Uniswap price provides a buying opportunity for UNI bulls before exponential break out towards $10

- Markets jack up the price from equities as a global recovery story unfolds.

- Uniswap price could recover 42%on the back of this recovery wind.

- UNI traders need to focus on support levels to get in and take profit at key areas.

Uniswap (UNI) price has witnessed a staggering move to the upside after Tuesday's US Consumer Price Index (CPI) numbers. With a further decline in inflation, markets are focusing on a full recovery story as other countries are also reporting lower inflation numbers. Although inflation remains elevated globally, the consecutive decline points to hopes that market conditions will soon return to normal.

Uniswap sprints ahead under idea markets will return to normal

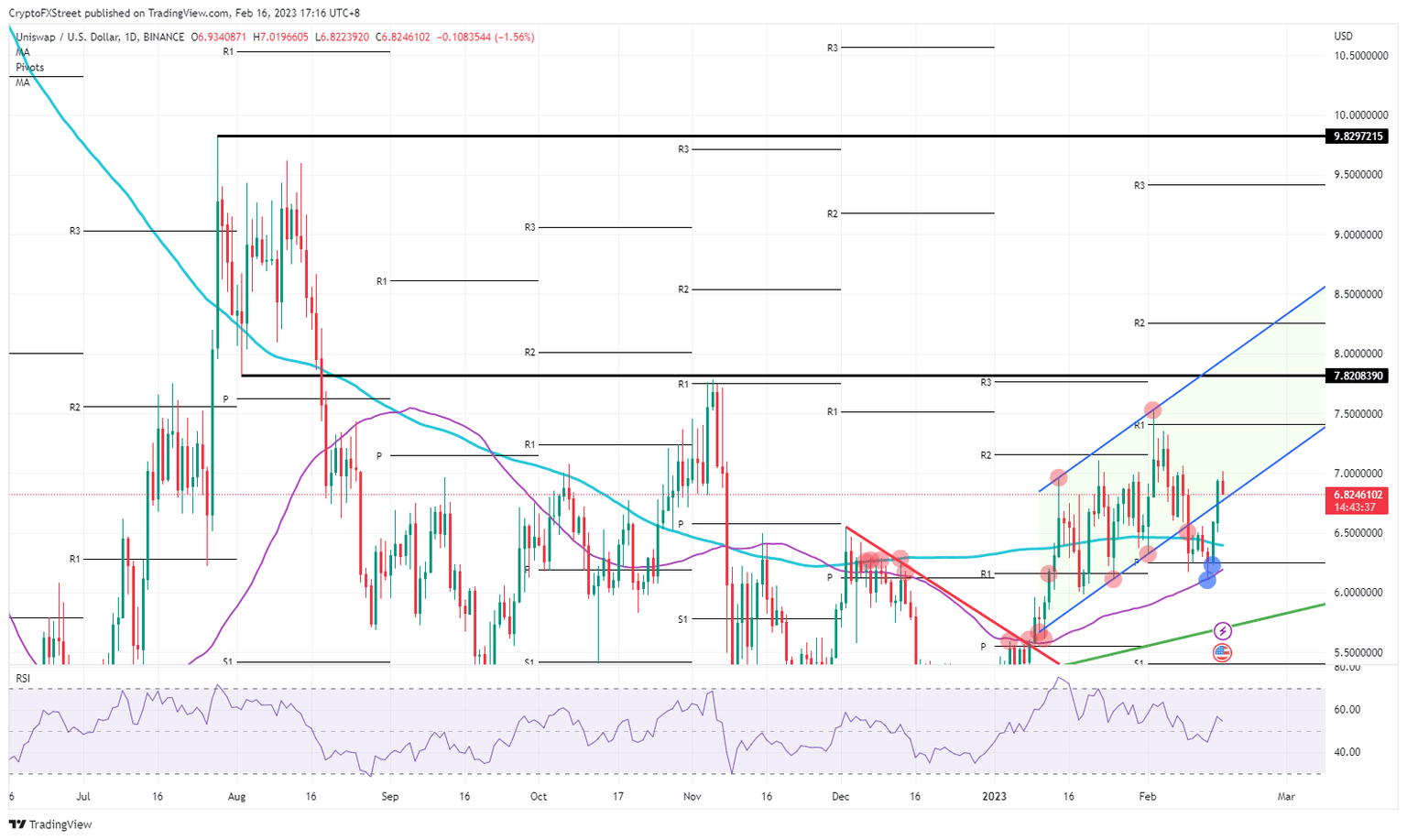

Uniswap price has already jumped over 10% on Tuesday and Wednesday though it is currently taking a small step back. From a purely technical point of view, an ideal moment to enter could soon arrive if support is met at the lower ascending trend line of the UNI price channel. Bulls were able to pierce through that as massive tailwinds gathered due to a global economic recovery story and global inflation decline as main narrative engines.

UNI is thus looking to rally further as this recovery could gain another leg to the upside. The first key level to watch is $7.82 at the top end of the trend channel. If bulls can break and close above that level in the coming weeks, expect to see a further continuation with $9.83 as the ultimate profit-taking target. That price would mean a 42% gain for traders and test the high of July 2022.

UNI/USD daily chart

The positive sentiment could last as far as the autumn of 2023, which is when the energy puzzle comes back into play. With the mild winter, gas storage could withstand the lack of Russian gas for Europe and the US. A big risk comes once temperatures drop again as not many new gas supply lines have been built or announced to fill the gap from Russian gas sanctions. Expect that element to trigger a knee-jerk reaction that could see Uniswap falling lower toward $6 later this year, fully unwinding the spring rally.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.