Uniswap Price Prediction: UNI at risk of falling towards $14 as whales go into a selling frenzy

- Uniswap price is contained inside an ascending parallel channel on the 4-hour chart.

- Whales have been selling a lot of UNI tokens in the past three days, increasing selling pressure.

- If a key support level at $19.7 breaks, Uniswap can quickly drop below $15.

Uniswap has been trading inside a strong uptrend since December 2020. However, in the past week, there has been a significant shift in momentum in favor of the bears which are looking for a massive 25% breakdown.

Uniswap price must defend key support level to avoid a 25% fall

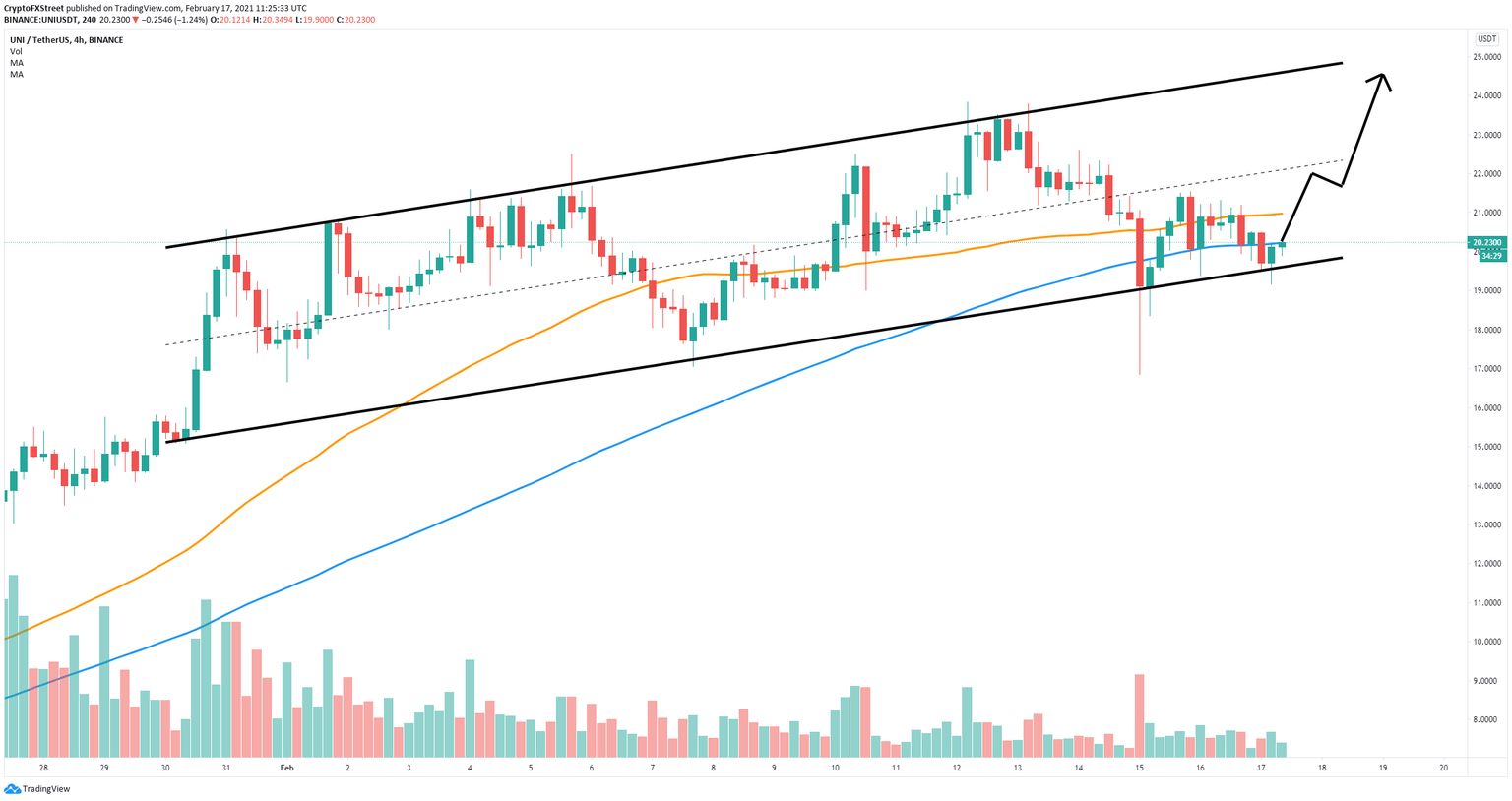

On the 4-hour chart, Uniswap established an ascending parallel channel with a key support trendline at $19.7. Losing this level will push Uniswap price down to $14.8, a 25% drop calculated by using the height of the parallel channel as a reference guide.

UNI/USD 4-hour chart

The number of whales holding between 1,000,000 and 10,000,000 UNI tokens ($20,000,000 and $200,000,000) has sharply declined from 66 on February 13 to only 63 now, indicating that large holders have exited their positions as they believe Uniswap price could decline even more.

UNI Holders Distribution chart

However, if UNI bulls can defend the key support level at $19.7 of the ascending parallel channel, they can expect a significant rebound. Currently, Uniswap price faces two critical resistance points at the 100-SMA and 50-SMA levels on the 4-hour chart.

UNI/USD 4-hour chart

Climbing above both resistance levels and establishing them as support can quickly push Uniswap price up to $22.5 at the middle trendline of the parallel channel and as high as $24.5, at the top.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B12.20.14%2C%252017%2520Feb%2C%25202021%5D-637491579480733716.png&w=1536&q=95)