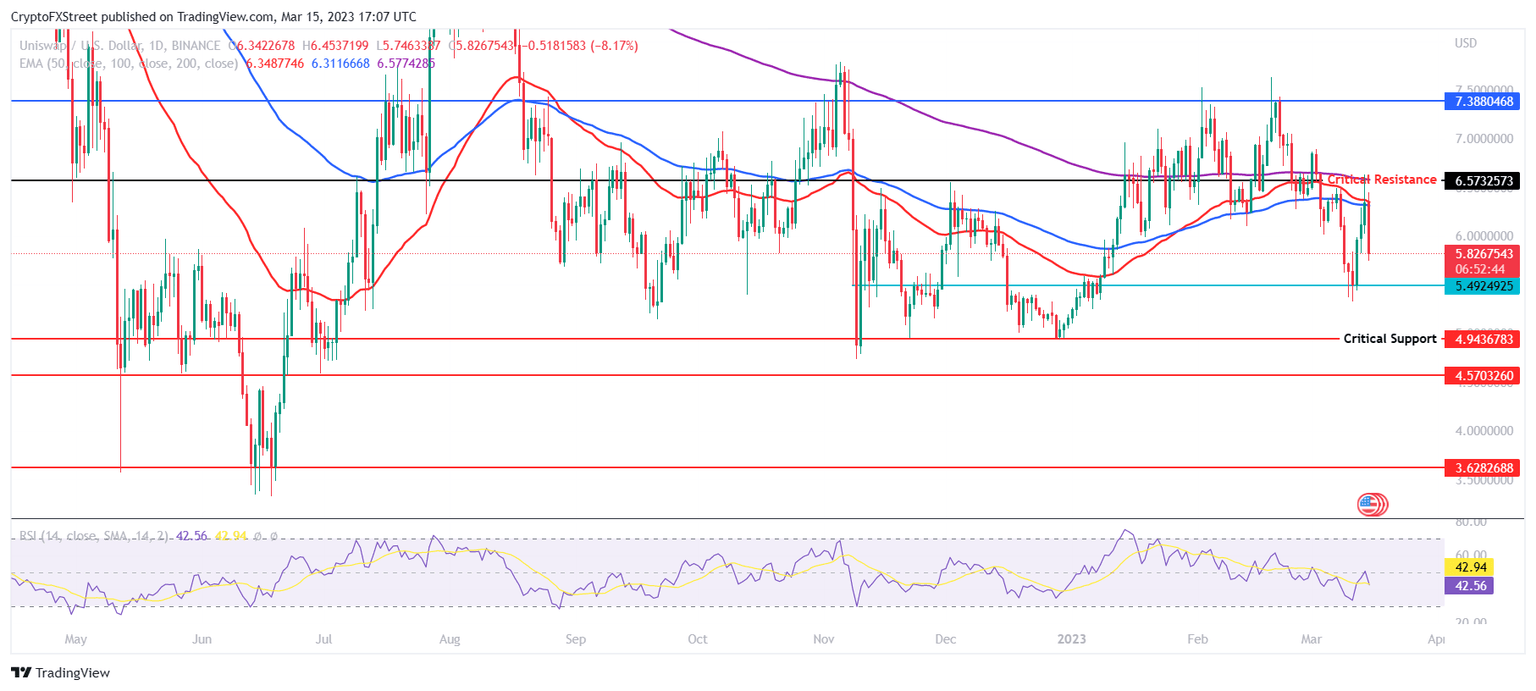

Ecosystem development as such usually results in a bullish outlook for the native asset, but in the case of Uniswap, the opposite happened as risk aversion surrounding financial markets is weighing on the crypto market. At the time of writing, Uniswap price could be seen trading at $5.82, having declined by more than 8% on the day.

The decline in price could have been the result of corrections following the sudden explosion in UNI’s value. Over the last four days, Uniswap price managed to increase by more than 15%, testing the critical resistance at $6.57.

Slipping toward the immediate support at $5.49, the altcoin is indicating a bearish outlook, which would materialize if the cryptocurrency drops below the critical support at $4.94. This would push the DeFi token below the December 2022 lows.

UNI/USD 1-day chart

However, if Uniswap price rises back and manages to flip the critical resistance of $6.57 into support, recovery might be on the cards. The bearish thesis would also be invalidated, and UNI would have an opportunity to climb back to a year-to-date high of $7.38.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.