- Uniswap price reached a new all-time high at $38.16 on April 12.

- The digital asset had a massive 30% surge in the previous three days.

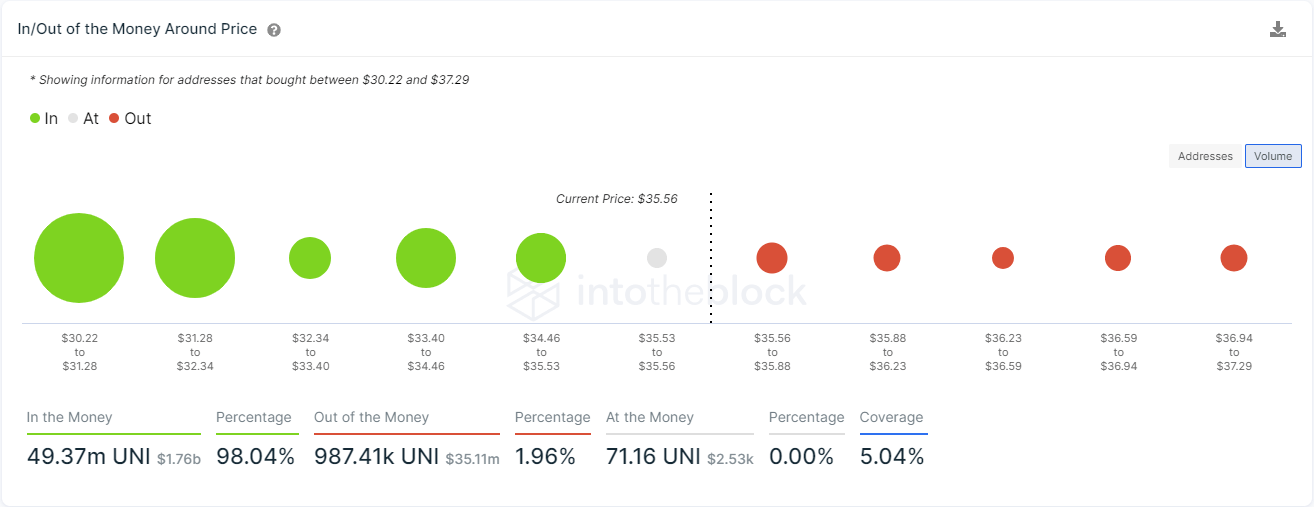

- On-chain metrics show practically no resistance ahead for the decentralized exchange token.

Uniswap has seen a massive surge in the last three days, hitting a new all-time high and reaching $18.5 billion in market capitalization. Despite the significant rally, the digital asset seems poised for more.

Uniswap price faces no critical barriers ahead of new all-time highs

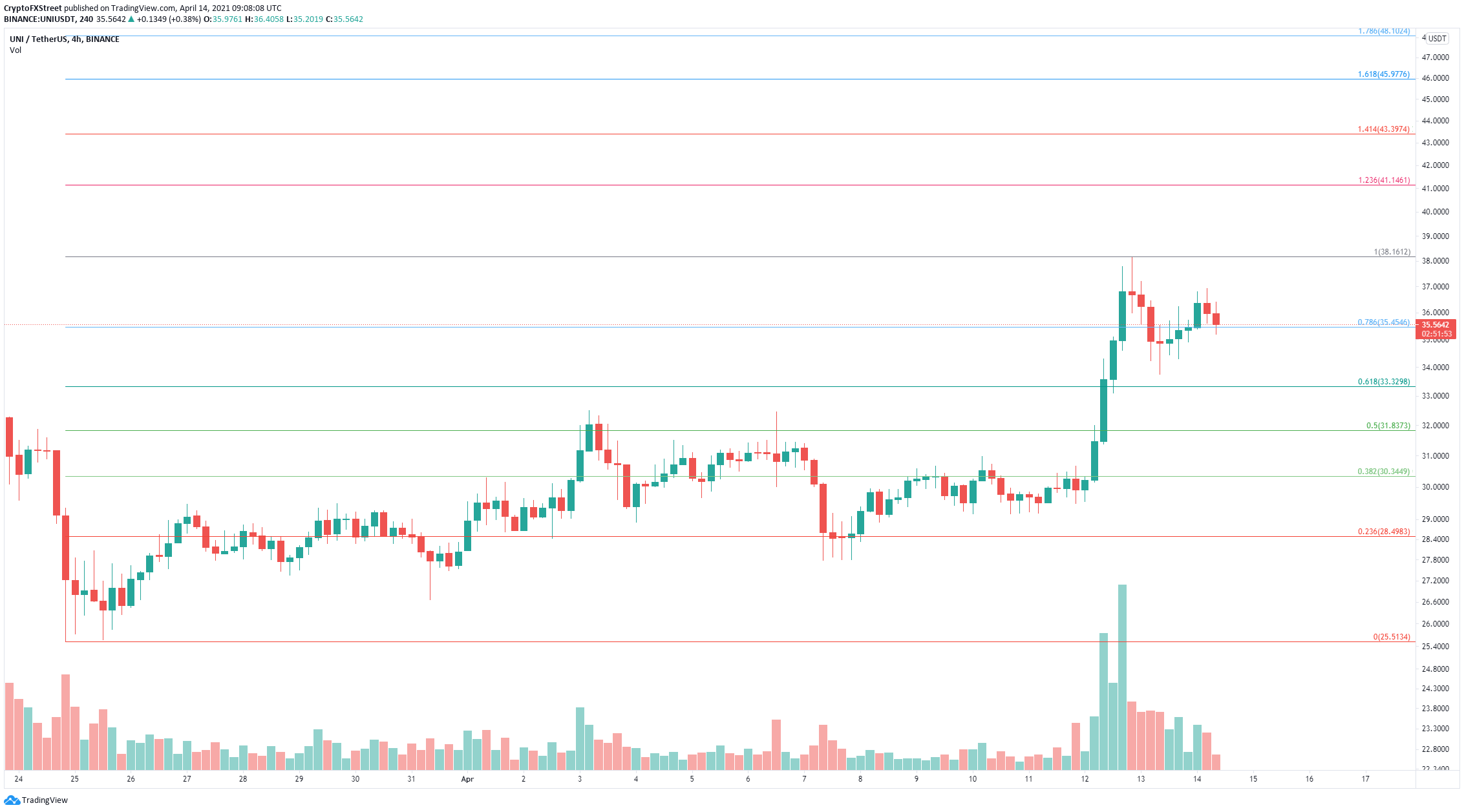

After a brief consolidation period down to $33.75, Uniswap managed to climb back above the 78.6% Fibonacci retracement level at $35.45 and aims for a new leg up above the previous all-time high of $38.16.

UNI/USD 4-hour chart

The next price target is located at $41.14 where the 123.6% Fibonacci level stands. Above that, Uniswap price could reach $43.39 as well at the 141.4% Fib level. According to the In/Out of the Money Around Price (IOMAP) chart, this is quite likely.

UNI IOMAP chart

The IOMAP model shows no significant resistance levels ahead. The most important barrier is the previous all-time high of $38.16. On the way down, there is a massive support area between $32.34 and $30.22 where 20,000 addresses purchased 36 million UNI tokens.

Losing the 78.6% Fibonacci retracement level at $35.45 could quickly drive Uniswap price down to the 61.8% Fib level at $33.32, just above the critical support area shown by the IOMAP.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin to extend its consolidation between the $75,000 to $88,000 range

Bitcoin price faces a slight rejection around the $85,000 resistance level on Wednesday after recovering 3.16% the previous day. A K33 report highlights that Cryptocurrencies and Equities have largely de-risked going into Donald Trump’s “Liberation Day” on Wednesday.

Maker, Gala and Polygon lead $100k whale transactions, can altcoins defy looming macro uncertainty?

Maker (MKR), GALA, and Polygon (POL) are among the crypto projects that have seen a spike in whale transactions of at least $100,000 in the past week, as revealed by Santiment on-chain data.

Cardano and Binance Coin Price Forecast: Altcoins ADA and BNB show weakness in momentum indicators

Cardano (ADA) and Binance Coin (BNB) prices edge slightly down, trading around $0.66 and $598, respectively, at the time of writing on Wednesday after a mild recovery so far this week.

Public firms turn balance sheets into Bitcoin vaults: Gamestop raises $1.5 billion; Metaplanet adds 160 BTC

Public companies are increasingly converting their balance sheets into Bitcoin reserves. Gamestop (GME) has raised $1.5 billion in capital, with potential plans to allocate part of the funds toward expanding its Bitcoin treasury.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.