- Uniswap price could undo its 115% rally since May 23 as MRI flashed a sell signal.

- Transactional data shows a massive cluster of underwater investors that might deter the upswing.

- Declining daily active addresses adds credence to the UNI bearish narrative.

Uniswap price has seen a tremendous run-up since the crash on May 23. This recovery rally could be in trouble as a sell signal threatens to wipe these gains.

Uniswap price awaits a hostile takeover from bears

Uniswap price has rallied roughly 30% over the past 18 hours but fell short of producing a higher high above the recent swing point at $28.46. This lack of buying pressure is due to the overextended nature of the recent run-up, combined with the 50 six-hour Simple Moving Average (SMA) acting as a resistance barrier, coinciding with $28.46.

To make matters worse for the bulls, the Momentum Reversal Indicator (MRI) has flashed a reversal sign in the form of a red ‘one’ candlestick on the six-hour chart, suggesting that this upswing has reached its peak.

Furthermore, this setup forecasts a one-to-four candlestick correction, which adds impetus to the said bearish thesis. Moreover, the 50 six-hour SMA has slithered close to the 100 six-hour SMA and ponders a move below it. If such a development were to occur, it would denote a bearish crossover, adding a tailwind to the pessimistic scenario explained above.

Therefore, investors can expect UNI to drop 20% to $21.51, the recent swing low formed on May 25. If the sellers overwhelm this level, Uniswap price will likely slide another 15% to tag the support level at $18.37.

UNI/USDT 6-hour chart

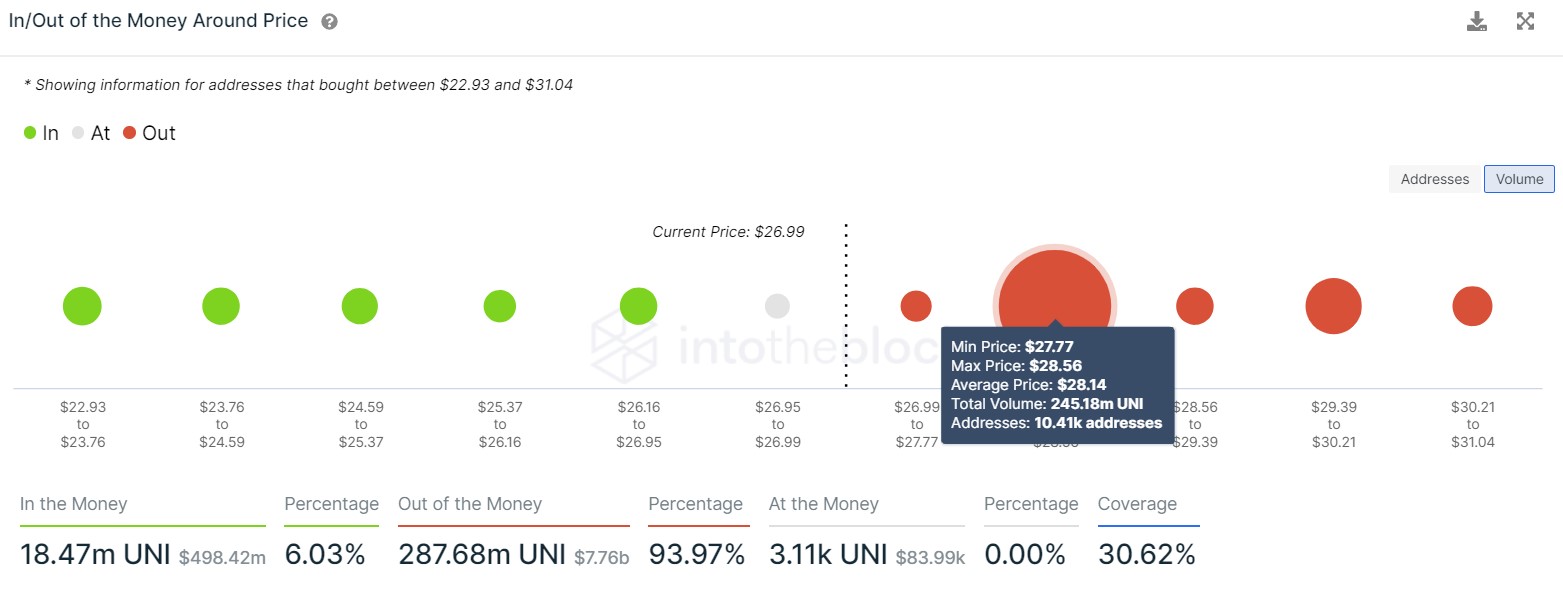

Further supporting the decline for Uniswap price is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows a cluster of underwater investors present ahead.

Roughly 10,400 addresses that purchased nearly 245 million UNI at an average price of $28.14 are “Out of the Money.”

These holders might want to break even if Uniswap price rises to $28.14, thereby adding more selling pressure and dampening the bullish momentum.

UNI IOMAP chart

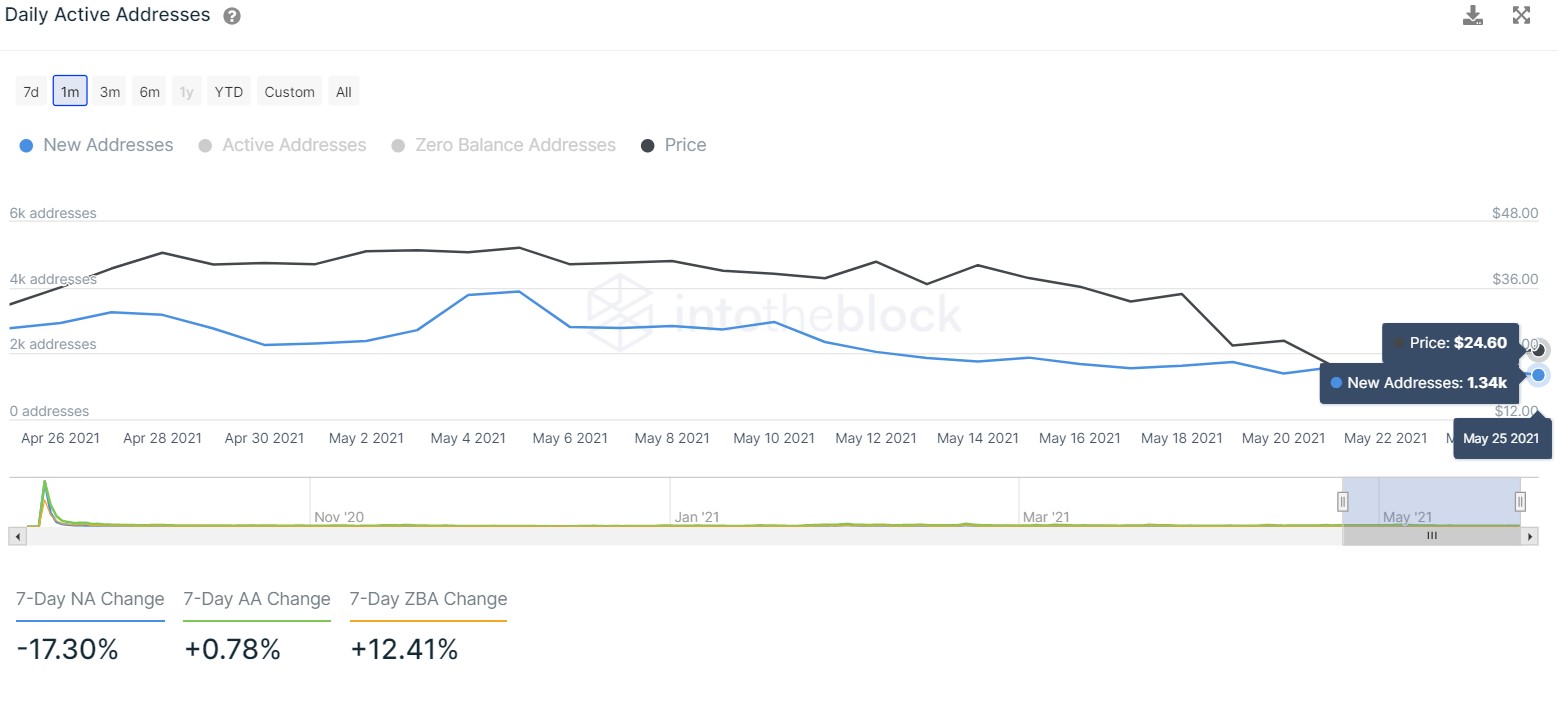

The number of new active addresses joining UNI has dropped from 2,760 on April 25 to 1,340 to date. This 51% decline indicates that the investors are either reallocating their holdings or booking profit. Hence, this metric also paints a bearish picture, suggesting that a drop in Uniswap price seems inevitable.

UNI new active addresses chart

While things look gloomy for the DeFi coin, a decisive close above the conjunction of the 50 and the 100 six-hour MAs at $35.45 will invalidate the bearish thesis referenced above.

In that case, Uniswap price may rally 22% to $42.40.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.