- Uniswap price triggers head-and-shoulders top pattern.

- 50-day simple moving average (SMA) providing support for 15 days.

- Neo-bank Revolut now listing UNI on their platform for trading.

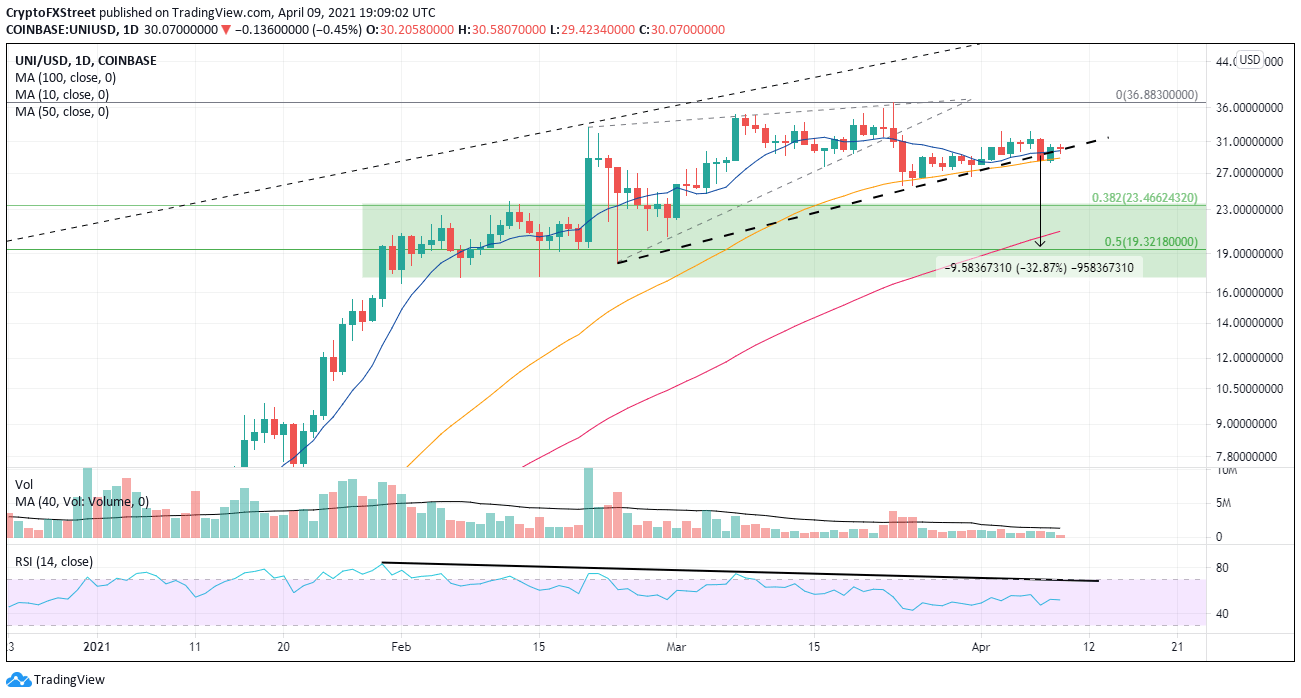

Uniswap price has failed to appreciate with many of the other cryptocurrencies since the late-March lows. Instead, UNI resolved an ascending wedge pattern to the downside, and the price action over the last fifteen days has shaped the right shoulder of a head-and-shoulders top pattern, carrying bearish near-term implications.

Uniswap price suggests that it may be losing the Battle of DEXes

Yesterday, the London-based neo-bank Revolut announced it had added the option for customers to buy and sell 11 more tokens, including Uniswap. Others added to the list are Cardano, Filecoin, and The Graph.

On the competition front, UNI is being confronted by a faster and cheaper alternative, PancakeSwap. PancakeSwap is a decentralized exchange like Uniswap, and detailed code analysis shows it is a virtual copy of UNI. Ethereum maxis have called the platform a rip-off, but proponents of open source code say it’s all fair.

A myriad of things could undermine UNI’s participation in the broader cryptocurrency rally, but the technicals speak with a bearish tone. On Wednesday, the token triggered the head-and-shoulders top but quickly found some support at the 50-day SMA at $28.52. However, the pattern remains active as long as the price does not rally above the right shoulder at $32.43.

The 38.2% retracement of the entire rally from the November 2020 low at $23.46 is the first prominent support, followed by the 100-day SMA at $20.95. Critical support surfaces at the confluence of the head-and-shoulders top measured move target at $19.57 and the 61.8% retracement level at $19.32.

There is more support around the February lows between $17.10 and 17.15. A failure to hold will lead to massive losses.

UNI/USD daily chart

A rally above $32.43 will void the head-and-shoulders top pattern and will likely lead to a test of the all-time high at $36.83. A close above the high could unleash a new phase for the rally that could test the topside trendline at $50.60.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Solana signals bullish breakout as Huma Finance 2.0 launches on the network

Solana retests falling wedge pattern resistance as a 30% breakout looms. Huma Finance 2.0 joins the Solana DeFi ecosystem, allowing access to stable, real yield. A neutral RSI and macroeconomic uncertainty due to US President Donald Trump’s tariff policy could limit SOL’s rebound.

Bitcoin stabilizes around $82,000, Dead-Cat bounce or trendline breakout

Bitcoin (BTC) price stabilizes at around $82,000 on Thursday after recovering 8.25% the previous day. US President Donald Trump's announcement of a 90-day tariff pause on Wednesday triggered a sharp recovery in the crypto market.

Top 3 gainers Flare, Ondo and Bittensor: Will altcoins outperform Bitcoin after Trump's tariff pause?

Altcoins led by Flare, Ondo and Bittensor surge on Thursday as markets welcome President Trump's tariff pause. Bitcoin rally falters as traders quickly book profits amid Trump's constantly changing tariff policy.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.